Gifting Property to Children in the US: Tax Guide to Benefits, Risks, and Long-Term Consequences

Feb 6, 2026

Passing down property to children is one of the biggest financial decisions families make. It often comes from love, legacy planning, or smart tax strategy. But gifting real estate is not as simple as handing over house keys. It can affect taxes, ownership rights, and long-term wealth for both parents and children.

Many business owners, executives, and independent professionals think gifting property is a quick way to reduce estate taxes or help their children financially. Sometimes it is. Sometimes it creates unexpected tax bills or legal challenges. The difference usually comes down to understanding how gifting works before making the move.

In this guide, you will learn:

How gifting property to children works in the United States

The tax rules and reporting requirements involved

The benefits and risks families must consider

The long-term financial consequences for children

When gifting property may or may not make sense

Planning strategies to help families stay compliant and protect wealth

What Does Gifting Property to Children Mean?

Gifting property means transferring real estate ownership to your child while you are still alive, and usually without receiving payment in return.

When you gift property, your child becomes the legal owner immediately. This is different from inheritance, where property transfers after death through a will or trust.

Common Types of Property Parents Gift

Families often gift:

Residential homes

Vacation properties

Rental or investment properties

Land or commercial real estate

How Ownership Transfer Works

The process usually involves:

Preparing a new property deed

Signing the deed in front of a notary

Recording the deed with the local county office

Filing required tax documentation

Once the transfer is complete, the parent no longer legally owns the property unless specific arrangements were made.

Why Families Consider Gifting Property

Many parents choose gifting because they want to:

Help children build wealth early

Reduce estate size for tax purposes

Simplify future inheritance planning

Avoid probate delays

However, gifting is permanent in most cases. That is why families must understand the full impact before moving forward.

How Does the IRS Treat Gifted Real Estate?

The IRS treats gifted property as a financial gift, which may trigger reporting requirements and affect lifetime tax exemptions.

Real estate is considered a valuable asset. Because of this, the IRS monitors property transfers closely.

The Annual Gift Tax Exclusion

Each year, you can gift a certain amount without reporting it to the IRS.

For 2025 and 2026, the annual exclusion is typically adjusted for inflation, but it often stays around:

$18,000 per recipient per year (estimate based on recent thresholds)=

If you gift property worth more than this amount, you must report it. But reporting does not always mean paying taxes.

Lifetime Gift and Estate Tax Exemption

The IRS allows a lifetime exemption that covers large gifts and estate transfers.

Current federal lifetime exemption is over $13 million per person (subject to change after 2025 law adjustments)

If your property gift exceeds the annual limit:

The excess amount reduces your lifetime exemption

Taxes are only due if total gifts exceed the lifetime threshold

Gift Tax Filing Requirements

If you gift real estate above the annual exclusion, you must file:

IRS Form 709 (United States Gift Tax Return)

This form tracks how much of your lifetime exemption you have used.

What Are the Benefits of Gifting Property to Children?

Gifting property can reduce estate taxes, simplify inheritance planning, and allow parents to support children financially during their lifetime.

1. Reduces Estate Size

Gifting property removes its value from your estate. This can help families:

Lower future estate taxes

Simplify asset distribution

Protect wealth for the next generation

This benefit is especially useful for high-net-worth individuals or business owners with multiple assets.

2. Avoids Probate Delays

Probate is the legal process that distributes assets after death. It can take months or even years.

When property is gifted:

Ownership transfers immediately

Children gain full control without court involvement

3. Allows Parents to See the Benefits

Some parents want to see their children enjoy the property while they are alive. This can include:

Helping children avoid housing costs

Supporting business or rental investment opportunities

Passing down family homes or vacation properties

4. Provides Financial Planning Opportunities

Gifting can help with:

Multi-generational wealth planning

Early tax strategy implementation

Asset protection planning

For business owners, gifting property may also support succession planning.

What Are the Risks of Gifting Property?

Gifting property carries serious risks, including loss of control, tax complications, and potential family disputes.

While gifting sounds appealing, families must carefully evaluate the downsides.

1. Loss of Ownership and Control

Once property is gifted:

The child becomes the legal owner

Parents usually cannot reverse the transfer

Parents lose decision-making authority

This means children can:

Sell the property

Use it as loan collateral

Transfer it to someone else

2. Exposure to Children’s Financial Risks

If your child faces financial trouble, the gifted property could be at risk.

Examples include:

Divorce settlements

Bankruptcy proceedings

Creditor claims

Parents often overlook these risks when making emotional decisions.

3. Potential Medicaid Eligibility Issues

Gifting property can affect eligibility for government benefits like Medicaid.

