Best Practices for Tracking Business Expenses in New York

Dec 26, 2025

Running a business in New York already comes with enough challenges. High costs, tight rules, and lots of paperwork. The last thing you want is trouble because of messy expense records.

Tracking business expenses in New York is not just about staying organized. It is about staying compliant, protecting your deductions, and being ready if the IRS or New York State ever asks questions. Many small business owners lose money simply because they did not track expenses the right way.

The good news is that you do not need to be an accountant to do this well. With the right habits and tools, you can keep clean records, save time at tax season, and avoid costly mistakes.

In this guide, you will learn:

Why expense tracking matters for New York businesses

What business expenses are deductible in New York

New York record-keeping rules you must follow

Best practices for tracking business expenses in NY

Sales tax and NYC-specific tracking tips

Common mistakes to avoid

Let’s break it down step by step.

Why Tracking Business Expenses Matters for NY Businesses

Tracking business expenses matters everywhere, but it matters even more in New York.

New York businesses must follow both federal IRS rules and New York State tax rules. On top of that, many businesses also deal with local taxes, especially in New York City. If your records are unclear or incomplete, you could face denied deductions, penalties, or audits.

Good expense tracking helps you:

Prove your deductions during tax filing

Reduce audit risk from the IRS or New York State

Understand where your money is going

Plan better for cash flow and taxes

When expenses are tracked correctly, tax time becomes easier. When they are not, it becomes stressful and expensive.

In short, tracking business expenses in New York protects your business and your wallet.

What Business Expenses Are Deductible in New York

Before you can track expenses properly, you need to know what counts as a business expense in New York.

General Rule for Deductible Business Expenses

A business expense is deductible if it is:

Ordinary, meaning common for your type of business

Necessary, meaning helpful for running your business

This rule applies to both the IRS and New York State.

If an expense is personal, or partly personal, it usually cannot be deducted unless you clearly separate the business portion and document it.

Common Deductible Business Expenses in NY

Here are examples of business expenses that are commonly deductible in New York:

Rent for office or workspace

Utilities like electricity, water, and internet

Employee wages and payroll taxes

Payments to independent contractors

Software and online tools

Advertising and marketing costs

Legal and accounting services

Business insurance

Office supplies and equipment

Business travel and transportation

Business meals, usually 50 percent deductible

Just because an expense is deductible does not mean it automatically qualifies. You must be able to prove it with proper records.

Why Proper Tracking Matters for NY Deductions

New York State and the IRS both require proof. If you cannot show receipts, invoices, or clear records, a deduction can be denied.

Good tracking answers four key questions:

When did you spend the money

Who did you pay

How much did you pay

Why was it a business expense

If one of these is missing, your deduction may be at risk.

For a complete breakdown of what counts as a business expense under New York law, see our detailed guide on what counts as a business expense in New York.

New York Record-Keeping Requirements for Business Expenses

This is where many business owners get confused. Let’s keep it simple.

IRS vs New York Expense Tracking Rules

The IRS and New York State have similar record-keeping expectations, but New York can be more detailed during audits.

Both expect:

Accurate income and expense records

Proof for deductions

Clear separation of business and personal spending

New York may also request:

Sales tax documentation

Local tax records

Detailed transaction histories

That is why NY businesses should track more, not less.

How Long to Keep Business Expense Records in NY

At a minimum, keep business expense records for three years after filing your tax return.

However, many professionals recommend keeping records for six years in New York. This gives you protection if questions come up later.

Some records should be kept even longer:

Payroll records. At least four years

Asset purchases and depreciation records. As long as you own the asset, plus several years after

When in doubt, keep it longer.

Records NY Businesses Must Maintain

New York businesses should keep:

Receipts and invoices for expenses

Bank and credit card statements

Payroll and contractor records

Sales records and cash register tapes

Sales tax filings and reports

Mileage and vehicle logs

Each record should clearly show the date, amount, vendor, and business purpose.

Are Digital Receipts Accepted in New York?

Yes. New York accepts digital records.

You can scan or photograph receipts and store them electronically. Digital records must be:

Clear and readable

Easy to access

Stored safely

You should be able to produce them quickly if asked.

Best Practices for Tracking Business Expenses in NY

This section is the heart of the guide. These are the habits that keep your records clean and compliant.

Separate Business and Personal Finances

This is the most important rule.

