New York State Tax Penalties and Interest Explained

Jan 15, 2026

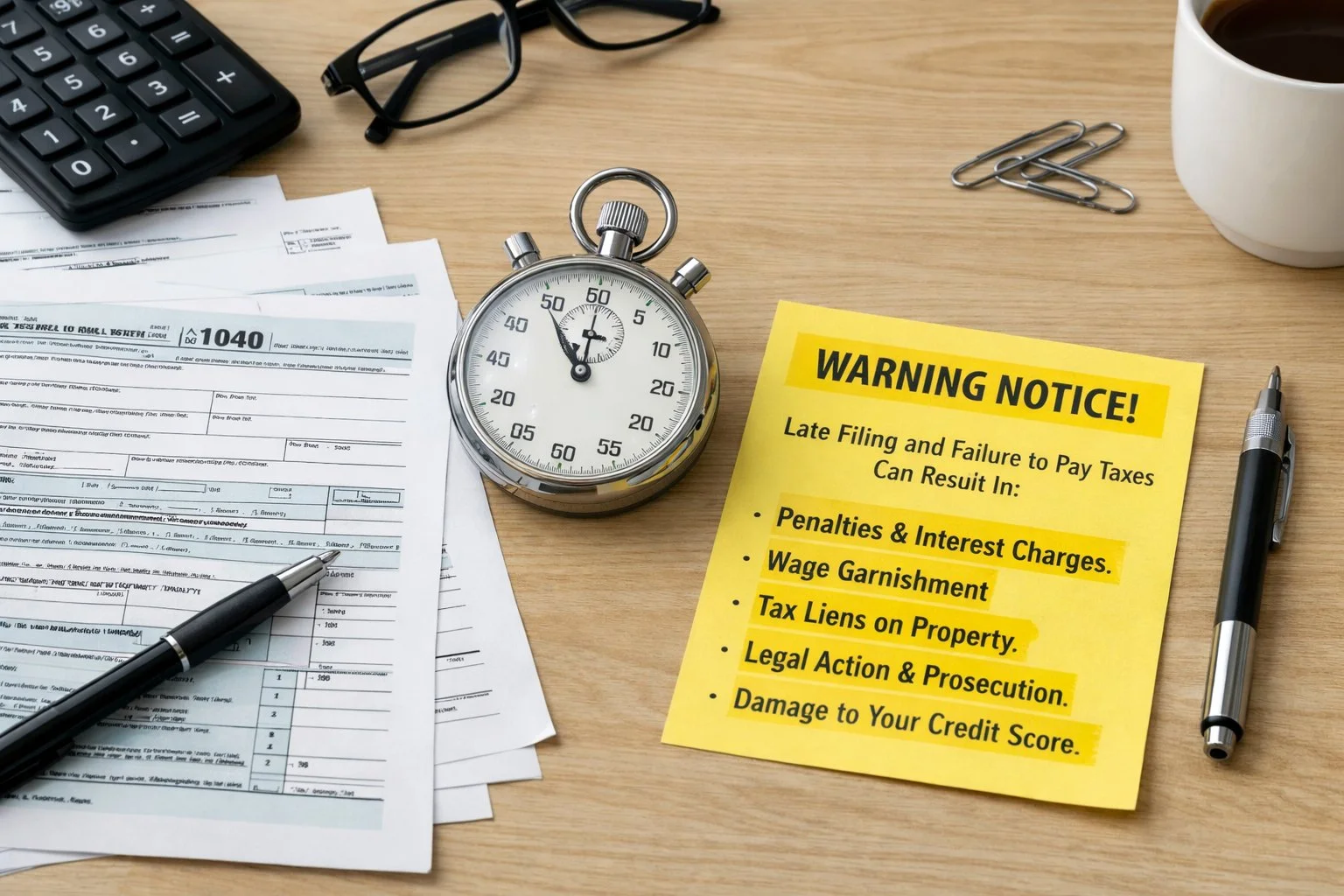

Getting a letter from New York State about unpaid taxes can feel like opening a bill that multiplied while you were not looking. You might think, “I already owe money. Why is the balance higher than last time?” That extra amount usually comes from penalties and interest.

