How to Use a Transfer on Death Deed to Pass Property to Your Children in the US

Feb 4, 2026

Passing property to your children should be straightforward. Yet for many families, real estate transfers turn into long probate delays, unexpected taxes, and legal stress that no one planned for.

A Transfer on Death Deed, also called a TOD deed, is one tool that can help avoid those problems. When used correctly and in the right situation, it lets parents pass real estate directly to their children without probate, while keeping full control during life. When used incorrectly, it can fail or even create new issues.

In this guide, you will learn:

What a Transfer on Death Deed is and how it works in the US

How to set one up step by step

The tax, debt, and Medicaid risks professionals should understand

When a TOD deed makes sense and when it does not

Let’s walk through it clearly and practically.

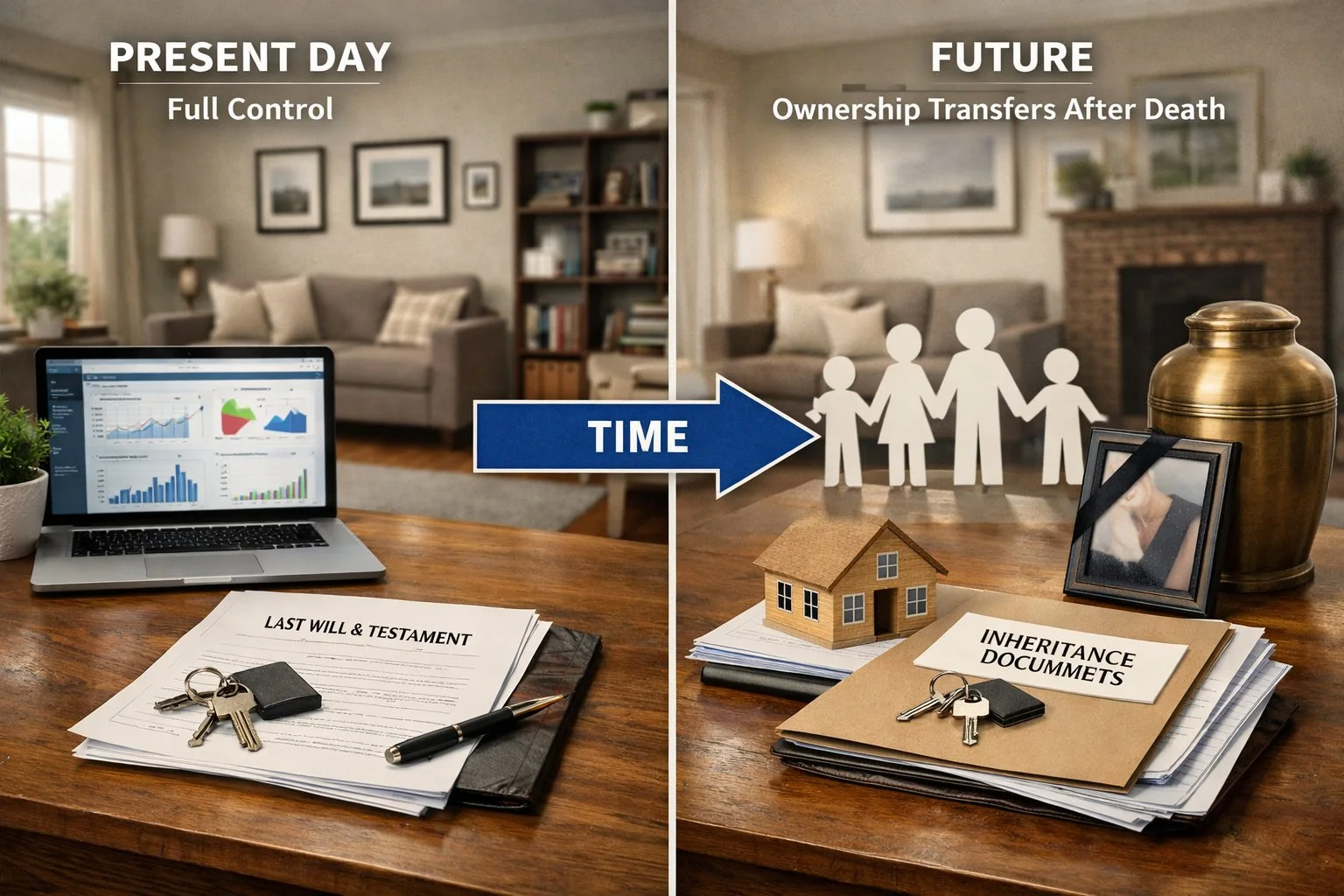

What Is a Transfer on Death Deed (TOD Deed) in the US?

A Transfer on Death Deed is a legal document that allows real estate to pass directly to your children when you die, without going through probate. You keep full ownership and control of the property while you are alive.

In simple terms:

The deed names beneficiaries, usually your children

Ownership transfers only after your death

The property skips probate in states that allow TOD deeds

Important details:

TOD deeds apply only to real estate

They are revocable at any time

Beneficiaries have no rights until death

Some states call these “beneficiary deeds,” but the function is the same.

Who Should Use a Transfer on Death Deed and Who Should Not?

A TOD deed is best for simple family and property situations, not complex estates. It works well when the goal is probate avoidance without giving up control.

A TOD deed may be a good fit if you:

Own one primary home or a small number of properties

Want your children to inherit equally and directly

Do not want to set up a living trust

Want to keep the right to sell or refinance

A TOD deed may not be appropriate if you:

Own property in multiple states

Have blended families or unequal inheritance plans

Are planning for Medicaid or long-term care

Have high creditor or lawsuit exposure

For business owners, the decision should factor in debt, taxes, and future risk, not just simplicity.

How Does a Transfer on Death Deed Work in the US?

A Transfer on Death Deed works by delaying ownership transfer until death while keeping control with the owner during life. Nothing changes legally until the owner passes away.

