What Is a SEP IRA? Complete Guide for Self-Employed and Small Business Owners

Dec 5, 2025

If you run a business, even a tiny one, you already juggle taxes, clients, and the joy of being your own boss. Planning for retirement often falls to the bottom of the list. A SEP IRA helps fix that. It gives freelancers, gig workers, and small business owners a simple way to save for retirement while lowering taxable income. It feels like a cheat code for self employed people who want a retirement plan that fits real life.

In this guide, you will learn exactly how a SEP IRA works, how much you can contribute, who qualifies, the tax perks, the rules you must follow, and how to set one up without stress. By the end, you will know whether a SEP IRA is the right fit for you or your business.

SEP IRA Eligibility Requirements

A SEP IRA is a retirement plan created by employers. If you work for yourself, you count as both employer and employee. To start one, you must meet IRS guidelines.

Who can open a SEP IRA

Self employed individuals

Small business owners with one or more employees

Freelancers, consultants, gig workers, and independent contractors

LLC owners and sole proprietors

There is no minimum revenue requirement. If you earn even a small amount from self employment, you may qualify.

Employee eligibility rules

If your business has employees, you must offer the SEP IRA to all eligible workers. The IRS says an employee is eligible if they:

Are at least 21 years old

Worked for your business in at least 3 of the last 5 years

Earned at least the minimum IRS compensation amount for the year

These rules apply unless your plan document lists more generous terms. You cannot create stricter rules.

Key point

If your business has employees, you must contribute the same percentage of compensation for every eligible worker, including yourself.

Want the full breakdown of who qualifies for a SEP IRA and how contributions work? Check out our detailed SEP IRA eligibility guide.

How a SEP IRA Works for Self Employed and Small Businesses

A SEP IRA functions like a traditional IRA with a twist. Only employers can contribute, which means you contribute as the employer to your own SEP IRA.

How it works

You open a SEP IRA with a provider.

Each year, you choose what percentage of income to contribute

You can change your contribution amount from year to year.

Contributions are tax deductible as a business expense.

Your investments grow tax deferred until you retire.

Who manages the money

You control your own investments. Providers usually offer stocks, index funds, ETFs, and mutual funds. There are no fancy requirements or complicated rules.

Good to know

SEP IRAs have no annual filing for most businesses. Administration is simple compared to other plans.

SEP IRA Contribution Limits for 2025

Contribution limits are one of the biggest reasons people choose a SEP IRA. The ceiling is far higher than a normal IRA.

2025 SEP IRA contribution limit

You can contribute:

Up to 25 percent of compensation, or

Up to the annual dollar limit (IRS updated yearly)

This amount is much higher than the traditional IRA contribution limit.

What counts as compensation

If you are self employed, your compensation is your net earnings after expenses.

If you have employees, contributions must match the same percentage of their compensation.

Why this matters

The high limits allow you to catch up on retirement savings quickly, especially if you are a late starter.

If you want help figuring out your exact number, you can check my guide on how to calculate your SEP IRA contribution. It walks you through the formulas step by step.

Tax Benefits of a SEP IRA

A SEP IRA gives you powerful tax advantages that help both your short term and long term finances.

Immediate tax deduction

SEP IRA contributions count as business expenses. This lowers:

Your income tax

Your self employment tax

Your taxable business profit

For many owners, this is one of the biggest legal tax reduction tools available.

Tax deferred growth

Your investments grow without being taxed each year. You pay taxes only when you take money out during retirement.

No payroll taxes on contributions

Employer contributions to a SEP IRA are not subject to Social Security or Medicare tax, which saves even more.

Bottom line

If you want to save for retirement and reduce your tax bill at the same time, a SEP IRA works extremely well.

