What Every Parent in the US Should Know Before Leaving Real Estate in a Will

Feb 13, 2026

You worked hard for your home. Maybe it is the house your kids grew up in. Maybe it is a rental property that helped you build wealth. Maybe it is a small commercial building tied to your business.

At some point, you start asking a simple question:

“What happens to this property when I’m gone?”

Many parents assume the answer is easy. “I’ll just leave it to my kids in my will.”

That sounds simple. But real estate is not like passing down a watch or a savings account. Property has titles, loans, taxes, co-owners, and sometimes business ties. If you are not careful, what you meant as a gift can turn into delays, court filings, or even family conflict.

This guide breaks it all down in plain English.

By the end, you will understand:

Why you need to give attention in using a will

What probate really means for your home or rental

How a will transfers real estate in the US

When a will controls property and when it does not

How taxes affect your children

What happens if multiple children inherit one property

Why business owners need extra planning

When a will is enough, and when it may not be

Let’s start with the basics.

Why Real Estate in a Will Deserves Special Attention

Real estate is different from other assets for three big reasons:

It has a legal title.

It often has debt attached.

It cannot be divided easily.

If you leave $100,000 in a bank account to two children, each can receive $50,000.

If you leave one house to two children, things are not as simple.

Real estate also goes through a formal legal process when passed through a will. That process is called probate, and it matters more for property than most people realize.

That is why planning carefully is so important.

Probate: What Parents Should Understand

Let’s talk about probate, because this is where real estate planning becomes real.

What Is Probate?

Probate is the court-supervised process of:

Validating your will

Paying debts

Distributing assets

When real estate passes through a will, it usually goes through probate.

Why It Matters

Probate:

Is public record

Can take time

Requires court approval

May involve attorney fees

In many states, real estate cannot change ownership until probate is completed.

If your children need to:

Sell the property

Refinance

Collect rental income

Access equity

They may have to wait. That does not mean probate is always bad, but it is something every parent should understand.

If you want to understand more about probate, including the timelines, fees, and alternatives to avoid court delays, check out our detailed guide about "What Happens to Real Estate During Probate in the US?".

How a Will Transfers Real Estate

Let’s clear up a common misunderstanding.

A will does not automatically transfer property the day you pass away. Instead, it starts a legal process.

What Actually Happens When You Leave Property in a Will

Here is what typically occurs:

Your executor files your will with the local probate court.

The court confirms the will is valid.

The executor gathers your assets.

Debts and taxes are paid.

The court approves distribution.

The property title is legally transferred to your children.

This process can take:

Several months in simple estates

A year or longer in complex cases

It is not instant. And until it is complete, your children may not have full control.

When a Will Controls Real Estate And When It Does Not

This is where many parents get surprised.

Property a Will Can Transfer

Your will controls property that is:

Solely owned real estate

Investment property in your personal name

Commercial buildings titled to you individually

Vacation or second homes owned outright

If your name alone is on the deed, your will typically directs where it goes.

Property a Will Does NOT Control

Your will does not override everything.

Here are common situations where a will has no control:

Joint tenancy with right of survivorship

The surviving owner automatically inherits the property.Property held in a revocable living trust

The trust document controls distribution.LLC-owned real estate

The company owns the property, not you personally.Transfer-on-death (TOD) deeds

These name a beneficiary directly on the deed.Certain community property arrangements in specific states.

Important note for business owners:

If your property is owned by an LLC, you will transfer your ownership interest in the LLC. It does not directly transfer the building itself. That distinction matters.

