How to Calculate Your SEP IRA Contribution

Dec 8, 2025

If you run a small business or work for yourself, you already know how many financial decisions land on your desk. Retirement planning is one of them. A SEP IRA is one of the most flexible and tax-friendly options you can use, but figuring out how much you can contribute is where most people get stuck. The rules look simple at first, then you discover formulas, percentage limits, and IRS exceptions you didn’t ask for.

It gets even more confusing when you’re self-employed. The IRS doesn’t let you use the same “25 percent of compensation” formula that applies to employees. Instead, you have to factor in net earnings, subtract half your self-employment tax, and apply an adjusted rate. Miss one step and your contribution ends up wrong. A lot of business owners rely on online calculators without knowing if the numbers are accurate.

The good news is that once you understand how the calculation works, you only need a few inputs to get the right number every time. In this guide, you’ll learn how SEP IRA contributions are determined, how to calculate them for both employees and self-employed individuals, what counts as compensation, how the 25 percent rule actually works, and which mistakes to avoid along the way.

What Is a SEP IRA Contribution

A SEP IRA contribution is an employer-funded retirement deposit made into a SEP IRA account. Employees cannot contribute to a SEP IRA. Only the employer can. If you are self-employed, you count as the employer.

SEP contributions are based on a percentage of “eligible compensation”. For employees, this is straightforward W-2 wages. For self-employed people, it is net earnings from self-employment after some adjustments.

Two limits always apply:

A percent of compensation (up to 25 percent for employees)

A yearly dollar cap ($69,000 for 2024 and $70,000 for 2025)

The contribution must follow both limits, and the lower number wins.

SEP IRA Contribution Limits for 2024 and 2025

Every tax year has two main limits that guide the maximum contribution:

Tax Year | Max Dollar Limit | Percent of Compensation |

2024 | $69,000 | 25 percent |

2025 | $70,000 | 25 percent |

For employees, the formula is simple. Take compensation, multiply by the employer contribution rate, and make sure the result does not exceed the yearly cap.

For self-employed people, the IRS uses a different formula because you cannot contribute a clean 25 percent. After self-employment tax adjustments, the effective rate becomes 20 percent when the plan advertises a 25 percent contribution.

Another important limit is the “compensation cap”. The IRS sets a maximum amount of compensation you can use to calculate the percentage. In 2025, the cap is $345,000. You cannot apply the 25 percent rate to income above that limit.

SEP IRA Calculation Basics

Before you run any numbers, it helps to understand the structure.

For employees, the calculation follows one formula:

Contribution = W-2 Compensation × Employer Contribution Rate

For self-employed people, the calculation uses the IRS rate table because the contribution affects the income that the contribution is based on. That creates a circular calculation. The IRS solved this by giving a reduced rate. When a plan says it allows a 25 percent contribution, the real rate for self-employed individuals becomes 20 percent.

Here is the simplified formula for self-employed contributions:

Contribution = Net Earned Income × 20 percent

The “net earned income” is not your Schedule C profit. It is your Schedule C profit minus half of your self-employment tax.

How to Calculate SEP IRA Contributions for Employees

If you have employees, your SEP IRA calculation is more direct. Here is the step-by-step process.

Step 1: Determine eligible compensation

Use an employee’s W-2 wages up to the yearly compensation cap.

Step 2: Choose the contribution percentage

Most employers pick a percentage between 0 and 25 percent. You must apply the same percentage to all eligible employees, including yourself.

Step 3: Multiply compensation by the percentage

Example:

The employee earns $80,000.

The employer chooses 10 percent.

SEP contribution = $80,000 × 10 percent = $8,000.

Step 4: Apply the yearly cap

If the percentage calculation exceeds the $69,000 or $70,000 limit, the yearly limit applies.

Eligibility reminder

An employee must be included if they:

Are age 21 or older

Earn at least $750 in compensation (2025 rule)

Worked for you in at least 3 of the last 5 years

Common mistakes employers make

Forgetting to use the same percentage for every eligible employee

Excluding part-time staff who meet the age and service rules

Using gross pay instead of the W-2 compensation definition

Missing the compensation cap

These small errors can cause compliance problems or force retroactive corrections.