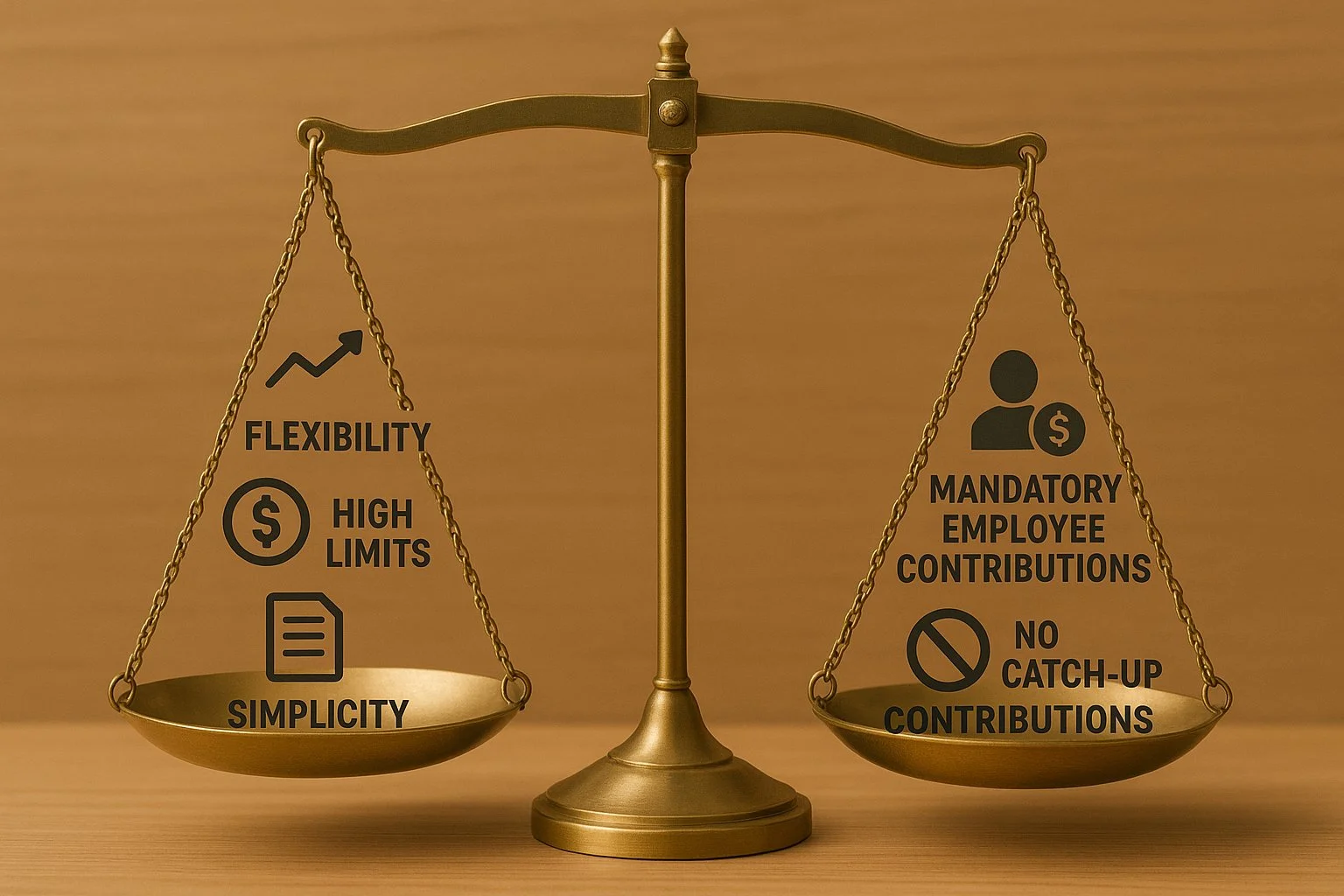

SEP IRA Pros and Cons

A SEP IRA offers advantages, but it is not perfect for everyone. Here is a simple look at both sides.

Pros

High contribution limits compared to traditional IRAs

Easy to set up and maintain

Contributions reduce taxable income

Flexible contribution amounts year to year

Ideal for self employed people with variable income

No annual filing requirements for most plans

Cons

Employees must receive the same contribution percentage

No catch up contributions for people over 50

Only employers can contribute

Required minimum distributions begin at age 73

Who benefits most

Freelancers and small business owners with no employees get the most flexibility and lowest costs.

SEP IRA Withdrawal and Distribution Rules

A SEP IRA follows the same distribution rules as a traditional IRA.

Retirement withdrawals

You can start withdrawing at age 59 and a half without penalty.

Withdrawals are taxed as regular income.

Withdrawals before retirement

If you take money out early, you pay:

Income tax on the amount

A 10 percent penalty, unless you qualify for an exception

Required minimum distributions

You must start taking required minimum distributions at age 73. If you delay, you face a penalty.