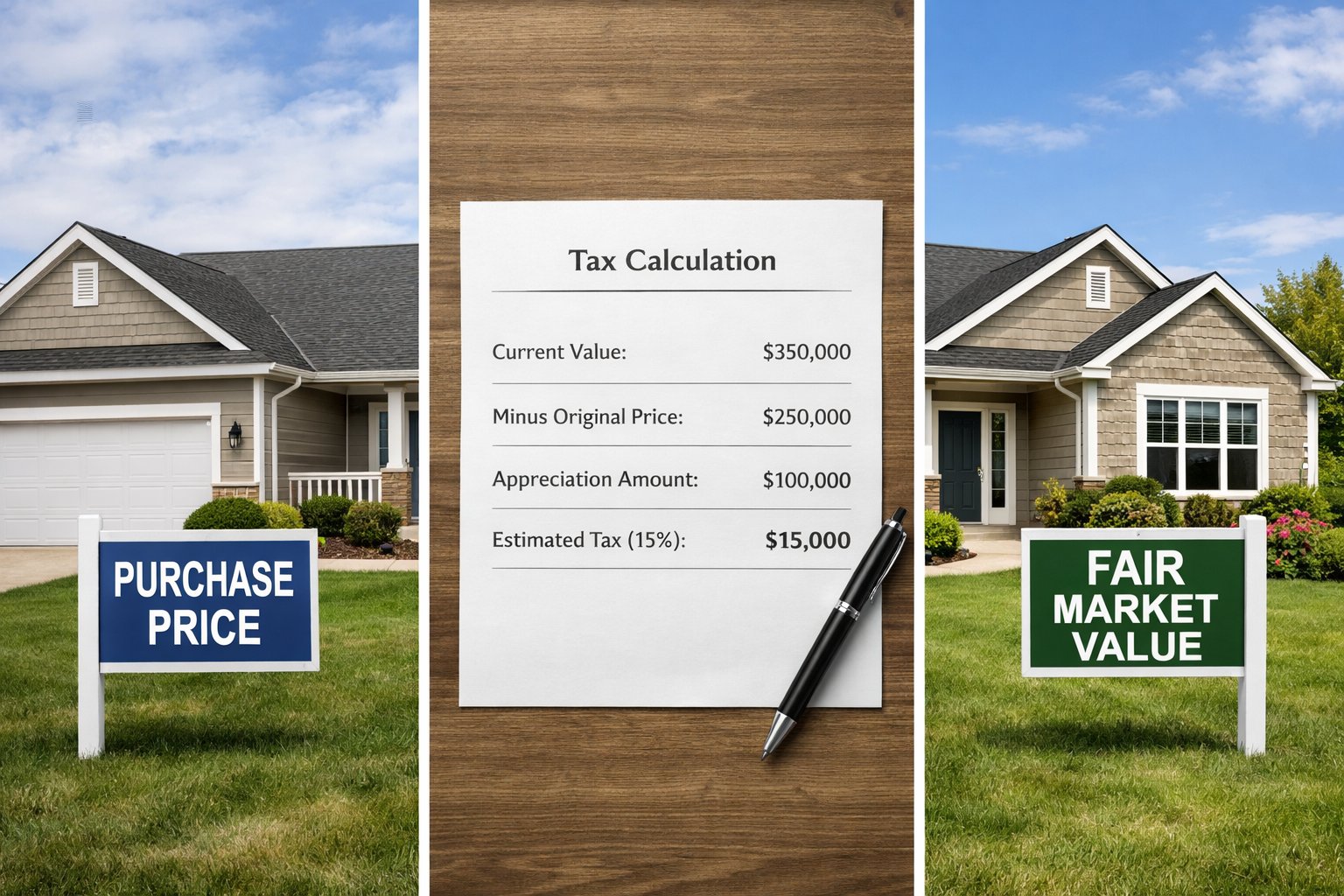

The Tax Side: What Your Children Actually Inherit

Taxes can sound scary. But there is good news here.

Step-Up in Basis

When your children inherit real estate, they usually receive a step-up in basis.

This means:

The property’s tax value resets to its fair market value at your death.

If they sell soon after, capital gains tax may be low or zero.

Example:

You bought a home for $200,000.

It is worth $800,000 when you pass away.

Your child’s new tax basis becomes $800,000.

If they sell for $810,000, they may only owe tax on $10,000.

This rule often reduces tax burden significantly.

Federal and State Estate Taxes

Most families will not owe federal estate tax because the exemption threshold is high.

However:

Some states have their own estate or inheritance taxes.

Large real estate portfolios can push estates into taxable ranges.

If you own multiple rental properties or high-value commercial buildings, coordination is important.

Property Taxes After Inheritance

Property tax rules vary by state.

Some states:

Reassess property value after inheritance.

Increase annual property taxes.

This is especially important for:

Rental properties

Long-held family homes in areas with rising value

Your children may inherit higher ongoing costs than you paid.

The Sibling Problem: Equal Is Not Always Fair

Parents often say, “I want to divide everything equally.”

That sounds fair. But with real estate, equal does not always mean simple.

Multiple Children Inheriting One Property

When siblings inherit one house together, they become co-owners.

That can create questions like:

Should we sell it?

Should one of us live there?

Who pays for repairs?

How do we split rental income?

If expectations are not clear, tension can build quickly.

Forced Sale Conflicts

If siblings disagree strongly, one may file a legal action called a partition action.

That can:

Force a sale of the property

Create legal fees

Strain family relationships

Many parents never consider this risk.

Buyout Provisions in a Will

A well-written will can include:

Clear instructions on sale vs. retention

Buyout rights for one child

Deadlines for decisions

The more specific your instructions, the fewer arguments your children may face.

Complex Real Estate Situations Business Owners Must Plan For

If you own business-related property, planning becomes more detailed.

