SEP IRA Eligibility Rules: Who Qualifies and How It Works (Owners and Employees)

Dec 10, 2025

Retirement planning might feel like something you can postpone until “later,” but for self-employed professionals and small business owners, the clock is ticking. A SEP IRA, or Simplified Employee Pension Individual Retirement Arrangement, is one of the most flexible and tax-efficient ways to save for the future—without drowning in paperwork or complicated rules.

If you’re running a small business, freelancing, or managing a growing team, understanding who qualifies for a SEP IRA is essential. Making contributions incorrectly or excluding eligible employees can lead to IRS headaches, missed tax deductions, and lost retirement savings.

In this guide, you’ll learn exactly who is eligible to participate in a SEP IRA, how eligibility affects contributions, what employees must know, common mistakes to avoid, and how to set up your plan properly. By the end, you’ll have a clear, actionable roadmap for compliance and maximizing retirement savings for both you and your team.

Who Can Open a SEP IRA (Owners & Self-Employed)

The beauty of a SEP IRA is its simplicity. Virtually any business owner or self-employed individual can set one up. This includes:

Sole proprietors

Partnerships

Limited Liability Companies (LLCs)

S Corporations and C Corporations

Even if you have no employees at all, you can establish a SEP IRA for yourself—and in some cases, for your spouse. This flexibility makes it an ideal choice for independent contractors, freelancers, and small business owners who want a simple retirement plan with high contribution limits.

It’s important to note that only the employer contributes to a SEP IRA. Unlike a traditional 401(k), employees cannot make their own salary deferral contributions. That means, as the owner, you control how much goes in each year—but if you have eligible employees, you must follow specific rules to remain compliant.

Key takeaway: SEP IRAs are accessible to almost any business owner, from solo entrepreneurs to corporations, making them a versatile retirement solution.

Employee Eligibility Rules

While owners can generally set up a SEP IRA without fuss, employee eligibility is regulated by IRS rules. The baseline requirements for most employees are known as the 21/3/750 rule:

Age Requirement: Employees must be at least 21 years old.

Service Requirement: They must have worked for the employer for at least 3 of the last 5 years. This is sometimes called the “3-of-5 rule.”

Compensation Requirement: They must have earned at least $750 from the employer in the current tax year (2025 threshold).

Optional employer adjustments

You can adopt less restrictive rules, such as allowing younger employees or those with fewer years of service to participate, but you cannot impose stricter rules.

Allowed exclusions

Union employees covered by a collective bargaining agreement can be excluded if their retirement benefits were already bargained for.

Nonresident aliens without U.S.-sourced income are generally excluded.

Immediate vesting

All contributions to employees’ SEP IRAs are 100% vested immediately. This means the money belongs to the employee right away, even if they leave the company later.

Key takeaway: Following these rules carefully ensures your SEP IRA is compliant and that all eligible employees benefit fairly.

Contribution Rules Tied to Eligibility

Once eligibility is clear, contributions are the next piece of the puzzle. Unlike other retirement plans, SEP IRAs are employer-funded only. Employees cannot make salary deferral contributions.

Uniform contribution percentage

If you decide to contribute for yourself as the owner, you must contribute the same percentage of compensation to all eligible employees. For example, if you contribute 10% of your compensation, your eligible employees must also receive a 10% contribution.