Here is how it works in practice.

During your lifetime

You remain the sole owner

You can sell, refinance, or revoke the deed

Your children have no ownership rights

At death

The TOD deed becomes effective automatically

Probate is avoided for that property

After death

Your children file a death certificate

Required affidavits are recorded with the county

Title transfers into their names

If the deed was not prepared or recorded correctly, this process can break down.

Which States Allow Transfer on Death Deeds in the US?

Transfer on Death Deeds are allowed in about 30 states plus Washington DC, but not nationwide. State law controls whether a TOD deed is valid.

Key points to understand:

The law of the property’s location applies

Living in a TOD state does not help if the property is elsewhere

Each state has its own rules and forms

Some states that do not allow TOD deeds offer alternatives, such as Lady Bird deeds. This is common in Florida and Michigan.

Always confirm state rules before relying on a TOD deed.

How Do You Set Up a Transfer on Death Deed Step by Step?

A TOD deed only works if every step is done properly. Skipping one step can invalidate the entire transfer.

Step 1: Confirm Your State Allows TOD Deeds

Before doing anything else:

Verify that your state recognizes TOD or beneficiary deeds

Confirm that the deed applies to your type of property

Never assume based on another state’s rules.

Step 2: Use the Correct State Specific Form

TOD deeds are highly technical documents.

You should:

Use a state approved form or attorney drafted deed

Follow statutory language exactly

Generic templates are one of the most common reasons TOD deeds fail.

Step 3: Identify the Property Accurately

You must use:

The full legal description from the current deed

Not just the street address or tax ID

A wrong legal description can void the deed.

Step 4. Name Children and Ownership Structure Clearly

When naming beneficiaries:

Use full legal names

Specify ownership type if naming multiple children

Options often include:

Tenants in common, equal or unequal shares

Joint tenancy, depending on state law

You should also:

Name alternate beneficiaries\

Plan for what happens if a child dies before you

Step 5: Sign, Notarize, and Witness as Required

Most states require:

Signing in front of a notary

Some require witnesses

You must also be mentally competent when signing. Challenges to capacity are a common cause of disputes.