Real Estate Used in a Business

You may:

Personally own the building

Lease it to your company

Operate your business from it

After your death:

Your children may inherit the building

The business may still operate there

Lease agreements may need review

Without planning, this can create confusion between heirs and business partners.

LLC-Owned or Partnership-Owned Property

If your LLC owns the building:

Your will transfers your membership interest.

The LLC operating agreement controls what happens next.

There may be:

Buy-sell clauses

Restrictions on ownership transfers

Valuation formulas

Your will must align with those documents.

High-Value Rental Portfolios

Rental properties bring ongoing responsibilities:

Tenant management

Maintenance

Rent collection

Accounting

If your children inherit several properties together, they may need:

A property manager

A clear income distribution plan

Asset protection structure

Without structure, rental portfolios can become overwhelming.

Minor Children as Beneficiaries

If your children are under 18:

They cannot legally manage real estate directly.

A guardian may be appointed.

A court may oversee management.

In many cases, property may need to be held in:

A custodial account

A trust structure

This adds another layer of planning.

Mortgages, Liens, and Debt on Inherited Property

Many parents ask, “What happens to the mortgage?”

Existing Mortgage

Good news. Under federal law, lenders generally cannot enforce a due-on-sale clause when property transfers to heirs.

However:

The loan does not disappear.

The heirs inherit the property subject to the debt.

Payments must continue.

If payments stop, foreclosure can still happen.

Business Debt or Personal Guarantees

If the property is tied to business loans:

There may be cross-liability exposure.

Personal guarantees may complicate matters.

This is why coordination with an attorney and CPA is critical for business owners.

Key Limitations of Using Only a Will for Real Estate

A will is powerful. But it has limits.

Here are the main ones:

It does not avoid probate.

Probate is public.

The process can take time.

Court approval is required.

Heirs may face delays accessing liquidity.

Poor wording can create disputes.

Understanding these limits helps you plan realistically.