Open a dedicated business bank account. Use a business credit card. Do not mix personal spending with business spending.

Why this matters:

Cleaner records

Easier tax filing

Lower audit risk

Stronger legal protection

Mixing funds is one of the biggest red flags in audits.

Use Accounting Software Designed for Small Businesses

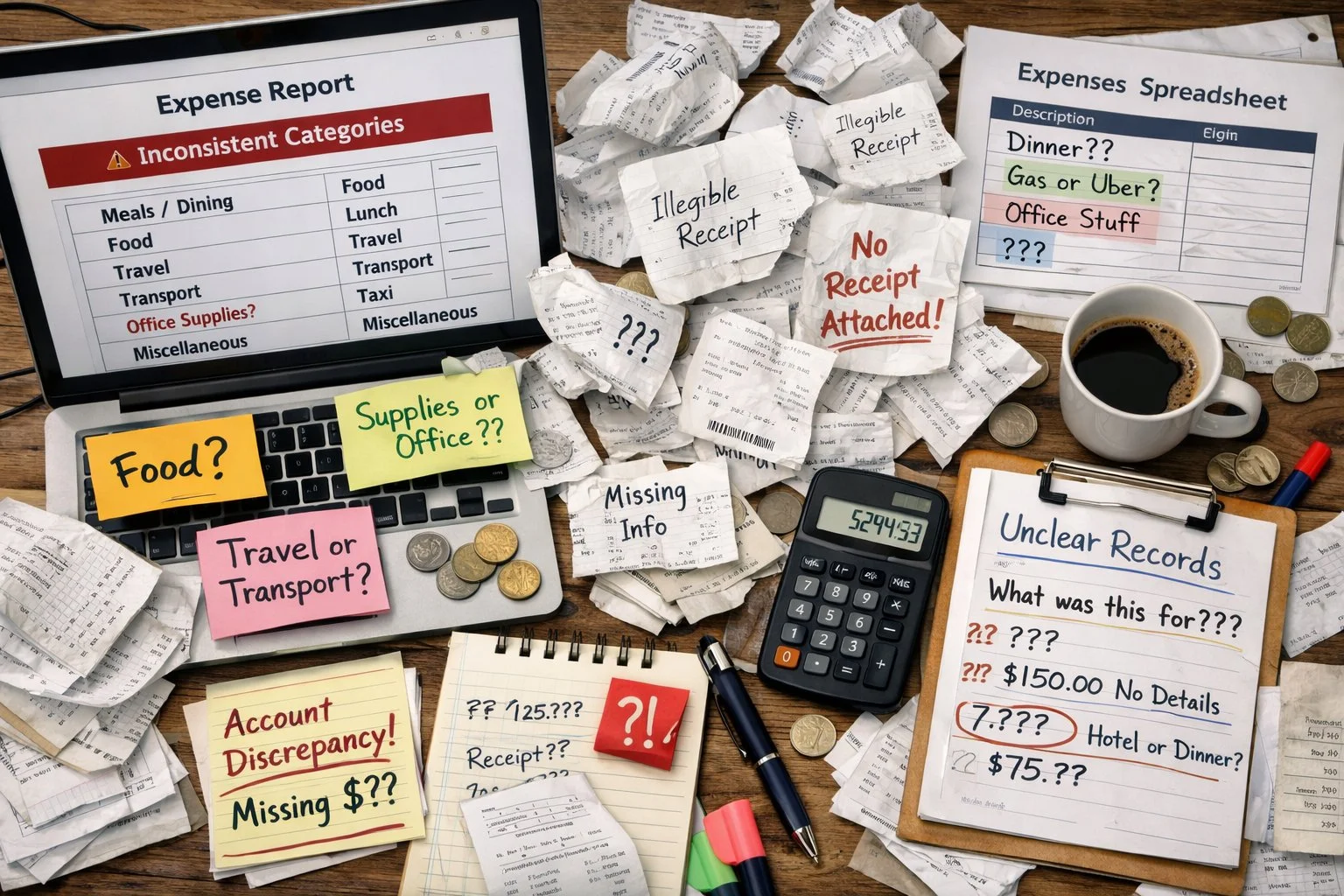

Manual spreadsheets can work, but they often lead to mistakes.

