What Happens If You Ignore a New York State Tax Notice? A Step-by-Step Timeline

Jan 6, 2026

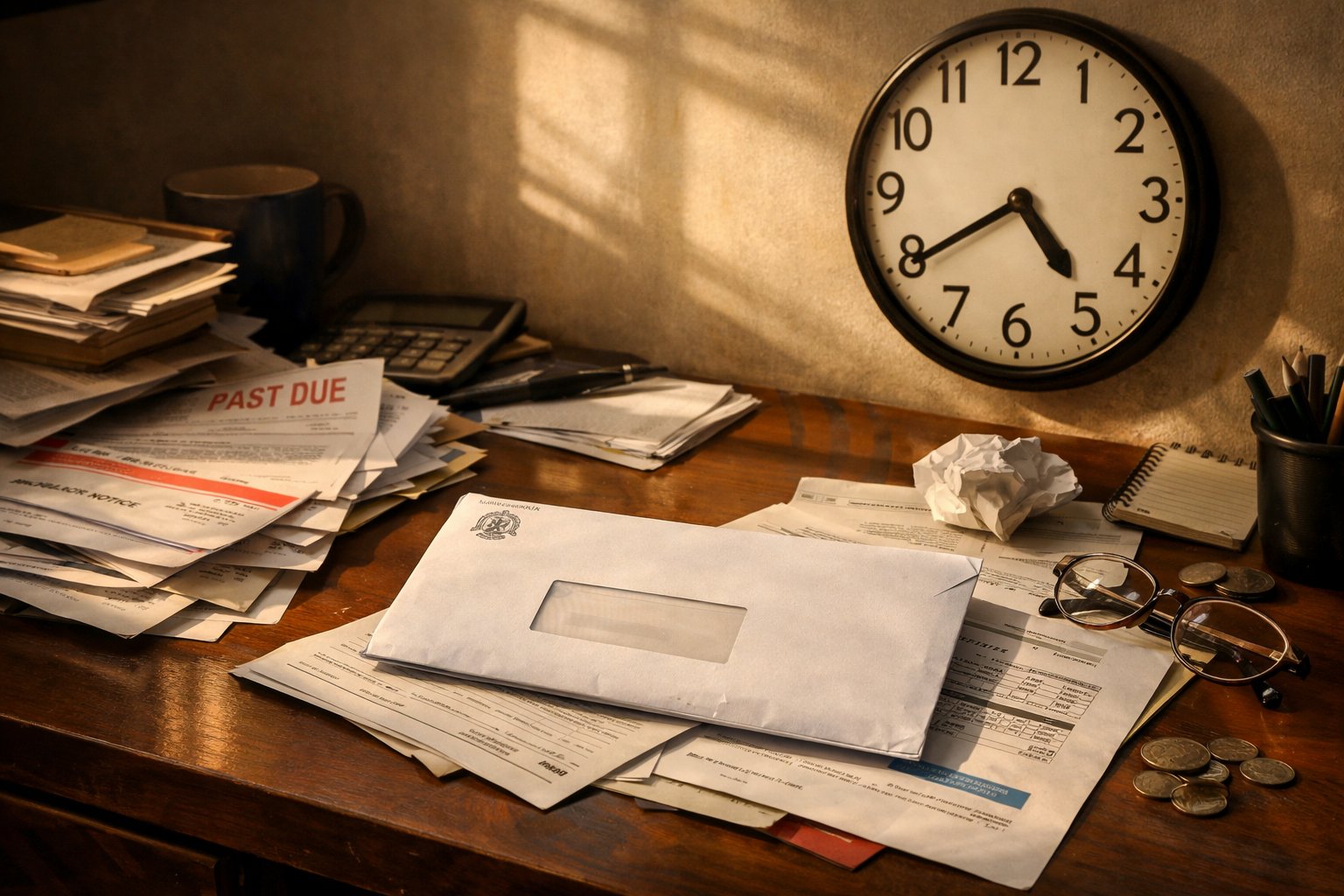

That official letter from New York State can feel easy to delay. The language is serious, the numbers may not make sense right away, and life or business keeps moving. Many people tell themselves they will deal with it later, once things slow down or feel less stressful.

But with New York State tax notices, silence does not pause the process. When a notice is ignored, the state keeps moving forward. Penalties and interest begin to grow, deadlines quietly pass, and what started as a simple request for payment or information can turn into a legal collection problem. Over time, this can lead to tax warrants, bank account freezes, wage garnishment, or even license suspension.

This guide explains exactly what happens if you ignore a New York State tax notice, step by step. By the end of this guide, you will understand:

How New York State escalates unpaid tax issues over time

What penalties and interest really look like in plain language

When the state can file a tax warrant and what that means for you

How bank levies, wage garnishment, and license suspensions happen

Why responding sooner, even if you cannot pay, can protect you

Now, let’s walk through the timeline so you can see exactly how ignoring a New York State tax notice plays out.

Before the Timeline Starts: Why Ignoring a Notice Is Risky

When New York State sends a tax notice, it expects a response. That response can be payment, documents, or a dispute. Silence sends a message too.

From the state’s point of view, ignoring a notice often means one of three things:

You agree with the notice but are not paying

You do not care to respond

You missed the deadline

Once a deadline passes, New York State is allowed to move ahead. That is when things shift from “question” to “collection.”