The government reviews financial transfers during a look-back period, often five years. Gifting property during this time may:

Delay Medicaid approval

Create penalty periods

4. Family Conflict

Property transfers can cause disagreements among siblings, especially if:

Gifts are uneven

Future inheritance expectations change

Clear communication and documentation help prevent disputes.

How Does Gifting Property Affect Capital Gains Taxes?

Children who receive gifted property inherit the parent’s original purchase cost, which can create higher capital gains taxes if they sell the property later.

This rule is called carryover basis, and it is one of the biggest tax concerns in property gifting.

What Is Cost Basis?

Cost basis is the original value of the property, usually including:

Purchase price

Improvements or renovations

Example of Carryover Basis

Imagine:

Parent bought property for $100,000

Property value increases to $500,000

Parent gifts property to child

Child later sells property for $550,000

The child’s taxable gain would be based on:

$550,000 sale price – $100,000 original basis = $450,000 taxable gain

How Inheritance Differs

If property is inherited instead of gifted, children usually receive a step-up in basis. This means:

Basis resets to current market value at time of death

Capital gains taxes are often reduced significantly

This difference is one of the most important factors families must consider.

When Does Gifting Property Make Financial Sense?

Gifting property often makes sense when reducing estate taxes is the main goal and parents are comfortable giving up control of the asset.

There is no one-size-fits-all answer. However, gifting tends to work best in certain situations.

Situations Where Gifting May Be Smart

Gifting property may be beneficial if:

Your estate may exceed federal or state estate tax limits

The property is expected to grow significantly in value

You trust your child to manage the property responsibly

The property is unlikely to be sold soon

You want to simplify inheritance planning

Situations Where Gifting May Not Be Ideal

Gifting may not work well if:

You still rely on the property for income

You may need the property later

Your child has financial instability

Capital gains taxes could be high

Professional tax planning is critical when making this decision.

What Are Alternative Strategies to Gifting Property?

Families often use trusts, life estate arrangements, or transfer-on-death deeds as safer alternatives to direct property gifting.

These options allow parents to maintain control while still planning future transfers.

1. Living Trusts

Living trusts allow parents to:

Retain control during their lifetime

Avoid probate after death

Provide structured inheritance instructions

Trusts can also help protect assets from legal risks.

2. Life Estate Arrangements

A life estate allows:

Parents to live in or use the property for life

Children to automatically inherit ownership after death

This option balances control and future planning.

3. Transfer-on-Death Deeds

Some states allow property owners to name beneficiaries who receive property after death without probate.

Benefits include:

Simple setup

Retained ownership control

Faster inheritance transfer

However, availability varies by state.

If you want to explore other real estate transfer options for families, check out our comprehensive guide about How to Transfer Real Estate to Children in the US to understand which method fits your situation.