Accounting software helps you:

Import bank and credit card transactions automatically

Categorize expenses consistently

Generate reports for taxes

Store receipts with transactions

Popular options include QuickBooks, Xero, and Wave. Choose one that fits your business size and comfort level.

Digitize Receipts and Documents Immediately

Do not wait until the end of the month.

As soon as you make a purchase:

Take a photo of the receipt

Upload it to your software

Attach it to the transaction

Paper receipts fade and get lost. Digital records last longer and are easier to manage.

Categorize Expenses Consistently

Create a clear list of expense categories and use them every time.

Examples:

Rent

Utilities

Advertising

Travel

Meals

Professional services

Avoid vague categories like “miscellaneous.” Clear categories make tax filing easier and more accurate.

Track Mileage and Travel Expenses Correctly

Vehicle and travel expenses are common audit targets.

If you deduct mileage or vehicle expenses, you must keep a log that shows:

Date of the trip

Start and end location

Miles driven

Business purpose

Do not guess at the end of the year. Track trips as they happen.

Reconcile Bank and Credit Card Accounts Monthly

Reconciliation means matching your records to your bank statements.

Do this at least once a month to:

Catch missing expenses

Spot errors or duplicates

Confirm balances

Monthly reviews prevent small problems from turning into big ones.

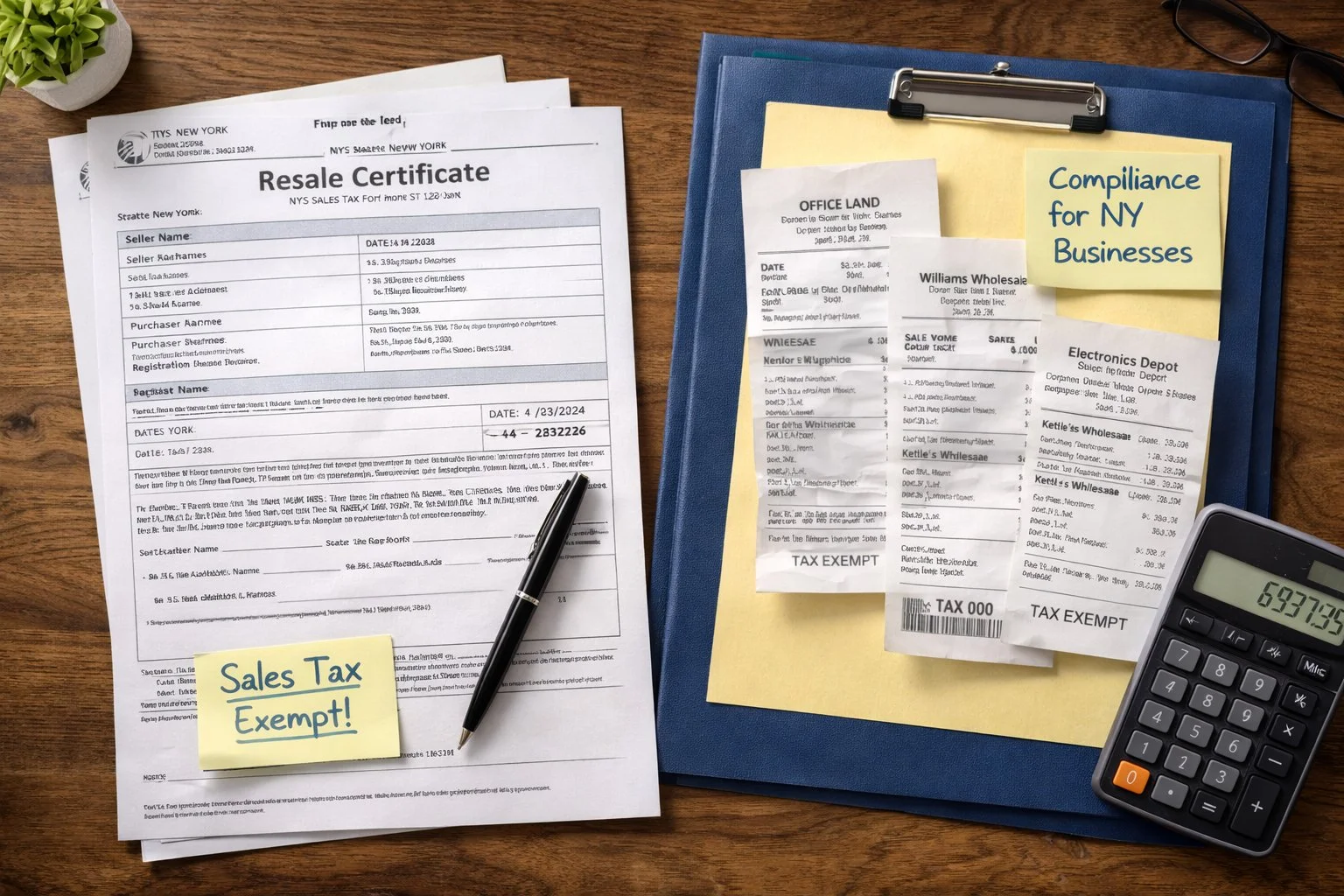

New York Sales Tax and Expense Tracking

Sales tax adds another layer to expense tracking in New York.

Tracking Sales Tax Paid vs Sales Tax Collected

Sales tax you collect from customers is not income. It belongs to the state.

Sales tax you pay on business purchases may or may not be deductible, depending on the situation.

Keep clear records showing:

Sales tax collected

Sales tax paid

Sales tax filed and remitted

Mixing these up can cause serious problems.

Resale Certificates and Exempt Purchases

If you buy items for resale, you may not pay sales tax at purchase. In these cases, you must keep resale certificates and supporting documents.

New York expects proof that exempt purchases were used correctly.

Why Sales Tax Records Matter in NY Audits

Sales tax audits are common in New York. Poor sales tax records can lead to penalties even if income taxes are correct.

Good expense tracking protects you.