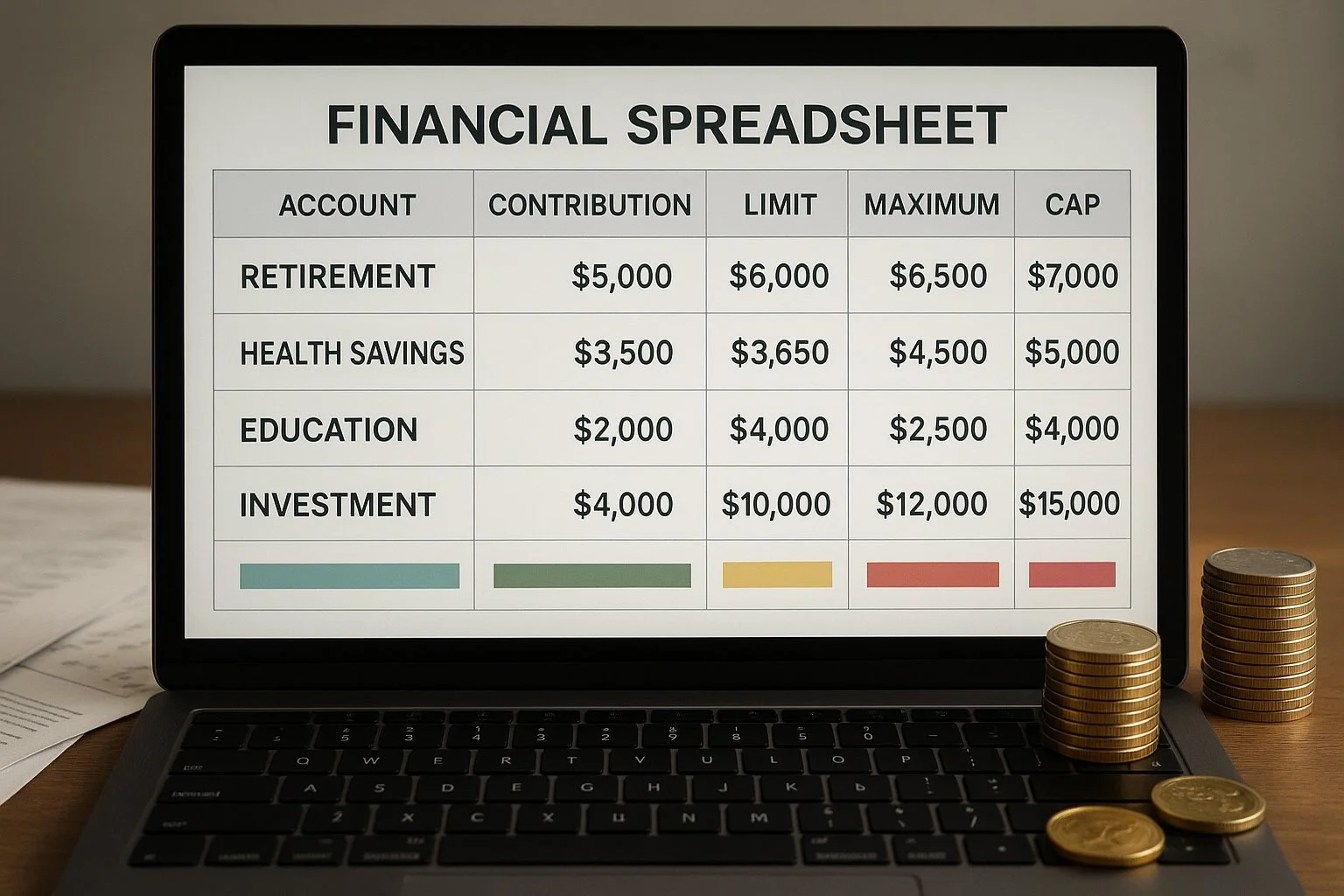

Annual contribution limits

For 2025:

Maximum contributions per participant = lesser of 25% of compensation or $70,000

Compensation for contribution calculation is capped at $350,000

Self-employed owner calculation

For sole proprietors and other self-employed individuals, contributions are calculated differently because of the self-employment tax:

Take net earnings from self-employment.

Subtract half of your self-employment tax.

Adjust for the SEP contribution itself to stay within the 25% limit.

In practice, the effective contribution rate for an owner is typically around 20% of net self-employment income, rather than the full 25%.

Key takeaway: Contribution rules are simple for employees, but self-employed owners should carefully calculate to avoid exceeding limits.

