SEP IRA Setup Guide: How to Open One for Your Business

Dec 17, 2025

Setting up a retirement plan for your business can sound complicated. Forms, rules, deadlines, and IRS language do not exactly scream “easy afternoon project.” But a SEP IRA is one of the rare cases where retirement planning actually lives up to its promise of being simple.

A SEP IRA, short for Simplified Employee Pension Individual Retirement Arrangement, is designed for self-employed people and small business owners who want a tax-smart way to save for retirement without heavy paperwork or ongoing admin work.

If you earn good money some years and less in others, a SEP IRA gives you flexibility. If you want large tax-deductible contributions without managing a full retirement plan, this might be the right fit.

In this guide, you will learn exactly how to set up a SEP IRA step by step, what rules you must follow, which forms matter, common mistakes to avoid, and how to stay compliant while maximizing tax benefits.

What You Need Before Setting Up a SEP IRA

Before opening accounts or filling out forms, it's helpful to ensure a SEP IRA is a suitable option for your business.

A SEP IRA can be set up by:

Sole proprietors

Freelancers and independent contractors

LLC owners

Partnerships

S corporations and C corporations

Small businesses with employees

You do not need a minimum income level to start. You also do not need to contribute every year. That flexibility is one of the biggest reasons business owners choose this plan.

You should also understand one key rule upfront. SEP IRAs are funded only by the employer. Employees do not put in their own money. If you are self-employed, you are still treated as the employer.

Once you are comfortable with those basics, you are ready to move forward.

SEP IRA Requirements and Eligibility Rules

Employer Eligibility Requirements

Almost any type of business can set up a SEP IRA. There is no limit on business size, and you can start one even if you are the only person working in your company.

You can also open a SEP IRA even if you already have another IRA, like a Traditional or Roth IRA. These accounts can coexist simultaneously.

Employee Eligibility Rules You Must Follow

If you have employees, the IRS sets basic rules for who must be included in the plan.

By default, an employee is eligible if they:

Are at least 21 years old

Worked for you in at least 3 of the last 5 years

Earned at least $750 in compensation for the year

You are allowed to make the rules more generous, such as allowing younger employees or shorter work histories. You are not allowed to make them more restrictive.

Certain workers may be excluded, such as:

Union employees covered by a collective agreement

Nonresident aliens with no U.S. income

Eligibility rules matter because excluding someone incorrectly can cause compliance problems later.

If you want a deeper dive about this, check out our full guide about SEP IRA Eligibility Rules.

How to Set Up a SEP IRA Step by Step

This is the core of the process. In most cases, these steps can be completed in a single day.

Step 1: Choose a SEP IRA Provider

A SEP IRA is opened through a financial institution. This can be a bank, brokerage firm, or investment company.

When choosing a provider, look at:

Fees. Many SEP IRAs have no setup or annual fees.

Investment options. Stocks, ETFs, mutual funds, and bonds are common.

Ease of use. Online setup and simple dashboards help.

Customer support. Useful if you have employees or questions.

Well-known providers like Fidelity, Schwab, and Vanguard are popular because they keep costs low and make setup simple.

You can usually open a SEP IRA online in minutes.

To compare more options and have a deep understanding about each provider, check out our full guide about best SEP IRA provider.

Step 2: Establish a Formal Written SEP Agreement

The IRS requires every SEP IRA to have a written plan agreement. This document explains how the plan works.

Most small businesses use IRS Form 5305-SEP. It is a model form provided by the IRS and works for businesses that do not have another retirement plan.

Important things to know:

Form 5305-SEP is not filed with the IRS

You keep it in your records

It defines eligibility rules and contribution formulas

If you open your SEP IRA through a provider, they may supply their own version of this agreement.

Step 3: Set Up SEP IRA Accounts for All Eligible Participants

Each eligible person must have their own SEP IRA account.

This includes:

You, as the business owner

Any eligible employees

Depending on the provider, accounts may be opened by the employer or by each individual with guidance.

Once accounts are open:

Each participant controls their own investments

Funds belong fully to the employee right away

There is no vesting schedule

If you have no employees, this step is very simple. You open one account for yourself.