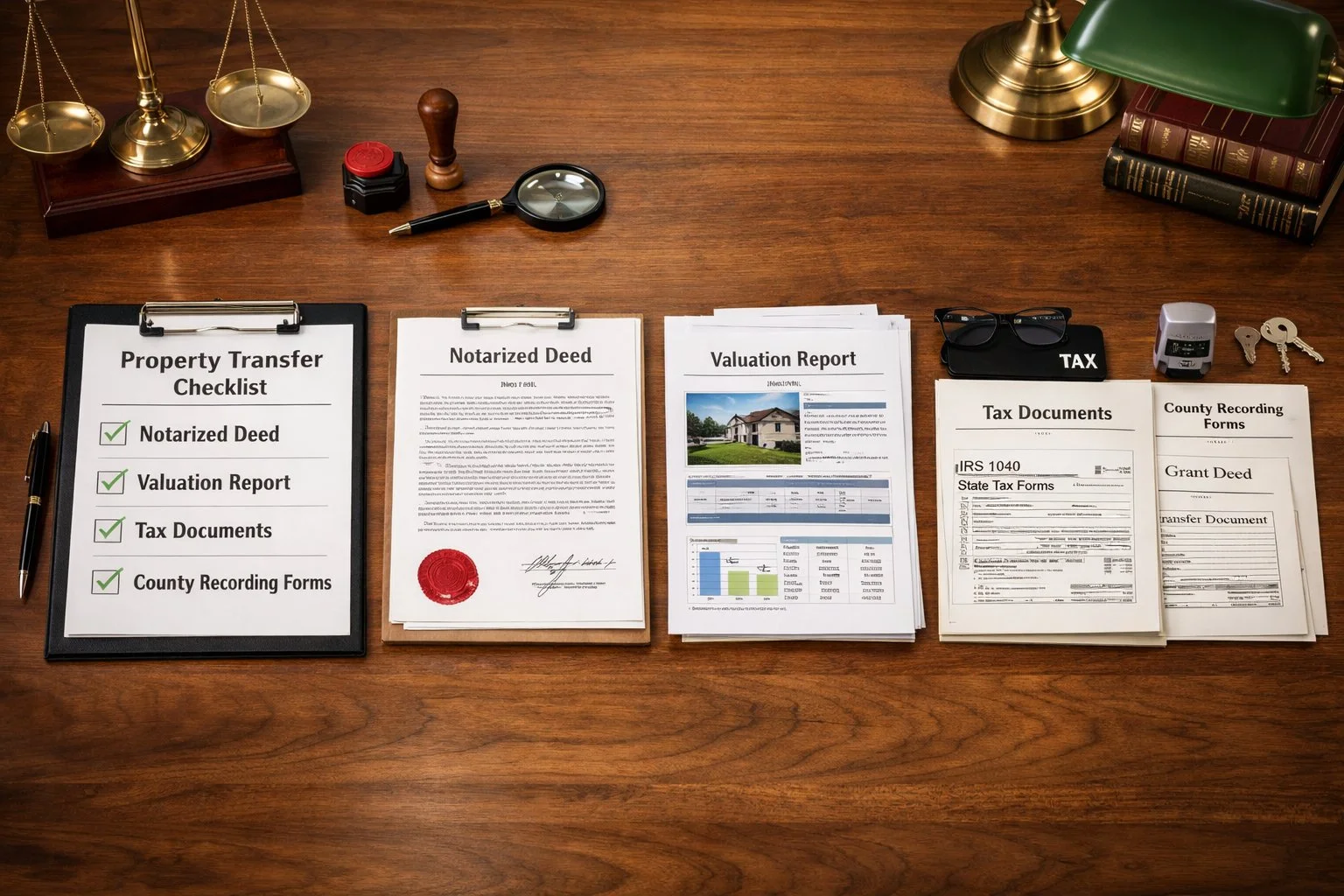

What Legal Steps Are Required to Gift Property?

Gifting property requires legal documentation, proper deed transfer, and tax reporting to ensure compliance with state and federal laws.

Skipping legal steps can create serious ownership disputes later.

Key Legal Requirements

Families usually need to:

Draft a legally valid property deed

Obtain professional property valuation

Notarize transfer documents

Record the deed with local authorities

File IRS gift tax forms if required

Importance of Professional Guidance

Real estate gifting involves:

Property law

Federal tax law

State-specific regulations

Working with professionals such as:

Tax advisors

Estate planning attorneys

Accountants

With these, it will help families avoid costly mistakes.

How Should Business Owners and Professionals Approach Property Gifting?

Business owners and high-earning professionals should evaluate property gifting as part of a broader tax and estate planning strategy rather than a standalone decision.

Real estate is often tied to overall wealth, investments, and retirement planning.

Key Planning Considerations

Professionals should review:

Total estate value

Business succession plans

Retirement income needs

Asset diversification strategies

Long-term tax exposure

Why Tax Strategy Matters

Property gifting can affect:

Estate tax obligations

Income tax planning

Asset protection structures

Intergenerational wealth transfer

Strategic planning often produces better financial outcomes than last-minute transfers.

What Questions Should Families Ask Before Gifting Property?

Families should evaluate financial, tax, legal, and emotional factors before transferring property ownership.

Important Questions to Consider

Do I still need income from this property?

Am I comfortable losing ownership control?

Will this gift create family conflict?

What taxes might my child face later?

Are there better estate planning alternatives?

How will this affect my retirement planning?

Answering these questions helps families make balanced and informed decisions.

Final Thoughts: Is Gifting Property the Right Move for Your Family?

Gifting property to children can be a powerful wealth transfer strategy. It can reduce estate taxes, simplify inheritance, and provide financial support during your lifetime. However, it also carries risks that many families overlook, especially related to tax consequences and loss of control.

The biggest mistake families make is treating gifting as a simple paperwork process. In reality, it is a major financial decision that affects multiple generations. Every family situation is different. What works for one household may create serious tax burdens or legal issues for another.

Careful planning, professional guidance, and open family communication are essential. When done correctly, property gifting can strengthen long-term financial stability and preserve family wealth.

Frequently Asked Questions

Is gifting property to children taxable?

Gifting property may require IRS reporting if it exceeds the annual gift exclusion. Taxes are only owed if lifetime gift limits are exceeded.

Do children pay taxes when receiving gifted property?

Children usually do not pay taxes when receiving the property. Taxes may apply later if they sell the property and owe capital gains tax.

Can parents still live in a gifted property?

Parents may continue living in the property only if legal arrangements allow it, such as a life estate agreement.

Is gifting property better than inheritance?

It depends on tax goals, estate size, and family financial plans. Inheritance often provides tax advantages through step-up in basis.