Special Eligibility Considerations

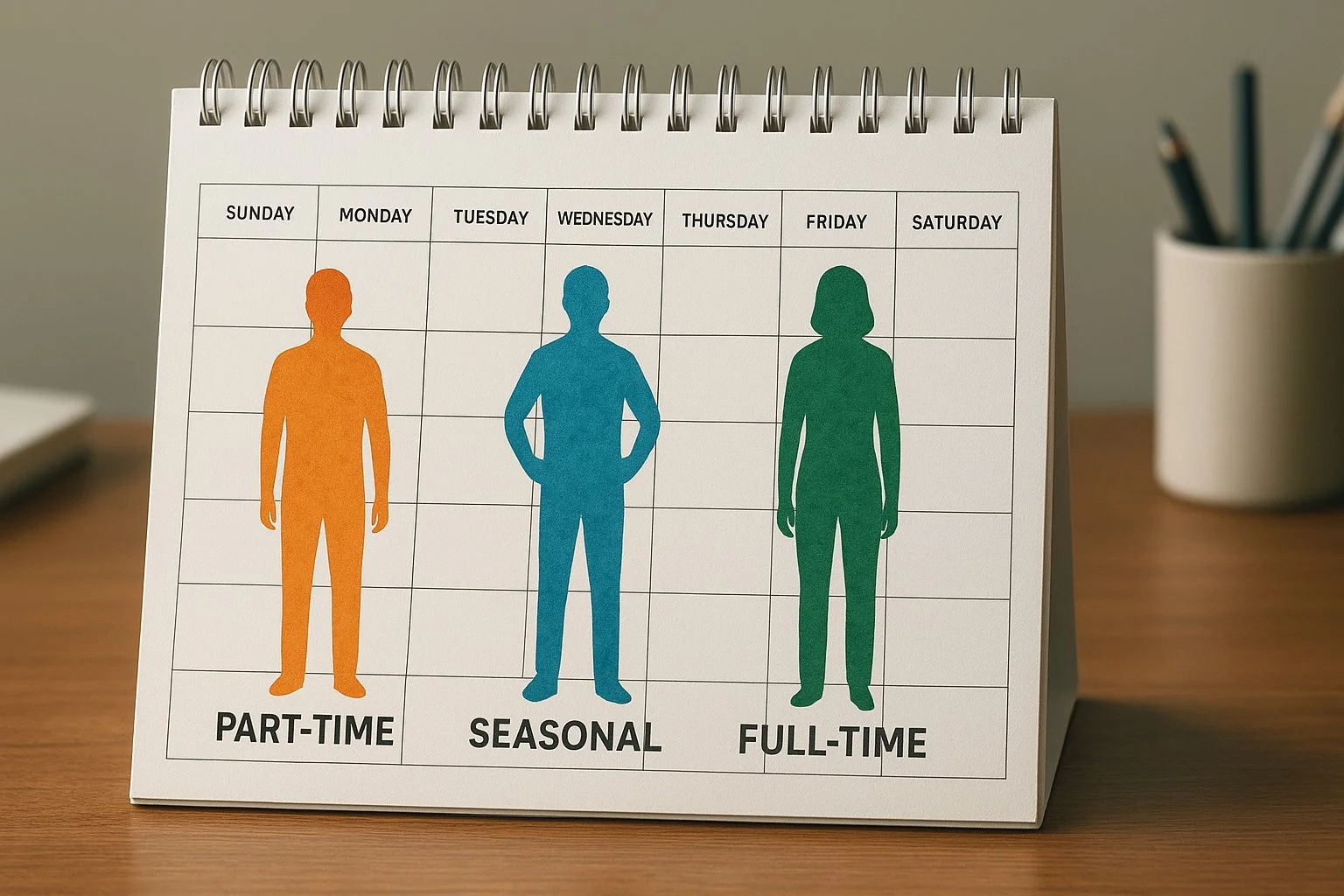

Part-time and seasonal employees

Part-time, temporary, or seasonal employees can qualify if they meet the standard 21/3/750 criteria. Employers cannot exclude eligible part-timers unless the IRS rules specifically exempt them.