Step 4: Inform Employees and Share Required Information

If you have employees, you must inform them about the plan.

You are required to provide:

A copy of the SEP agreement

A written explanation of how contributions work

Information about eligibility and participation

This step is often skipped by competitors in guides, but it matters. Clear communication protects you if questions or audits arise later.

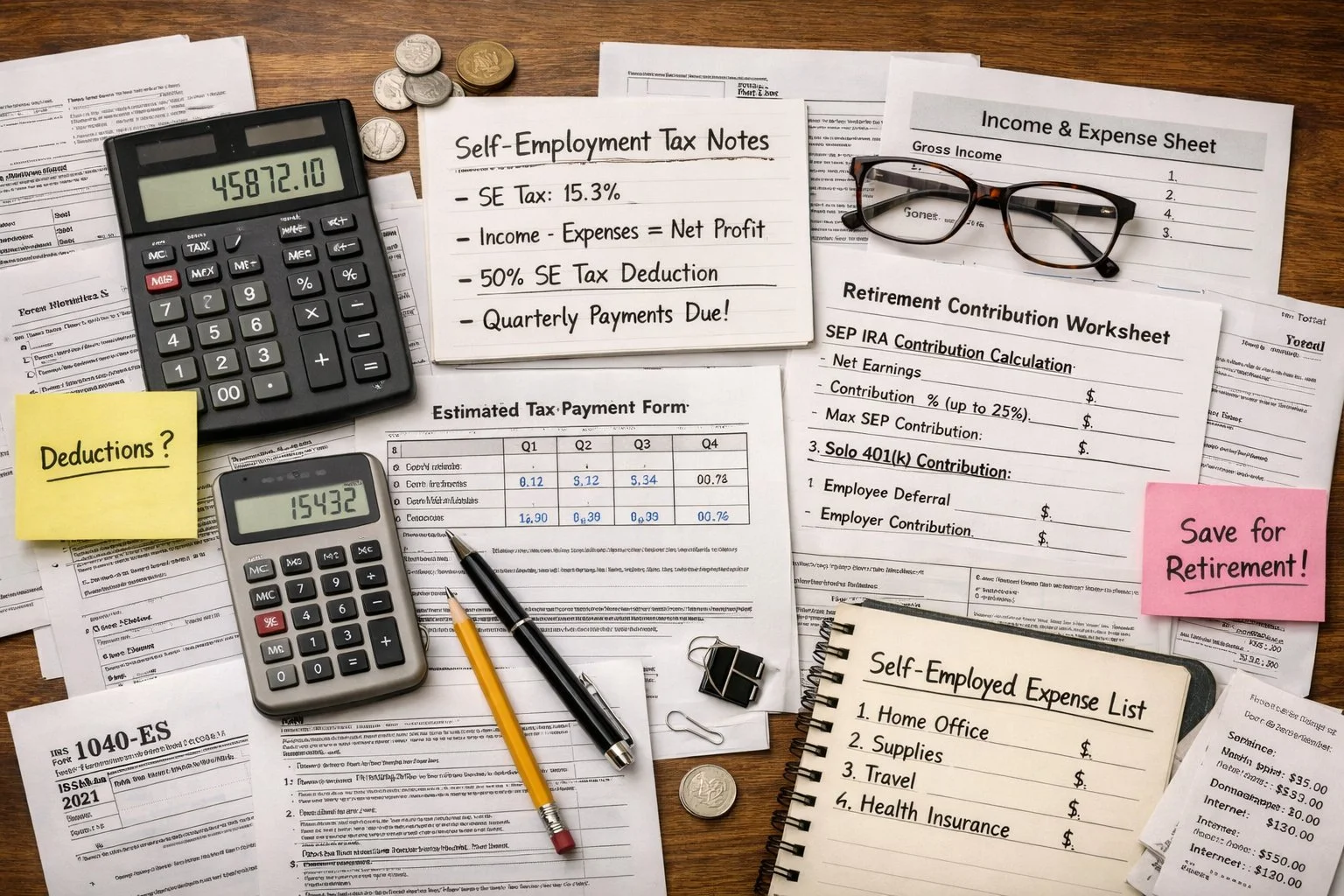

SEP IRA Contribution Rules You Must Follow

How SEP IRA Contributions Work

SEP IRA contributions are made only by the employer. Employees do not defer salary or make their own deposits.