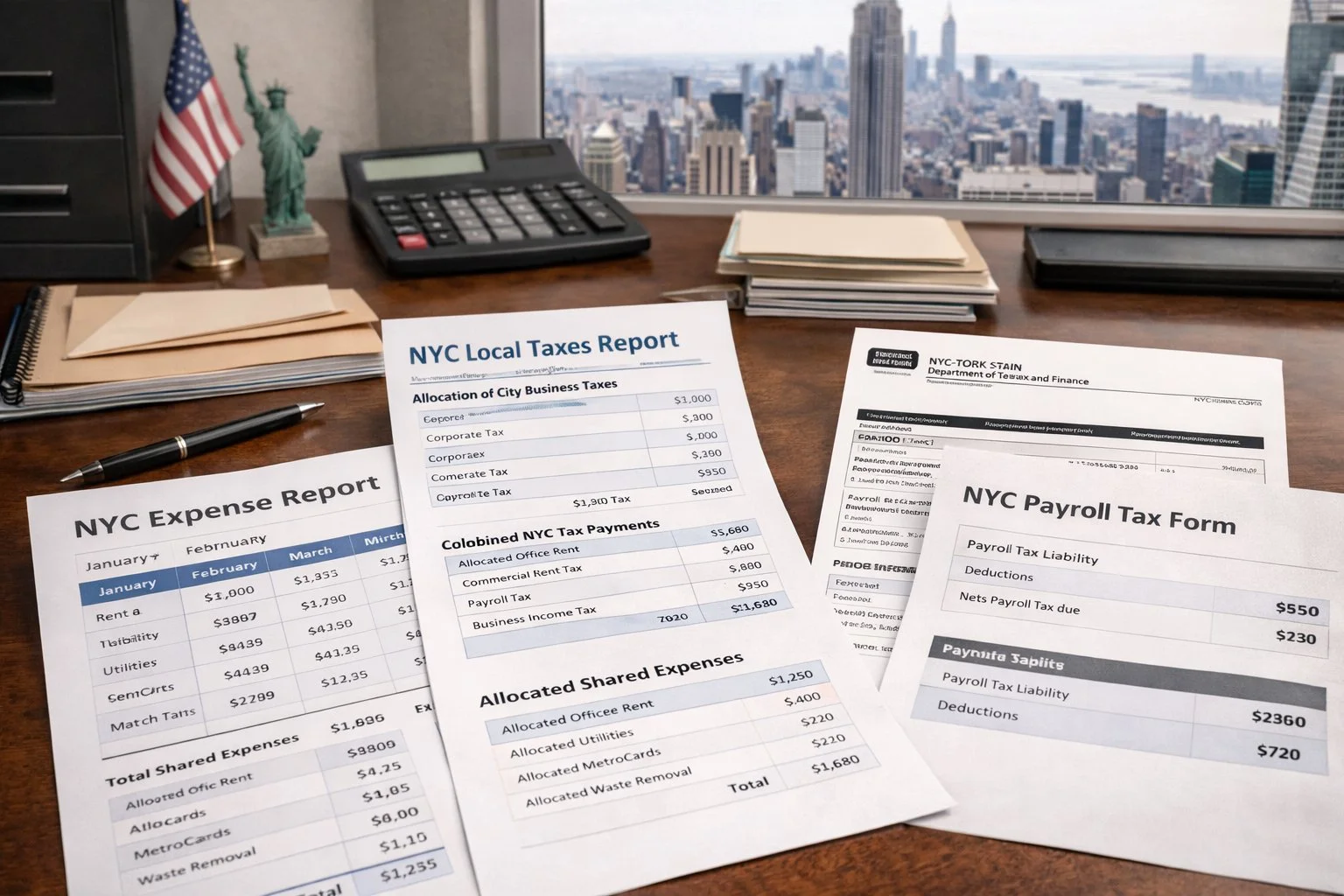

Expense Tracking for NYC Small Businesses

If you operate in New York City, there are extra things to consider.

NYC Unincorporated Business Tax and Expense Records

Some NYC businesses are subject to the Unincorporated Business Tax. Expense records often affect how this tax is calculated.

Accurate tracking helps support deductions and allocations.

Local Compliance and Documentation Considerations

NYC businesses may need to:

Track income sources by location

Allocate shared expenses

Keep local filings consistent with state records

Clear documentation makes this much easier.

Expense Allocation Issues Unique to NYC Businesses

If your business operates both inside and outside NYC, you may need to split expenses. This must be done carefully and consistently.

Keep notes explaining how and why expenses were allocated.

Best Tools for Tracking Business Expenses in NY

The right tools make everything easier.

Accounting Software for NY Small Businesses

Popular options include:

QuickBooks. Strong reporting and tax support

Xero. Clean interface and automation

Wave. Free option for simple businesses

Choose software that supports bank syncing and receipt storage

Expense and Receipt Tracking Tools

Many tools offer:

Mobile receipt scanning

Mileage tracking

Expense approvals

These tools reduce manual work and errors.

Choosing the Right Tool for Your Business Size

Small solo businesses may need simple tools. Growing teams need more controls and reporting.

Pick tools that can grow with you.

Common Expense Tracking Mistakes NY Businesses Make

Avoid these common errors:

Mixing personal and business expenses

Losing receipts or failing to document purpose

Waiting until tax season to organize records

Ignoring sales tax documentation

Using inconsistent expense categories

Each of these mistakes increases risk and stress.

Final Thoughts: When NY Businesses Should Get Professional Help With Expense Tracking