Tip

Since withdrawals are taxable, many business owners plan to withdraw when their retirement income is lower than their peak earning years.

How to Set Up a SEP IRA Step by Step

Setting up a SEP IRA is simple. You do not need a lawyer or accountant, although some business owners ask for help with tax planning.

Step 1: Choose a provider

Popular options include Vanguard, Fidelity, Schwab, Betterment, and other brokerages. Look for:

Low fees

Wide investment choices

Easy online setup

Step 2: Complete IRS Form 5305 SEP

This document establishes the plan. Most providers fill it out for you during setup.

Step 3: Open SEP IRA accounts for yourself and your employees

If you have eligible workers, you must open an account for each participant.

Step 4: Fund the accounts

You choose how much to contribute each year, up to the limit. Contributions must be made before your tax filing deadline, including extensions.

Step 5: Keep simple records

You do not need complicated paperwork. Track contributions and store your plan documents in case of audits.

For a complete, step-by-step guide, check out our article discussing how to open a SEP IRA for your business.

Best SEP IRA Providers for 2025

Different SEP IRA providers offer different benefits. Here is a quick breakdown to help you compare.

Fidelity

No account fees

Great index funds

Strong customer support

Vanguard

Best for low cost mutual funds

Ideal for long term investors

Easy online account management

Charles Schwab

Broad ETF selection

No fees for most accounts

User friendly platform

Betterment

Automated investing

Good for people who prefer a hands off approach

Annual management fee

Which provider is best

If you like picking funds yourself, Fidelity, Vanguard, or Schwab are all strong choices. If you prefer automation, Betterment works well.

If you’re wondering which provider to choose for your small business, see our full guide about top SEP IRA providers in 2025.

SEP IRA vs SIMPLE IRA vs Solo 401k

Choosing the right retirement plan depends on how your business works and whether you have employees.

SEP IRA

Best for owners with no employees

High contribution limits

No employee contributions

SIMPLE IRA

Designed for small businesses with employees

Employees can contribute

Lower contribution limits

Solo 401k

Best for self employed owners with no employees

Allows employee and employer contributions

Higher potential contribution limits

More paperwork

Which is right for you

If you want simple and flexible, SEP IRA is strong.

If you want to contribute more than a SEP IRA allows, Solo 401k might be better.

If you have employees who want to contribute, SIMPLE IRA is often the best choice.

Final Thoughts

A SEP IRA gives small business owners and self employed people a powerful way to save for retirement while lowering taxes. It is simple to manage, offers high contribution limits, and works well for anyone with variable income. Whether you are a freelancer, a consultant, a shop owner, or an LLC owner, a SEP IRA can make your retirement planning easier and more reliable.

For a full breakdown of how all small business retirement plans stack up, see our guide on choosing the right plan for your business.

Frequently Asked Questions

Can I have a SEP IRA and a Roth IRA?

Yes. Your SEP IRA contributions do not affect your ability to contribute to a Roth IRA. You must meet the Roth income limits.

Can I have a SEP IRA and a Solo 401k?

Yes, but your total contributions across all employer plans cannot exceed IRS limits.

Is a SEP IRA better than a traditional IRA?

It depends. A SEP IRA allows much higher contributions, which is better for business owners. A traditional IRA lets you contribute personally and may offer Roth options.

Do SEP IRAs have fees?

Many have no annual account fee. You do pay investment fund fees, which vary by provider.

Can employees contribute to a SEP IRA?

No. Only employers can contribute.

Do SEP IRA contributions affect Social Security benefits?

No. Contributions do not reduce the earnings used to calculate your Social Security benefits. They only reduce your taxable income for the year.

Can I skip contributions in a year?

Yes. SEP IRA contributions are optional. You can contribute different amounts each year or contribute nothing at all without penalty.

What happens if I hire employees after opening a SEP IRA?

Once you have eligible employees, you must include them in the plan. This means you must contribute the same percentage of compensation to their accounts as you contribute to your own.

Is a SEP IRA protected from creditors?

In most cases, yes. SEP IRAs have strong federal protections in bankruptcy and are often protected from creditors under state law. The level of protection can vary by state, so check your state rules if you need details.

How much should I contribute each year

Many owners contribute the maximum percentage allowed, but even small amounts reduce taxes and build retirement savings.