Freelancers and 1099 contractors

Independent contractors are not considered employees under IRS rules, so you cannot include them in your SEP IRA contributions. Only W-2 employees and owners can participate.

New hires or departing employees

If a new employee meets the eligibility rules, they must be included in the plan the same year. Employees who leave mid-year but meet the eligibility requirements still must receive contributions for the period worked.

Roth SEP option

Under SECURE 2.0, some plan sponsors can allow Roth SEP contributions, which are taxed upfront but grow tax-free. Participation in Roth SEP contributions may depend on plan design, so check with your provider.

Key takeaway: Knowing the exceptions and special cases helps prevent mistakes and ensures fairness for all employees.

Common Eligibility Mistakes and Compliance Issues

Even experienced business owners sometimes trip up on SEP IRA rules. The most common errors include:

Forgetting to include eligible employees – Seasonal, part-time, or new hires often get overlooked.

Miscomputing owner contributions – The self-employment adjustment is commonly misunderstood.

Unequal contribution percentages – Failing to contribute the same percentage for every eligible employee triggers compliance issues.

Excluding employees improperly – Only allowed exclusions are union employees and nonresident aliens with no U.S. income.

Missing contribution deadlines – Contributions must be made by the tax filing deadline, including extensions, to be deductible.

Pro tip: A checklist or table can help ensure all employees are included and contributions are calculated correctly.