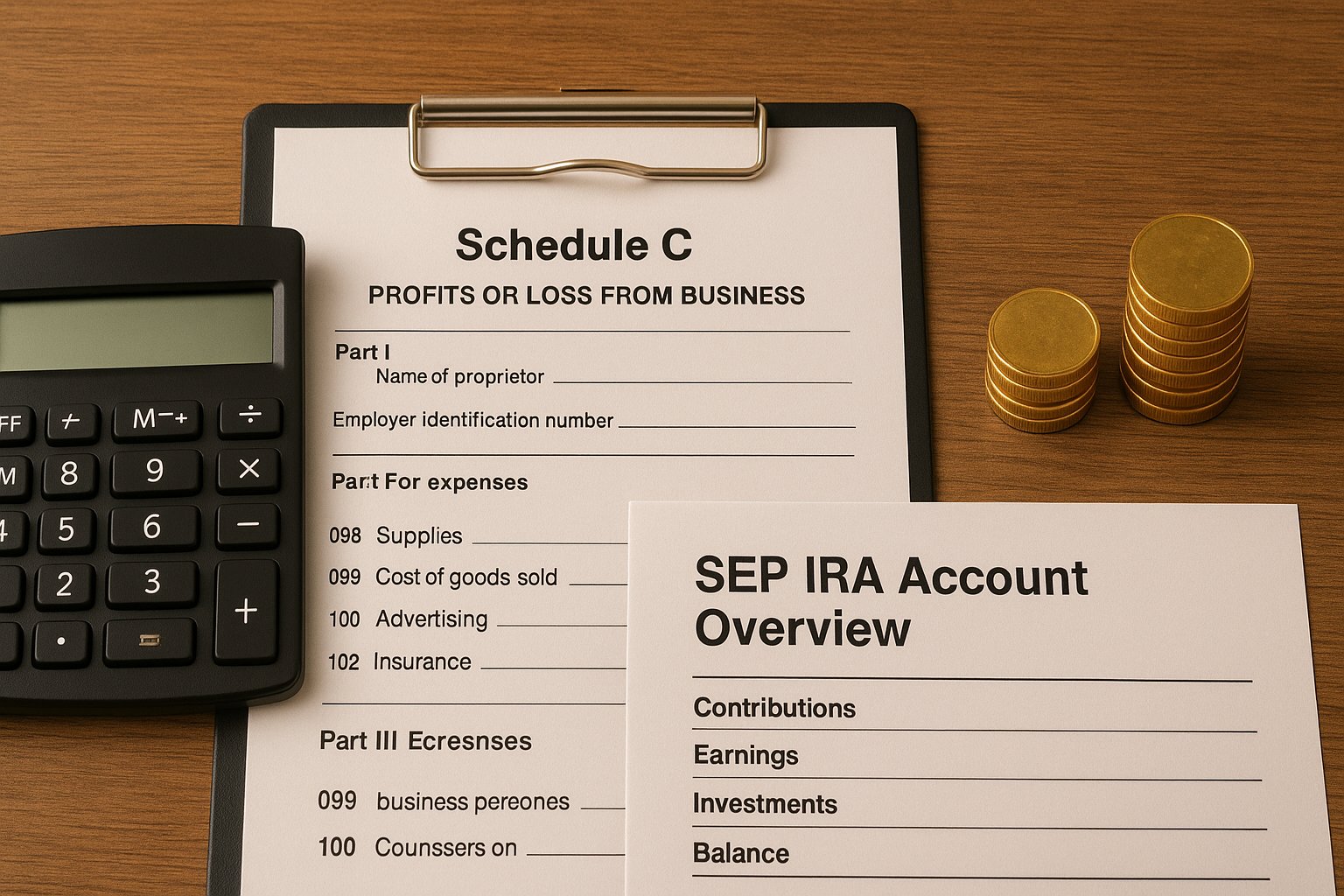

How to Calculate SEP IRA Contributions for Self-Employed

This is the section most readers need. The process is not hard once you understand the steps.