New York State is very strict about deadlines. When taxes are filed late, paid late, or calculated incorrectly, extra charges start piling on fast. For business owners, freelancers, and professionals who already juggle cash flow, staff, and clients, this can quickly turn into a stressful situation.

The good news is this. Once you understand how New York State tax penalties and interest work, the situation becomes much easier to manage. Most people get into trouble not because they refuse to pay, but because they do not understand the rules or wait too long to act.

In this guide, you will learn:

What New York State tax penalties and interest really are

How interest is calculated and why it keeps growing

The most common penalties that affect businesses and professionals

Which penalties may be reduced or removed

What steps can you take if you cannot pay right away

Let’s break it all down in clear, simple language.

What Are New York State Tax Penalties and Interest?

New York State uses two different tools when taxes are not handled correctly. Penalties and interest.

Interest is the cost of borrowing money from the state. If you do not pay your tax bill on time, New York charges interest on the unpaid amount. This starts right after the due date.

Penalties are extra charges added because a rule was broken. Filing late, paying late, or underpaying taxes can all trigger penalties.

A simple way to remember it:

Interest is about time

Penalties are about behavior

You can sometimes remove penalties. Interest is much harder to get rid of.

In most cases, penalties and interest appear after a missed deadline or an unresolved notice from the state. If you’re not sure why New York contacted you in the first place, check out our guide about what happens if you get a tax notice from New York State and see what the letter is really asking for.

How New York State Tax Interest Works

When Interest Starts Accruing

Interest begins the day after your tax is due. Not the day you receive a notice. Not the day the state contacts you. The day after the original deadline.

This catches many people off guard. Even if you file for an extension to submit your return, interest still grows on any unpaid tax. An extension gives you more time to file paperwork, not more time to pay.

How Interest Is Calculated

New York State interest:

Accrues daily

Compounds over time

Changes every quarter

Daily compounding means interest is added every single day. Then the next day, interest is charged on the new total. This is why balances can grow faster than expected.

You do not need to calculate this yourself. New York provides an official penalty and interest calculator. But it helps to understand why waiting even a few months can make a big difference.

Can New York State Waive Interest?

In almost all cases, no.

Interest is considered a mandatory charge. It applies even if:

You had a valid reason for being late

You were dealing with financial hardship

You filed an extension

Only very rare administrative errors by the state may lead to interest removal. For most taxpayers, interest will continue until the tax is paid in full.

Common New York State Tax Penalties Explained

Late Filing Penalty

This penalty applies when you do not file your tax return on time.

5 percent of the unpaid tax per month

Maximum of 25 percent

If the return is more than 60 days late, there is a minimum penalty

Even if you cannot pay, filing the return on time helps avoid this penalty. Many people make the mistake of waiting to file until they have the money. That usually makes things worse.

Late Payment Penalty

This penalty applies when you file but do not pay the full amount owed.

0.5 percent per month on the unpaid balance

Maximum of 25 percent

Charged in addition to interest

This penalty grows more slowly than the late filing penalty, which is why filing on time is always a smart move.

Underpayment of Estimated Tax Penalty

This penalty often affects:

Freelancers

Consultants

Business owners

Independent professionals

If you are required to make estimated tax payments and do not pay enough throughout the year, New York may charge a penalty. This can happen even if you pay everything by the end of the year.

Many people do not realize they are required to make estimated payments until they get this penalty notice.

Negligence and Accuracy-Related Penalties

These penalties apply when New York believes your tax return contains serious errors.

Common triggers include:

Large underreported income

Missing business records

Incorrect deductions without support

The penalty is usually a percentage of the underpaid tax, plus extra interest.

This is why good recordkeeping matters, especially for businesses.

Fraud and Frivolous Return Penalties

These penalties are more serious and apply in limited cases.

Fraud penalties can be very high

Frivolous returns can result in flat dollar penalties

Most taxpayers never face these penalties. They usually apply when someone intentionally provides false information or file returns meant to delay or disrupt the system.

How Much Can New York State Penalties and Interest Really Cost?

A Simple Example

Imagine a small business owes $10,000 in New York State taxes.