Step 6: Record the Deed Before Death

Recording is critical.

You must:

File the deed with the county recorder

Pay the required recording fee

Do this before death

An unrecorded TOD deed often has no legal effect.

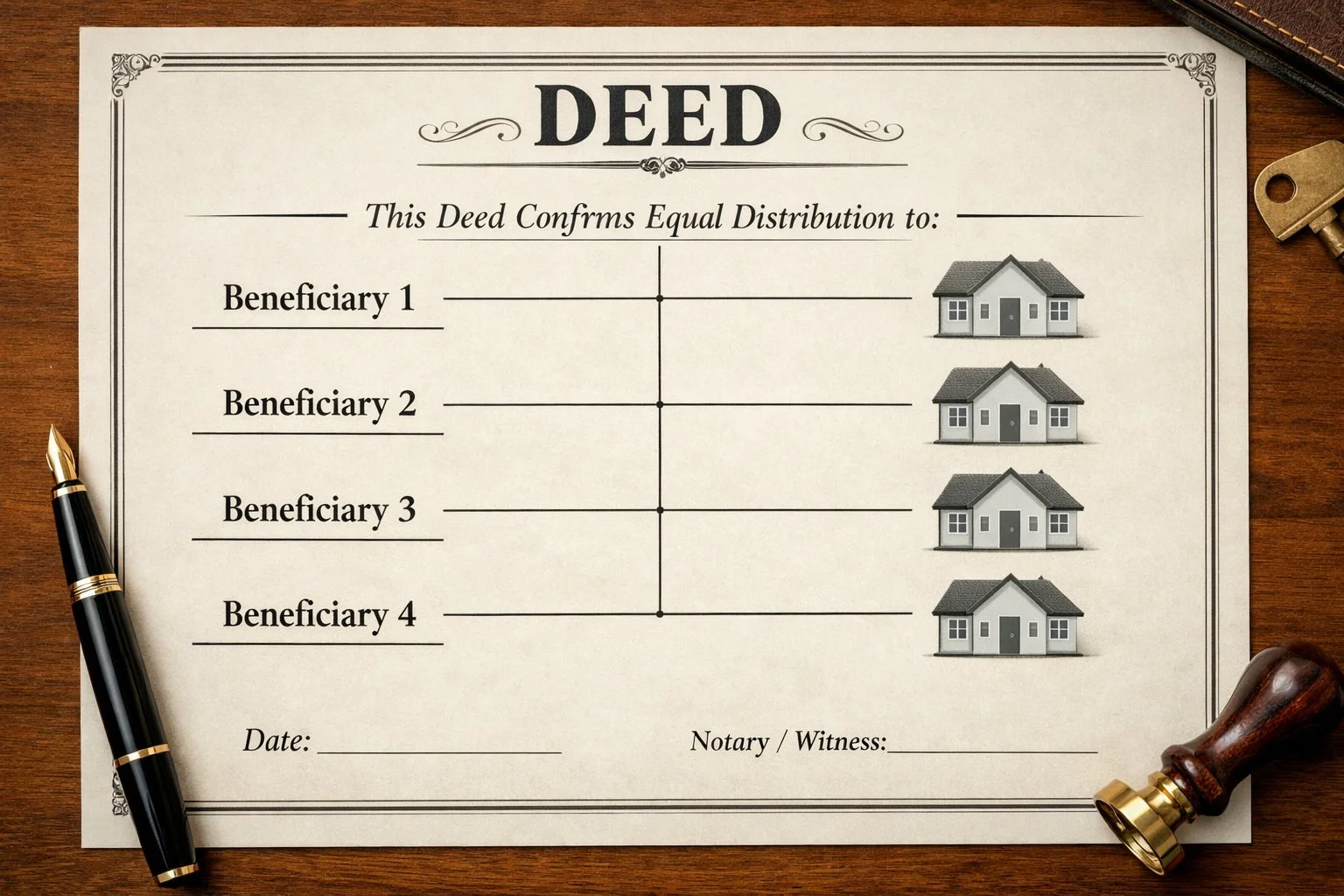

How Should You Name Children as Beneficiaries on a TOD Deed?