All contributions must follow one rule. The same percentage of pay must be given to every eligible participant.

If you contribute 10 percent of compensation for yourself, you must contribute 10 percent for every eligible employee.

You can choose a different percentage each year, including zero.

Contribution Limits and Calculations

For 2025, contributions are limited to:

Up to 25 percent of compensation

A maximum of $70,000 per person

For employees, the calculation is simple. For self-employed individuals, it is more complex.

Self-employed contributions are based on:

Net earnings

Minus half of self-employment taxes

Minus the contribution itself

This is one area where mistakes often happen. Many business owners overestimate what they can contribute. Using a calculator or a tax professional can help.

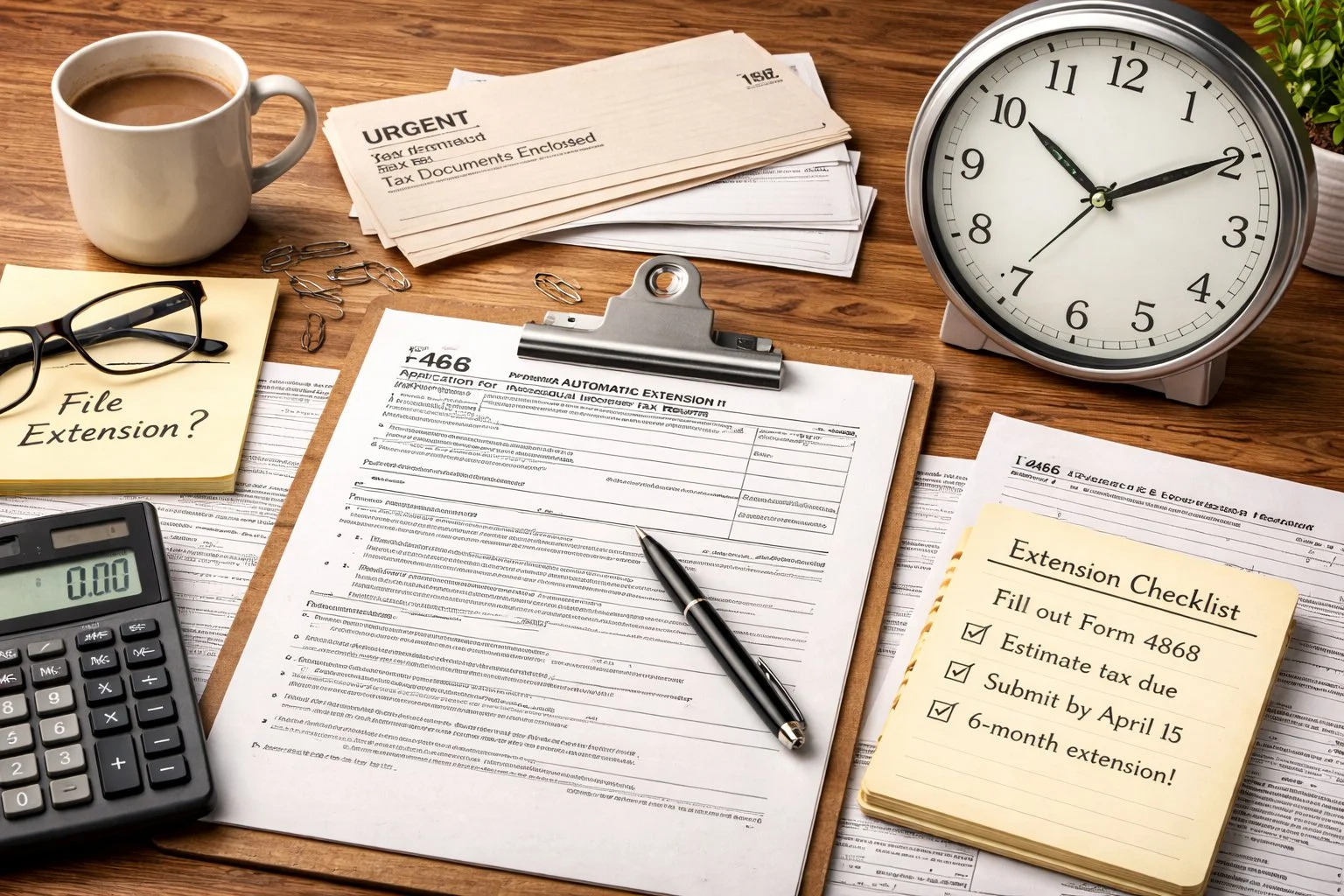

SEP IRA Deadlines and Timing

One of the biggest benefits of a SEP IRA is timing flexibility.