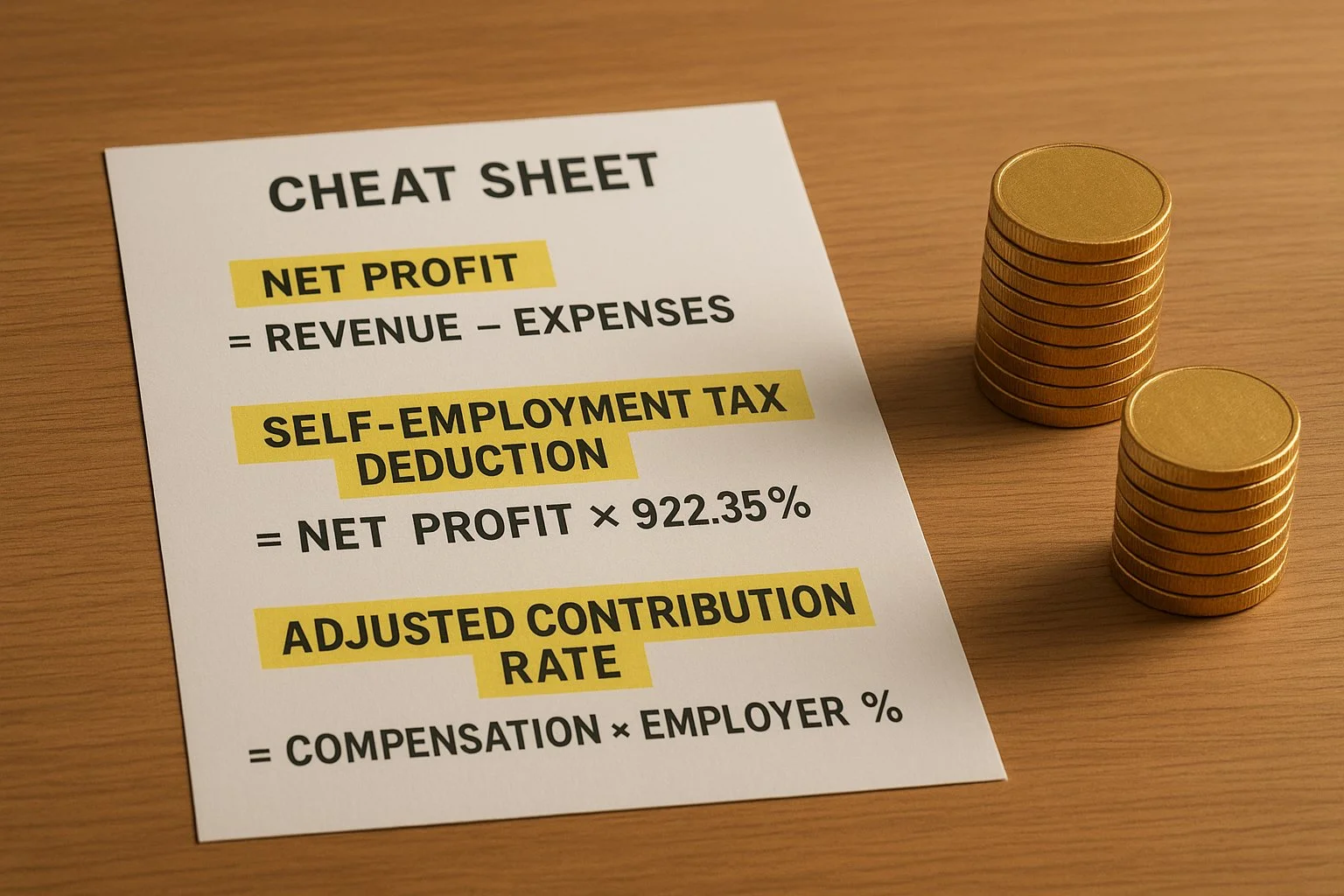

Step 1: Find your net profit

This is your Schedule C (Form 1040) net profit.

Step 2: Calculate your self-employment tax

Use Schedule SE. The standard formula is:

Net profit × 92.35 percent × 15.3 percent.

Step 3: Deduct half of your self-employment tax

You get this deduction on Form 1040.

Your “net earned income” is:

Net profit minus half of your SE tax.

Step 4: Apply the adjusted rate (20 percent if plan allows 25 percent)

This adjusted rate fixes the circular formula problem.

If the plan allows 15 percent, the adjusted rate would be 13.04 percent.

If the plan allows 25 percent, the adjusted rate is 20 percent.

Step 5: Apply the yearly dollar limit

If the calculation is higher than the annual cap, the cap applies.

