How to Use a Living Trust to Pass Real Estate to Children in the US

Feb 11, 2026

Real estate is not just property. It is often the biggest asset you own.

Maybe it is your family home. Maybe it is a rental property that helps fund your retirement. Maybe it is a commercial building tied to your business. Whatever the case, one question matters:

What happens to it when you are no longer here?

If you are a business owner, executive, or independent professional, you probably care about three things:

Staying compliant

Minimizing taxes

Making things simple for your family

A revocable living trust can help you do exactly that.

In this guide, you will learn:

What a living trust is and how it works

How to transfer real estate into a trust step by step

How taxes work when your children inherit property

What business owners need to watch out for

Common mistakes to avoid

Clear answers to frequently asked questions

Let’s break it down in simple terms.

What Is a Living Trust and Why Use It for Real Estate?

A revocable living trust is a legal arrangement where you place assets, like real estate, into a trust during your lifetime. When you pass away, those assets transfer directly to your children without going through probate court.

It allows you to keep control while you are alive and pass property smoothly after death.

What Does “Revocable” Mean?

Revocable means you can:

Change it

Update it

Cancel it

As long as you are alive and mentally capable, you stay in control.

Why Use a Living Trust for Real Estate?

Here are the main reasons people use a living trust to pass property to children in the US:

1. Avoid Probate

Probate is the court process that validates a will and transfers assets.

It can be:

Expensive

Slow

Public

In some states, probate can take months or even over a year. Court fees and legal fees can add up to 2% to 7% of the estate’s value.

If your property is properly placed in a living trust, it usually avoids probate entirely.

2. Maintain Privacy

Probate records are public.

A trust is not.

If privacy matters to you or your family, a living trust helps keep details about your property and its value out of public records.