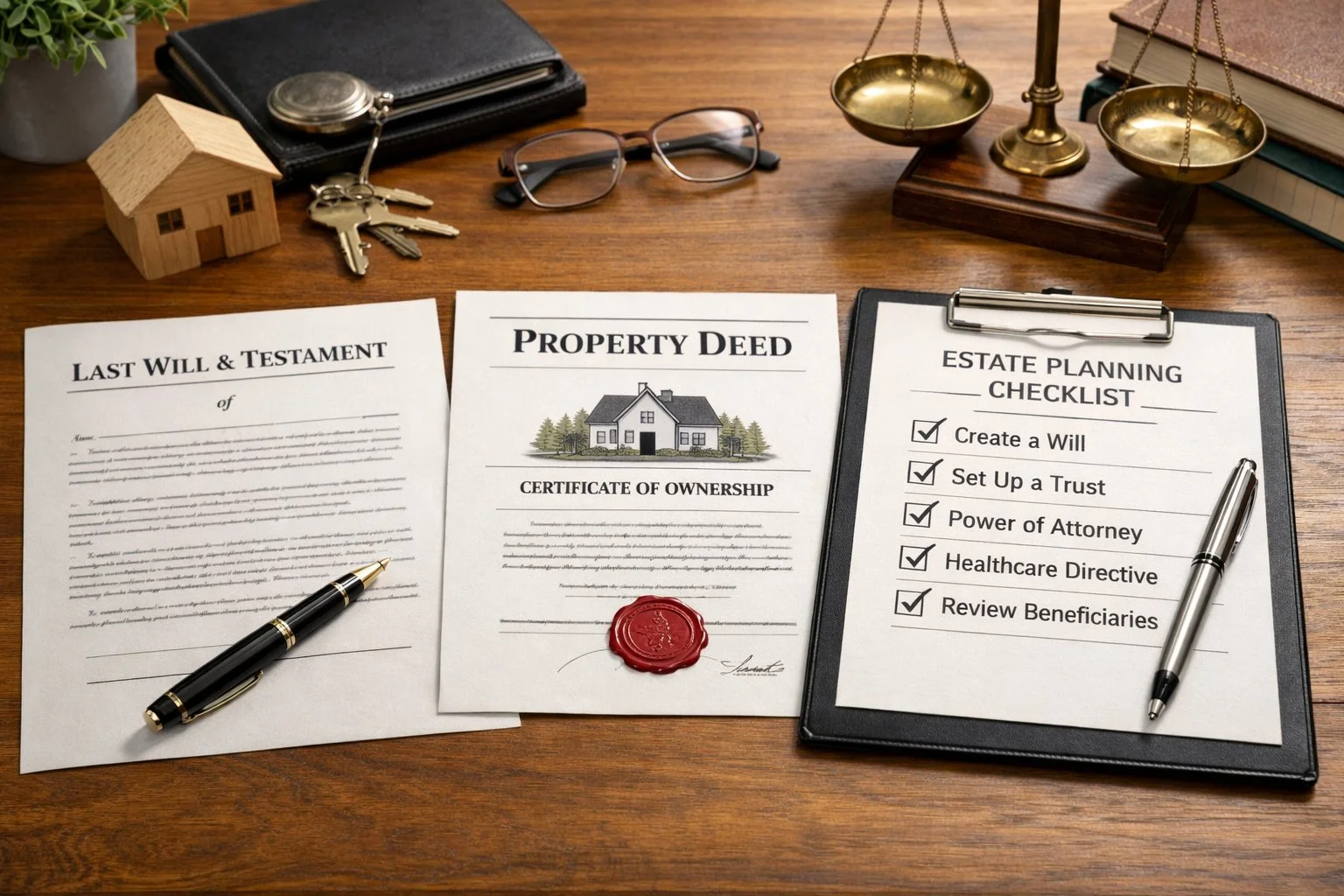

Best Practices When Using a Will for Real Estate

If you decide to use a will to transfer property, follow these best practices.

Use Exact Legal Property Descriptions

Do not rely on “my house at 123 Main Street.”

Use the full legal description from your deed.

Name a Primary and Backup Executor

If your first choice cannot serve, a backup prevents delays.

Add Clear Contingency Language

Address:

What happens if a child predeceases you

Whether property should be sold

How proceeds should be divided

Clarify Sale vs. Retention

Be specific:

“Property must be sold within 12 months.”

Or “One child may buy out the others at appraised value.”

Clarity prevents conflict.

Coordinate With Business Documents

If property is tied to:

An LLC

A partnership

A corporation

Make sure your will aligns with the operating agreement.

Review Your Will Regularly

Review at least:

Every 1–3 years

After major purchases

After changes in family structure

Life changes. Your documents should too.

Work With Professionals

An experienced:

Estate planning attorney

CPA

can help ensure your will fits your full financial picture.

When a Will Is Enough And When It Is Not

Not every estate needs complex planning.

A Will May Be Enough If:

You have one primary residence.

The estate is simple.

There is low risk of family conflict.

Privacy is not a major concern.

No business-related property exists.

A Will May Not Be Enough If:

You own high-value real estate.

You have rental income properties.

Property is connected to a business.

You have a blended family.

You want to avoid probate.

Minor children are involved.

The key is matching the tool to your situation.

If you fall into one of these categories, a "will" alone may not fully address your goals. There are other legal structures parents use to transfer real estate more efficiently, reduce court involvement, or provide more control. You can explore the full range of property transfer options in our complete guide to transferring real estate to children in the US.

Final Thoughts for Parents Planning Ahead

Passing down real estate is not just about transferring a title. It is about making things easier for the people you love.

A well-prepared will can work in many situations. But real estate adds complexity. Probate, shared ownership between siblings, business ties, mortgages, and taxes can all affect what your children actually receive and how smoothly the process goes.

The good news is that most of these issues can be addressed with proper planning.

Taking time to:

Confirm how your property is titled

Make sure your will truly controls it

Align your estate plan with any business interests

Clarify instructions for multiple heirs

can prevent confusion later.

If you are unsure whether your current plan fully protects your property and your family, consider having your documents reviewed by an experienced estate planning professional. A simple review today can provide peace of mind for tomorrow.

Frequently Asked Questions

Can I leave my house to only one child and give other assets to the others?

Yes. You are free to divide your estate however you choose. Many parents leave real estate to one child and balance things out by giving other children cash, investments, or life insurance proceeds. Clear wording in your will is essential to avoid disputes.

What happens if I die without a will and own real estate?

If you die without a will, your state’s intestacy laws decide who inherits your property. This usually means your spouse and children share the estate according to a fixed formula. The court will still oversee the process, and the outcome may not match your wishes.

Can I change who inherits my property after I create my will?

Yes. As long as you are mentally competent, you can update your will at any time. This is done through a formal amendment called a codicil or by creating a new will that replaces the old one. Regular reviews are important, especially after major life changes.

Do my children have to accept inherited real estate?

No. A beneficiary can legally refuse an inheritance through a formal disclaimer. If they do, the property will pass to the next beneficiary named in the will or according to state law. This sometimes happens if the property has debt or high maintenance costs.

Does leaving real estate in a will affect Medicaid eligibility?

Potentially, yes. If you require long-term care before passing away, Medicaid rules may impact how property is treated. In some cases, states may attempt to recover costs from your estate after death. This area is complex and often requires specialized planning with an elder law attorney.