You can:

Set up a SEP IRA as late as your business tax filing deadline

Include extensions

Fund it up until that same deadline

This means you can decide to open and fund a SEP IRA after the year has ended, once you know your income.

For many business owners, this makes SEP IRAs a powerful tax planning tool.

SEP IRA Setup for Common Business Scenarios

SEP IRA Setup for Self-Employed Individuals

If you work for yourself and have no employees, a SEP IRA is very easy to manage.

You:

Open one account

Make employer contributions to yourself

Deduct contributions on your tax return

However, a Solo 401(k) may allow higher contributions in some cases. Comparing both options is smart before committing.

SEP IRA Setup for LLC Owners

LLC owners can use a SEP IRA, but the tax treatment depends on how the LLC is taxed.

Single-member LLCs follow self-employed rules

Multi-member LLCs follow partnership rules

LLCs taxed as corporations follow employer rules

The setup process is the same, but contribution calculations may differ.

SEP IRA Setup With Employees

When employees are involved, planning becomes more important.

You should think about:

Cost of matching your own contributions

Whether income varies year to year

How many employees may become eligible

SEP IRAs work best when employee counts are small or compensation levels are similar.

Common SEP IRA Setup Mistakes to Avoid

Many SEP IRA problems come from small oversights.

Common mistakes include:

Excluding eligible employees

Miscalculating self-employed contributions

Missing contribution deadlines

Forgetting employee notices

Assuming SEP IRAs require annual IRS filings

SEP IRAs usually do not require annual IRS filings, which is a major advantage when handled correctly.

SEP IRA Setup Checklist

Here is a simple checklist to keep things on track:

Confirm your business is eligible

Choose a SEP IRA provider

Complete a written SEP agreement

Open SEP IRA accounts for all eligible participants

Inform employees and provide required documents

Calculate contributions correctly

Fund accounts by the tax deadline

This checklist alone answers many common “how do I start” questions.

Final Thoughts: Is a SEP IRA the Right Retirement Plan for Your Business?

A SEP IRA is not the right solution for everyone, but for many small business owners, it checks all the right boxes.

It is easy to set up, flexible year to year, and allows large tax-deductible contributions with minimal paperwork. If you value simplicity and control, a SEP IRA is often a smart choice.

The key is setting it up correctly from the start. Follow the steps, respect eligibility rules, and plan contributions carefully.

If you’re ready to take the next step, consider consulting a financial professional or tax advisor who can guide you through setting up your SEP IRA. They can help ensure your contributions are calculated correctly, all eligible employees are included, and your plan is fully compliant with IRS rules. A little expert guidance now can make setting up your SEP IRA smooth, stress-free, and maximally beneficial for your retirement.

Moreover, if you want to to get a complete understanding of SEP IRAs, including detailed rules, contribution limits, and comparisons with other retirement plans, check out our full guide about what a SEP IRA is.

Frequently Asked Questions About SEP IRA Setup

Can I set up a SEP IRA after the tax year ends?

Yes. You can set up and fund a SEP IRA up until your business tax filing deadline, including extensions.

Can I open a SEP IRA if I have no employees?

Yes. Many self-employed people use SEP IRAs with no employees.

Do SEP IRAs require annual IRS filings?

No. Most SEP IRAs do not require annual filings, which keeps administration simple.

Can I change SEP IRA contribution amounts each year?

Yes. You can increase, decrease, or skip contributions entirely depending on business income.

Is a SEP IRA better than a Solo 401(k)?

It depends. SEP IRAs are simpler, while Solo 401(k)s may allow higher contributions in some cases.