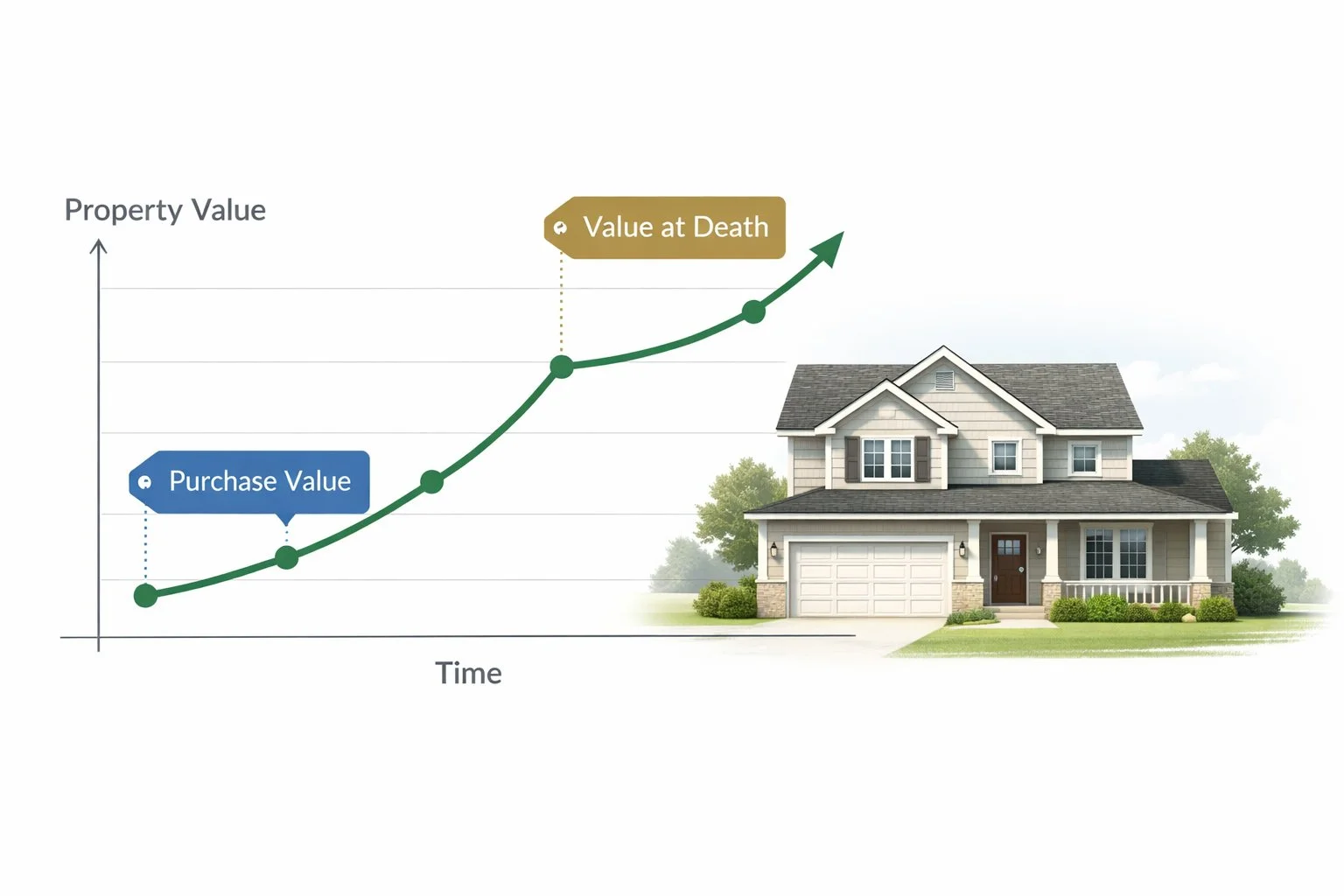

3. Preserve the Step-Up in Basis

This is one of the biggest tax advantages.

When your children inherit real estate through a living trust, they typically receive a step-up in basis.

This means:

The property’s value is adjusted to its fair market value at your death.

If they sell soon after inheriting, capital gains taxes are often very low.

This is usually better than gifting property while you are alive.

4. Keep Control During Your Lifetime

You can:

Sell the property

Refinance

Rent it out

Change beneficiaries

The trust does not take control away from you. You remain in charge as the trustee.

Step-by-Step: How to Use a Living Trust to Pass Real Estate to Children

Let’s walk through the process clearly.

Step 1: Create the Revocable Living Trust

First, you need a properly drafted trust document.

This document should:

Name you as the grantor (creator of the trust)

Name you as the initial trustee

Name your children as beneficiaries

Appoint a successor trustee

Outline how property should be distributed

For example, you can specify:

Equal shares among children

Delayed distribution until a certain age

Instructions to sell and divide proceeds

Most people hire an estate planning attorney to draft this. Legal fees typically range from $1,000 to $3,000 or more, depending on complexity.

You may also create a pour-over will, which moves any forgotten assets into the trust after death.

Step 2: Transfer the Property Into the Trust

This step is critical.

Creating the trust is not enough. You must fund the trust.

To fund it:

Draft a new deed transferring the property from your personal name to the trust.

The new title may look like:

John Smith, Trustee of the Smith Family Revocable Living Trust.Record the deed with the county recorder’s office.

Pay any required recording fees.

If you skip this step, the property may still go through probate.

Step 3: Notify Relevant Parties

Depending on your situation, you may need to notify:

Your mortgage lender

Your homeowners association

Your title insurance company

Most lenders allow transfers into revocable trusts, but it is smart to confirm.

Step 4: Continue Managing the Property

After transferring it:

You still collect rent.

You still pay property taxes.

You still make decisions.

Nothing changes in your day-to-day control.

How Taxes Work When Passing Real Estate Through a Living Trust

Taxes are often the biggest concern for business owners and professionals.

Let’s simplify how it works.

Step-Up in Basis Explained

Suppose you bought a property for $200,000.

At your death, it is worth $500,000.

If your children inherit it through your living trust, the new basis becomes $500,000.

If they sell for $510,000, they only pay capital gains tax on $10,000.

Without a step-up, they might have paid tax on $310,000.

This can mean huge tax savings.

Estate Taxes

A revocable living trust does not eliminate federal estate tax.

However:

Most estates do not exceed the federal exemption limit.

The trust helps with organization and administration.