Step-by-Step Guide to Ensuring Eligibility Compliance

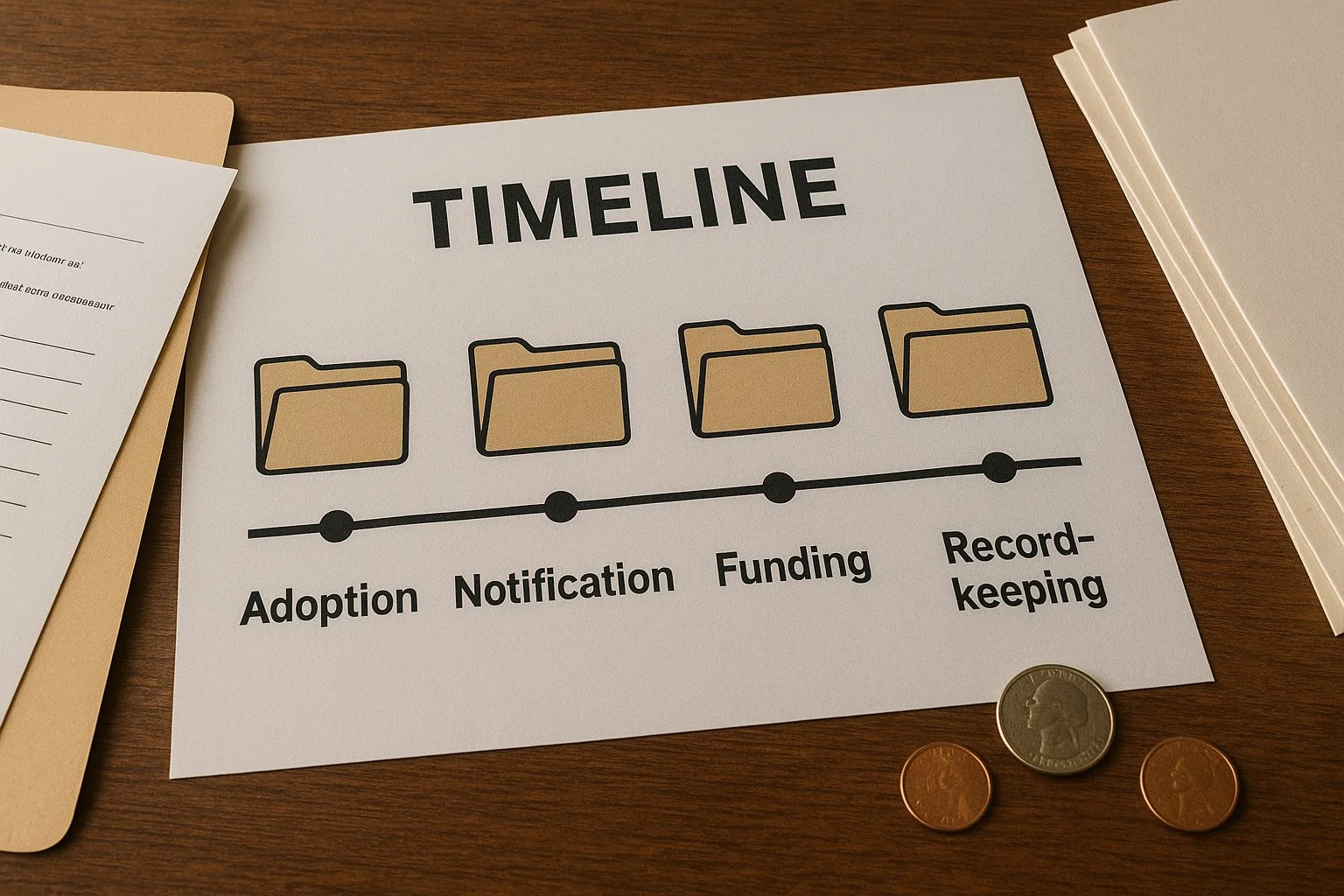

Setting up a SEP IRA correctly is easier than it sounds if you follow these steps:

Adopt a written SEP plan – Use IRS Form 5305-SEP or a provider’s adoption agreement. Keep it in your records.

Notify eligible employees – Provide required notices explaining participation, contribution percentages, and deadlines.

Open SEP-IRAs – Each eligible participant, including yourself, needs a separate SEP IRA account at a qualified financial institution.

Fund contributions – Apply the same percentage of compensation to all eligible employees.

Maintain records – Track contributions, eligibility, and employee notifications for IRS compliance.

Annual review – Update the plan for new hires, departing employees, or changes in compensation.

Visual idea: Include a timeline infographic showing adoption, notification, funding, and reporting steps.

Conclusion

SEP IRAs are a powerful tool for self-employed professionals and small business owners to save for retirement while enjoying tax benefits. Understanding eligibility rules is critical: you must include all qualifying employees, calculate contributions correctly for yourself, and follow IRS guidelines to avoid penalties.

By following the step-by-step guidance in this article, you can set up a SEP IRA confidently, ensure compliance, and maximize retirement contributions for both you and your employees.

Next steps:

Review your employee roster for eligibility.

Calculate potential contributions using the IRS worksheets.

Consider consulting a financial advisor or using a SEP IRA provider for seamless setup.

For a full breakdown of SEP IRA setup, contribution limits, and comparisons to other retirement plans, visit our comprehensive SEP IRA guide.

Frequently Asked Questions

Can part-time employees participate in a SEP IRA?

Yes, if they meet the IRS 21/3/750 requirements. Part-time status alone doesn’t disqualify them.

How does a business owner qualify for a SEP IRA?

Any owner of a sole proprietorship, partnership, LLC, or corporation can establish a SEP IRA for themselves. No employees are required.

What are the income requirements for a SEP IRA?

Employees must earn at least $750 in the calendar year to be eligible. This threshold is indexed annually by the IRS.

How does eligibility affect contribution limits?

Only eligible employees and owners receive contributions. Contributions must be the same percentage of compensation for everyone eligible that year.

Can you exclude certain employees?

Yes, but only union-covered employees or nonresident aliens with no U.S. income. All other eligible employees must be included.

Are spouses considered eligible?

If a spouse is employed by the business and meets the eligibility requirements, they must be included in the plan.

How does Roth SEP designation affect eligibility?

Roth SEP contributions are optional and follow the same eligibility rules as traditional SEP contributions. Taxes are paid upfront, and growth is tax-free.