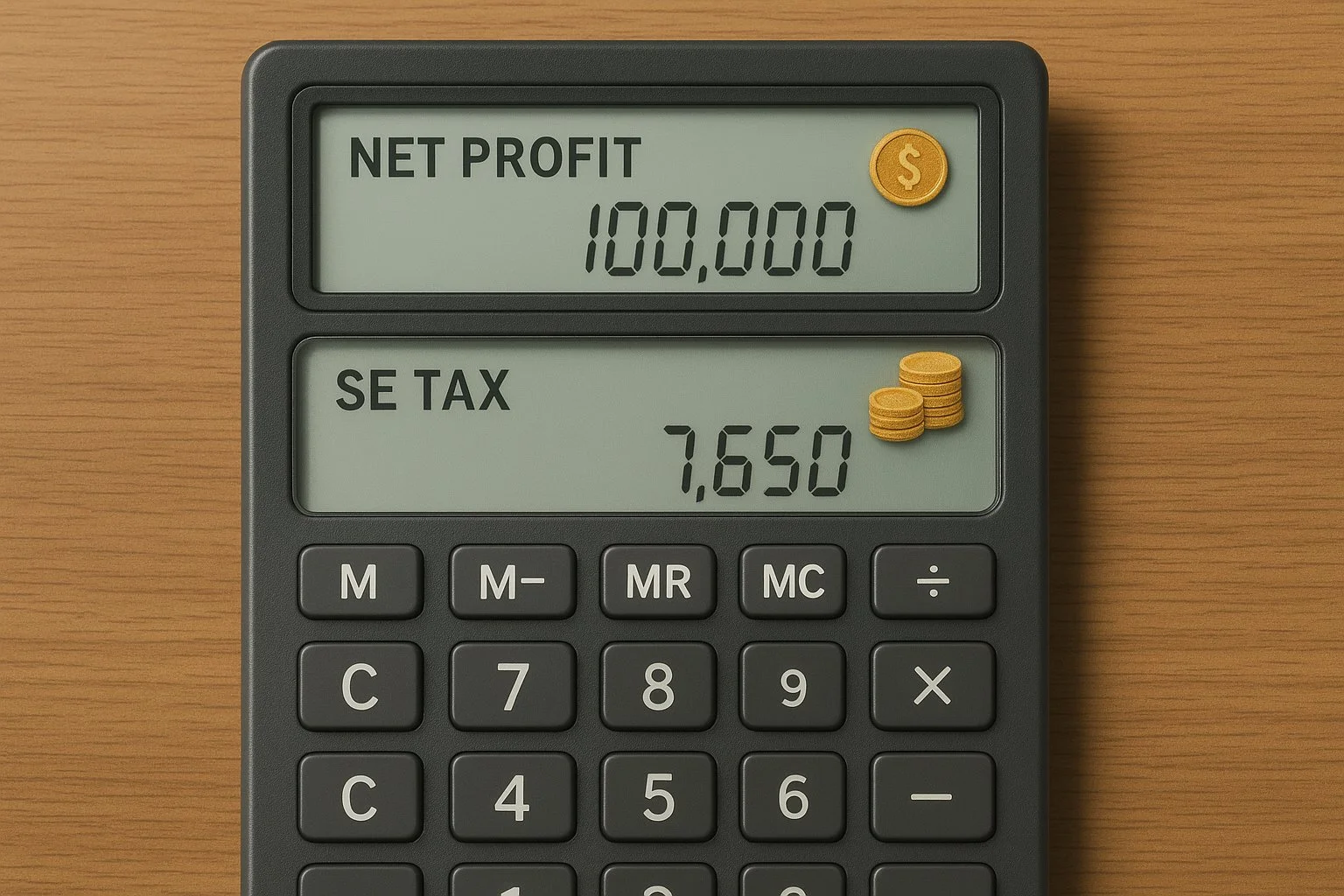

Full Example

Net Profit: $100,000

Self-Employment Tax: $14,130

Half of SE Tax: $7,065

Net Earned Income: $92,935

Adjusted Rate: 20 percent

Contribution: $92,935 × 20 percent = $18,587

Why does the adjusted rate exist?

The IRS recognizes that your contribution lowers your net earnings. Instead of forcing you into a circular loop, they created a reduction rate that does the math for you.

SEP IRA Formula Cheat Sheet

A quick reference section helps readers who want the answer fast.

For Employees:

Contribution = Compensation × Employer Contribution Rate

Limit: Lesser of 25 percent or the annual dollar cap.

For Self-Employed:

Contribution = Net Earned Income × Adjusted Rate

Limit: Lesser of adjusted percentage amount or the annual cap.

Adjusted rate for a 25 percent plan: 20 percent.