State estate tax rules vary. It is important to review your state’s laws.

Income-Producing or Rental Property

If the property earns rental income:

Income continues to be reported.

After death, the trustee manages rent collection.

The trust may file a tax return during administration.

Business owners should coordinate this with their CPA or tax advisor.

Special Situations Business Owners Should Consider

If you run a business, things can get more complex.

Here are key areas to review:

Real Estate Held in an LLC

Many business owners hold property inside an LLC.

In that case:

You may transfer your LLC membership interest into the trust.

The trust becomes the member of the LLC.

The property itself remains in the LLC.

Before doing this:

Review the LLC operating agreement.

Confirm there are no transfer restrictions.

Consult legal and tax advisors.

This step is often missed in competitor guides, but it is critical.

Commercial Property

If you own office space, retail space, or industrial property:

Consider:

Existing leases

Tenant rights

Property management agreements

Your trust should clearly authorize the successor trustee to manage or sell commercial property.

Multiple Children and Fair Distribution

If you have more than one child, planning becomes more important.

Questions to address:

Will each child receive equal ownership?

What if one wants to sell and another does not?

Should the trustee sell the property and divide cash instead?

You can include:

Buyout provisions

Forced sale instructions

Delayed transfers

Clear instructions reduce family conflict.

Costs and Practical Considerations

Before setting up a living trust, understand the costs.

Typical Costs

Attorney fees: $1,000 to $3,000+

Deed recording fees

Possible minor transfer taxes

While upfront costs are higher than a simple will, avoiding probate can save significant money later.

Ongoing Review

Review your trust if:

You refinance the property

You buy or sell real estate

You move to another state

Your family situation changes

Outdated documents create problems.

Common Mistakes to Avoid

Even smart professionals make these mistakes.

1. Not Funding the Trust

This is the most common error.

If you do not transfer the deed, the property may still go through probate.

2. Forgetting to Update After Refinancing

Sometimes refinancing changes how the property is titled.

Always confirm it remains in the trust afterward.

3. Ignoring LLC Structure

If property is inside an LLC, you must transfer the membership interest properly.

4. Choosing the Wrong Successor Trustee

Your successor trustee should be:

Responsible

Organized

Financially capable

You can also name a professional trustee.

5. Assuming It Eliminates All Taxes

A revocable trust does not:

Avoid income taxes

Automatically eliminate estate taxes

Protect assets from personal creditors

It is an estate planning tool, not a magic shield.

Final Thoughts

Passing real estate to children is not just about paperwork. It is about protecting what you built.

For business owners and professionals, property often represents years of work, risk, and planning. A living trust helps ensure that asset transfers smoothly, privately, and with fewer tax surprises.

It keeps control in your hands while you are alive. It reduces court involvement after you are gone. And it gives your children clearer direction during a difficult time.

If you own real estate and have not reviewed your estate structure recently, now may be a good time to do so. A conversation with an experienced estate planning attorney and tax professional can help confirm that your property, LLC interests, and trust documents are aligned.

Clear planning today can prevent costly complications tomorrow.

For other options like gifting property, wills, and transfer-on-death deeds, read our comprehensive guide about transferring real estate to children in the US.

Frequently Asked Questions

What happens to property in a living trust after you pass away?

When you pass away, the successor trustee takes control of the trust. Because the property is already titled in the trust’s name, it usually avoids probate. The trustee follows your written instructions and either transfers the deed to your children or sells the property and distributes the proceeds.

Can you sell or refinance property in a living trust?

Yes. If the trust is revocable and you are the trustee, you keep full control. You can sell, refinance, or transfer the property just as you could before placing it in the trust. Lenders may ask for proof of your authority as trustee.

Does a living trust protect real estate from creditors?

Generally, no. A revocable living trust does not protect assets from your personal creditors during your lifetime.

Is a living trust better than a will for passing real estate?

For real estate, a properly funded living trust often avoids probate, which can save time and costs. A will alone usually requires probate before property can transfer.

Do children pay taxes when they inherit property from a living trust?

They usually receive a step-up in basis, which reduces capital gains if they sell. However, rental income or future gains are still taxable.