Tracking business expenses in New York is not just a bookkeeping task. It is a core part of staying compliant, protecting deductions, and keeping your business financially healthy.

If you follow the best practices in this guide, such as separating finances, keeping clear records, using the right tools, and reviewing expenses regularly, you will already be ahead of many businesses. Clean expense tracking makes tax filing easier, reduces stress, and lowers the risk of problems with the IRS or New York State.

That said, there are times when professional help makes sense.

You may want to work with a tax or accounting professional if:

Your records are disorganized or incomplete

Your business is growing quickly

You deal with sales tax, payroll, or NYC-specific taxes

You are preparing for or responding to an audit

You are unsure whether certain expenses are deductible

Getting help early can prevent costly mistakes later. A professional can help you set up better systems, review your records, and make sure you are following New York rules correctly.

At the end of the day, good expense tracking gives you control. It helps you understand your business, stay compliant, and focus on growth instead of paperwork. Start simple, stay consistent, and treat expense tracking as a regular part of running your business, not just something you think about at tax time.

Frequently Asked Questions

How long do I need to keep business expense records in New York?

At least three years. Many businesses keep them for six years to be safe.

Does New York accept digital receipts for business expenses?

Yes. Digital receipts are allowed if they are clear and accessible.

What records does NY require during a business tax audit?

Receipts, invoices, bank statements, payroll records, and sales tax documentation.

Do NYC businesses have different expense tracking rules?

Yes. NYC businesses may face additional local tax and allocation requirements.

What is the best way to organize business expenses in New York?

Use separate accounts, accounting software, consistent categories, and digital records.