SEP IRA Contribution Calculator: How to Use It Correctly

Online calculators can help, but many skip key IRS adjustments. A reliable calculator should ask for:

Net profit from your Schedule C

Your self-employment tax

Whether you want the maximum allowed contribution

Your plan’s contribution percentage

A good calculator follows the IRS formulas from Publication 560. Many simple calculators do not. If your results seem too high or too low, run the calculation by hand using the steps earlier.

What Counts as Compensation

Compensation varies depending on whether you have employees or you are self-employed.

For employees

It includes W-2 wages and any taxable bonuses. It does not include:

Fringe benefits

Employer health insurance

Employer contributions to retirement plans

Certain reimbursements

For self-employed individuals

Compensation is your net earned income, which equals:

Net profit

minus half of your self-employment tax

minus your SEP IRA contribution (already accounted for by the reduced rate)

This definition matters because using gross income or unadjusted net profit will inflate your contribution and cause compliance issues.

SEP IRA Contribution Rules Employers Must Follow

Here are the rules you must apply consistently:

Uniform percentage rule

You must contribute the same percentage for every eligible employee. If you choose 10 percent for yourself, you must give every eligible employee 10 percent.

Eligibility requirements

Employees must be included if they meet the minimum IRS requirements. Employers may choose looser rules but cannot choose stricter ones.

Immediate vesting

Employees own their SEP contributions right away.

Deadlines

You must make contributions by the due date of your business tax return, including extensions. This gives you more time than most retirement plans.

SEP IRA Deduction Rules

SEP contributions are deductible as employer contributions. How you claim them depends on your business structure.

Sole proprietors

Deduct contributions directly on Schedule C as a business expense.

Partnerships

Partners receive contributions on their individual returns.

S-Corporations and C-Corporations

The corporation deducts contributions on its business tax return.

Why does this matter?

Your SEP IRA contribution reduces taxable business income, which can lead to significant tax savings. It is also important to avoid deducting contributions twice. You can take the deduction once as an employer contribution, not again as a personal deduction.

Special Cases and Edge Scenarios

Real-world businesses often have situations that do not fit the simple examples.