Children should be named clearly and precisely on a TOD deed to avoid disputes or probate. Small mistakes in naming can undo the benefit of the deed.

Best practices include:

Use full legal names, not nicknames

Specify equal or unequal shares

Define ownership structure for multiple children

If one child dies before you:

Their share may pass to surviving siblings

Or fall into probate if no alternate is named

If a child is a minor:

A custodian may be required

Court involvement may still occur

Planning for these scenarios is critical.

What Are the Tax Implications of Using a Transfer on Death Deed?

Using a TOD deed usually preserves favorable tax treatment for inherited property. The biggest tax benefit is the stepped-up basis.

Capital gains tax

In most cases:

Children receive the property at fair market value on the date of death

Capital gains tax is based on that value, not what you paid

This can significantly reduce taxes if the property is sold.

Gift tax

A TOD deed is not an immediate gift.

No gift tax is triggered when the deed is recorded

Transfer happens only at death

Estate tax

Most families are below federal estate tax thresholds

Some states impose estate or inheritance taxes

This depends on total estate value and location.

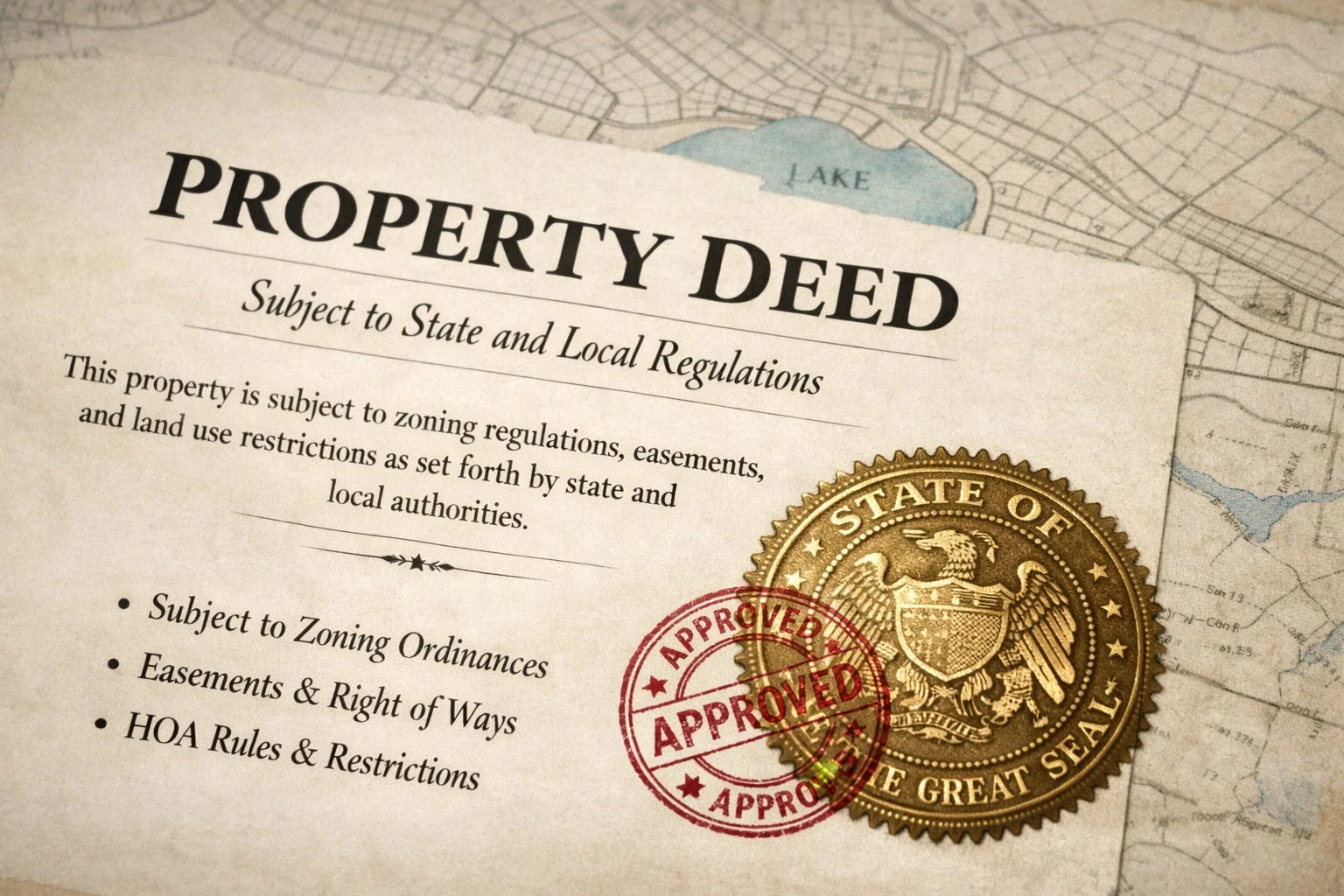

What Happens to Mortgages, Liens, and Debts With a TOD Deed?

A TOD deed does not eliminate mortgages, liens, or debts tied to the property. Your children inherit the property subject to all existing obligations.

This includes:

Mortgages and HELOCs

Property tax liens

Judgment or business-related liens

For business owners:

Real estate used as collateral remains encumbered

Lenders retain their rights

Children should understand these obligations before inheriting.

How Does a Transfer on Death Deed Affect Medicaid Eligibility?

A Transfer on Death Deed does not protect property from Medicaid rules. In many cases, it can still affect eligibility and estate recovery.

Important considerations:

States may treat TOD deeds as available resources

Medicaid look-back rules may apply

Estate recovery can still occur after death

If long-term care planning is a concern, a TOD deed alone is not sufficient.