If the owner:

Files late

Pays late

Waits several months to act

They may face:

Late filing penalties

Late payment penalties

Daily interest

After one year, the balance could be thousands of dollars higher than the original amount owed.

This is not because New York is adding surprise fees. It is because penalties stack and interest compounds.

Why Waiting Makes the Problem Worse

Every month you wait:

Interest keeps growing

Penalties may continue

More notices are issued

The longer a balance remains unpaid, the fewer options you may have. Early action almost always leads to better outcomes.

Can New York State Reduce or Remove Penalties?

Reasonable Cause Penalty Abatement

New York State may remove penalties if you can show reasonable cause.

Reasonable cause means:

You tried to comply

The issue was beyond your control

You acted responsibly once the problem was discovered

Examples that may qualify:

Serious illness

Natural disasters

Records destroyed by fire or flood

Examples that usually do not qualify:

Forgetting

Being too busy

Not knowing the rules

How to Request Penalty Relief

Penalty relief is not automatic. You usually must:

File all required returns

Pay or arrange payment

Submit a written request with documentation

Strong documentation makes a big difference. Clear timelines, proof, and explanations matter.

Tools New York State Provides to Calculate Penalties and Interest

Penalty and Interest Calculator

New York State offers an online calculator that helps estimate:

Interest owed

Penalties owed

This tool is useful if you want to understand your balance before contacting the state or setting up a payment plan.

Notices and Statements

Tax notices often show:

Original tax owed

Penalties added

Interest added

Many people focus only on the total amount due. Reviewing how the balance is built can help you decide your next step.

What to Do If You Cannot Pay the Full Amount

Installment Payment Agreements

If you cannot pay everything at once, New York may allow a payment plan.

With an installment agreement:

You make monthly payments

Interest continues

Some penalties may stop increasing

This option helps prevent more aggressive collection actions while you work down the balance.

Voluntary Disclosure and Compliance Program

This program is designed for taxpayers who:

Have unfiled returns

Want to come forward before enforcement

Benefits may include:

Reduced penalties

Avoidance of criminal charges

This option is time-sensitive and not available once enforcement actions begin.

How Penalties and Interest Affect Businesses vs Individuals

Sole Proprietors and Freelancers

These taxpayers often struggle with:

Estimated tax payments

Irregular income

Cash flow timing

Missing one quarter can trigger penalties that continue even after income improves.

Corporations and Partnerships

Businesses may face additional risks:

Payroll tax penalties

Sales tax enforcement

Higher scrutiny

Business tax issues can escalate faster, especially when trust fund taxes are involved.

When Penalties and Interest Signal a Bigger Problem

Sometimes, penalties and interest are warning signs.

Red flags include:

Repeated notices

Growing balances despite payments

Threats of liens or levies

At this stage, ignoring the problem usually leads to higher costs and fewer options.

Final Thoughts

New York State tax penalties and interest can feel overwhelming, but they are predictable once you understand the rules. Interest grows with time. Penalties grow when deadlines are missed or mistakes are repeated.

The most important step is acting early. Filing on time, even without payment, reduces penalties. Addressing notices quickly limits interest growth. Knowing your options helps you stay in control instead of reacting under pressure.

If you treat tax notices as information instead of threats, you are already ahead of the problem.

Frequently Asked Questions

Can New York State waive tax penalties?

Yes, New York State may waive penalties if you can show reasonable cause, such as serious illness, natural disasters, or circumstances beyond your control. You must request the waiver and provide proof. Interest is usually not waived.

Does interest stop if I set up a payment plan?

No. Interest continues to accrue until the full tax balance is paid. A payment plan helps prevent collection actions, but it does not stop interest.

Do I still owe interest if I filed a tax extension?

Yes. A filing extension gives you more time to submit your return, not more time to pay. Interest starts accruing after the original tax due date.

How fast do New York State tax penalties grow?

Late filing penalties can grow up to 25 percent of the unpaid tax. Late payment penalties grow at 0.5 percent per month, up to 25 percent, plus daily interest.

What happens if I ignore New York State tax penalties and interest?

Ignoring them can lead to tax warrants, liens, wage garnishment, bank levies, and loss of appeal rights. Acting early gives you more options and usually lowers the total cost.