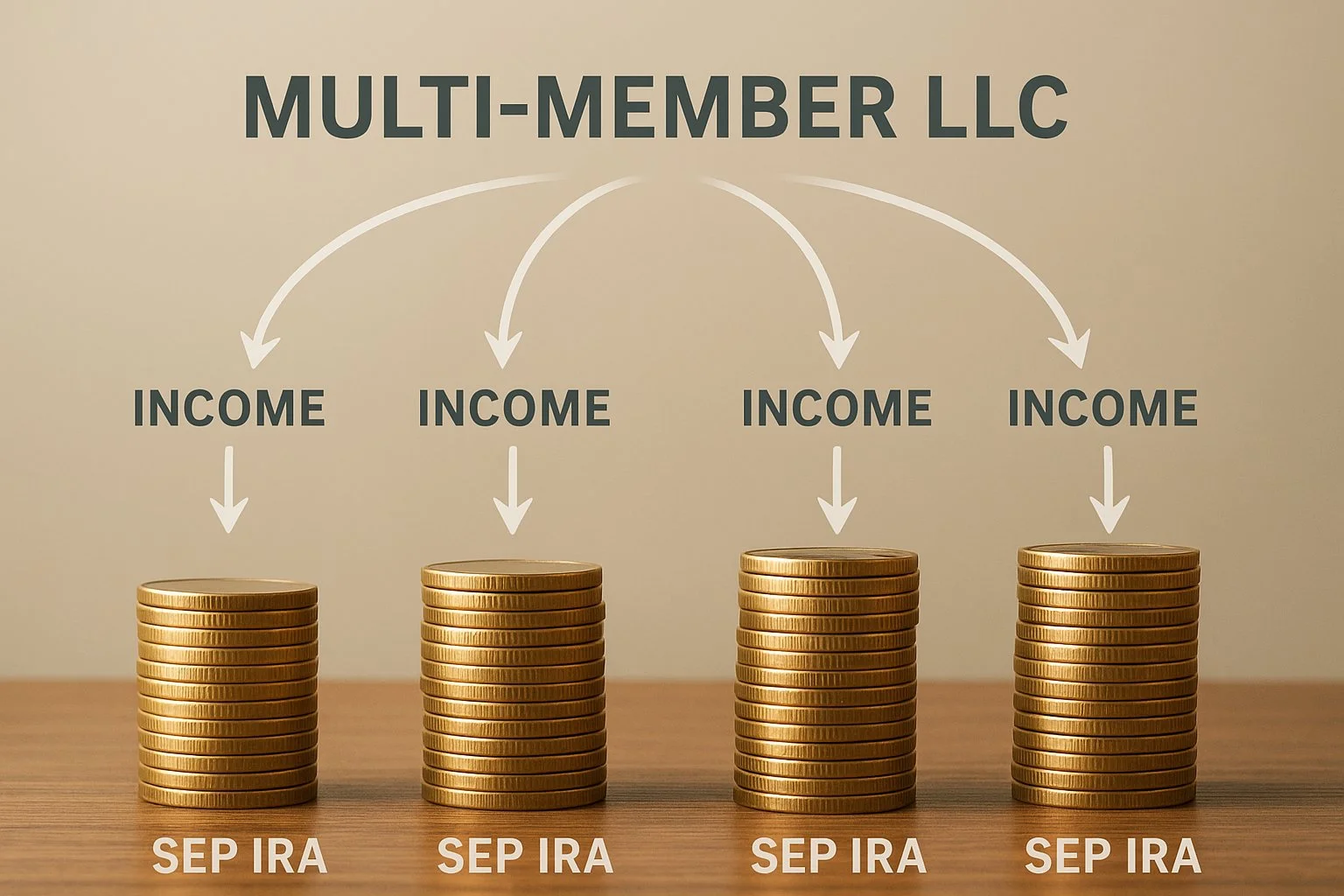

Multi-member LLCs

Each member calculates their own SEP IRA contribution based on their share of income.

S-Corp owners

Your contribution is based on W-2 wages, not distributions.

Low earnings

If your net profit is low, your eligible compensation after SE tax may not allow a large contribution.

Combining with other plans

You can maintain a SEP IRA and other plans like a Solo 401(k), but contribution rules differ. SEP contributions count separately from employee deferrals.

Seasonal and part-time workers

If they meet the minimum age, compensation, and service rules, they must be included.

Common Mistakes When Calculating SEP IRA Contributions

Avoid these issues that often lead to incorrect contributions.

Using the 25 percent rate instead of the adjusted 20 percent rate for self-employed people

Using gross income instead of net earned income

Forgetting to deduct half of self-employment tax

Applying the percentage to income above the IRS compensation cap

Leaving out eligible employees

Confusing employee contributions with employer contributions

Correcting a SEP IRA mistake after the fact can require plan amendments or IRS filings, so it helps to get it right the first time.

Conclusion

Calculating your SEP IRA contribution is easier once you break it down into steps. Employees follow a simple percentage formula. Self-employed individuals use a reduced rate to adjust for self-employment tax. Once you know your compensation base and your plan’s contribution rate, you can figure out your correct contribution without confusion.

If you want to double-check your numbers, you can use an IRS worksheet, an accurate online calculator, or a tax professional who works with small businesses and self-employed individuals.

Moreover, if you’re still getting comfortable with SEP IRA basics, our main guide on what a SEP IRA is can help. It covers eligibility, rules, and other must-know details that pair well with the math we covered here.

Frequently Asked Questions

How much can I contribute to a SEP IRA?

Up to 25 percent of compensation or the annual cap. In 2025, the cap is $70,000.

What is the SEP IRA 25 percent rule?

You cannot contribute more than 25 percent of eligible compensation. Self-employed people must use a reduced rate, usually 20 percent, to follow this rule.

What is Net Earned Income?

It is your Schedule C net profit minus half of your self-employment tax.

Do SEP IRA limits change each year?

Yes. The IRS adjusts both the contribution cap and the compensation limit for inflation.

Can S-Corp owners contribute to a SEP IRA?

Yes. Your contribution is based on your W-2 wages from the corporation.

Can I have a SEP IRA and a Solo 401(k)?

Yes, but the contributions follow different rules. A SEP IRA does not use employee deferrals.

What forms do I need?

You may need Form 5305-SEP to establish the plan and Publication 560 for calculation worksheets.

Can I change my SEP IRA contribution each year?

Yes. SEP IRA contributions are flexible. You can adjust the percentage or skip contributions in years when business income is low.

Are SEP IRA contributions tax-deductible?

Yes. Contributions reduce your business’s taxable income, providing a tax deduction for the employer while the employee defers taxes until withdrawal.

What happens if I miss the SEP IRA contribution deadline?

Contributions must be made by your business tax return due date, including extensions. Missing the deadline means the contribution cannot count for that tax year.