How Does a Transfer on Death Deed Compare to Other Property Transfer Options?

A TOD deed is one of several ways to pass property, each with tradeoffs.

TOD deed vs will

TOD avoids probate

Wills do not avoid probate for real estate

TOD deed vs living trust

Trusts manage multiple assets and incapacity

TOD deeds apply only to real estate

TOD deed vs gifting during life

Gifting loses stepped-up basis

TOD preserves tax benefits

TOD deed vs adding a child to the deed

Adding a child creates immediate ownership and risk

TOD keeps control until death

To understand more the comparison between TOD, will, living trust, gifting during life and adding a child to the deed, check our comprehensive guide about How to Transfer Real Estate to Children in the US.

What Mistakes Can Invalidate a Transfer on Death Deed?

Many TOD deeds fail due to avoidable errors. These mistakes often surface only after death.

Common problems include:

Using the wrong form

Failing to record the deed

Incorrect legal descriptions

Conflicts with trusts or wills

Not updating after major life changes

Regular review is essential.

Final Thoughts: When Does a Transfer on Death Deed Make Sense for US Families?

A Transfer on Death Deed makes sense when the estate is simple and the goal is to avoid probate while keeping control. It works best when tax, debt, and family risks are clearly understood.

It is most effective when:

Property is located in a TOD-friendly state

Inheritance plans are straightforward

No Medicaid or complex creditor planning is needed

For professionals and business owners, a TOD deed should be part of a broader tax and compliance strategy, not a standalone fix.

Before recording a deed, review your situation carefully. Once death occurs, mistakes are often permanent.

Frequently Asked Questions

Does a TOD deed avoid probate?

Yes, for the property it covers, in states where TOD deeds are allowed.

Can I sell my property after recording a TOD deed?

Yes. You retain full ownership and control.

Do children owe capital gains tax when they inherit?

Usually less than with a lifetime gift, due to stepped-up basis.

Can creditors claim the property after death?

Yes. Valid liens and claims may still apply.

Can a TOD deed be revoked?

Yes. It is revocable at any time during life.