This is especially risky for business owners. Business taxes like sales tax and payroll withholding are treated as trust fund taxes. New York takes these very seriously, and enforcement can move faster.

Step 1. The Initial Notice (Weeks 0 to 4)

The first notice is usually calm and informational.

It may be:

A notice asking for documents

A bill showing tax due

A reminder to file a missing return

Most first notices give you about 21 to 30 days to respond.

At this stage:

Penalties may be small or just starting

Interest may already be accruing

You still have full rights to respond or dispute

If you respond now, many problems end right here. This is the easiest and least expensive point to fix the issue.

Ignoring this notice starts the clock.

Step 2. Follow-Up Notices and Growing Penalties (30 to 90 Days)

If the first notice is ignored, New York State sends follow-up notices. These letters sound more serious.

During this time, money starts adding up.

Penalties begin to grow

Common penalties include:

Late filing penalty: Often 5 percent of the tax due for each month the return is late, up to 25 percent.

Late payment penalty: Often around 0.5 percent per month, also capped.

Interest keeps adding

Interest is charged on unpaid tax and penalties. It compounds daily and cannot usually be waived.

This is where people are surprised. A balance that started small can grow quickly.

New York State is also preparing for the next step if nothing changes.

Step 3. Loss of Appeal Rights and Final Assessments

Deadlines matter more than most people realize.

Many tax notices include a window to:

File a protest

Request a conciliation conference

Challenge the amount owed

If that deadline passes without a response, New York State can make the assessment final.

Once an assessment is final:

You usually cannot dispute the amount later

The state does not need your agreement to collect

Options become limited

This is one of the most costly effects of ignoring a notice. Even if the amount is wrong, missing deadlines can lock it in.

Step 4. Tax Warrant Filed: When the Problem Becomes Public

After notices are ignored and deadlines pass, New York State can file a tax warrant.

A tax warrant is similar to a judgment. It gives the state legal power to collect the debt.

Here is why this step matters.

It becomes public

Tax warrants are filed with county clerks or the Department of State. They become public records.

That means:

Lenders can see them

Business partners may find them

Credit decisions can be affected

It creates a lien

The warrant creates a lien against your property. This can include:

Real estate

Business assets

Personal property

Selling or refinancing property becomes difficult until the debt is resolved.

The clock is long

New York State can often collect for up to 20 years after a warrant is issued. This is not a short-term problem.

Step 5. Active Collection Actions Begin

Once a tax warrant exists, New York State can actively take money and property. This is where ignoring the notice becomes very real.

Bank account levies

New York State can tell your bank to freeze your account.

What this means:

You may lose access to funds without warning

The bank holds the money

The state can take funds up to the amount owed

For businesses, this can stop payroll, rent payments, and vendor payments overnight.

Wage garnishment (income execution)

If you have a job, New York State can order your employer to withhold part of your paycheck.

Typically:

Up to 10 percent of gross wages, or

Up to 25 percent of disposable income, whichever is lower

This continues each pay period until the debt is paid or resolved.

Asset seizure

In serious cases, New York State can seize property.

This can include:

Business equipment

Vehicles

Other valuable assets

Some basic items are protected, but many business assets are not.

Step 6. License Suspensions and Business Disruptions

Ignoring tax notices can also affect your ability to work.

Driver’s license suspension

If you owe $10,000 or more in personal income tax, including penalties and interest, New York State can suspend your driver’s license.

Before suspension, warnings are usually sent. Ignoring those warnings leads to suspension.

Professional and business licenses

Certain unpaid tax debts can affect:

Professional licenses

Business permits

Sales tax authority

For business owners, this can shut down operations or prevent legal sales.

Sales tax debts are especially risky because New York treats collected sales tax as money held in trust for the state.

Step 7. Long-Term Collection and Escalation

If collection actions do not fully resolve the debt, New York State does not give up easily.

Over time, the state may:

Offset tax refunds

Take lottery winnings

Refer accounts to private collection agencies

Continue enforcing liens

In rare cases involving willful tax evasion, criminal charges can be considered. This usually involves repeated, intentional nonpayment, especially with trust fund taxes.

For most people, the bigger issue is long-term financial pressure that never goes away until addressed.

What If You Already Ignored the Notice?

Many people find out late. Mail gets lost. Addresses change. Life happens.

If you already ignored a New York State tax notice, do not assume it is too late.

In many cases:

Payment plans may still be available

Collections can sometimes be paused

Penalties may be reduced in limited situations

The key is acting now. The longer enforcement continues, the fewer options remain.

Even if a tax warrant exists, addressing the issue is better than continuing to ignore it.

What to Do Next: Your Decision Paths

Here are simple paths depending on your situation.

If you owe and can pay

Paying the balance stops interest and enforcement. This is the fastest resolution.

If you owe and cannot pay

You may be able to:

Set up an installment payment plan

Request temporary relief

Explore settlement options in limited cases

Ignoring the debt removes these options over time.

If you disagree with the amount

Act quickly. You may still have rights to:

Dispute the assessment

Request review

Correct errors

Deadlines matter here more than anything else.

If enforcement has already started

Do not panic, but do not wait.

Contact the state or a professional

Ask about stopping or releasing levies

Explore payment or resolution options

Many enforcement actions can be addressed, but only if you engage.

Before choosing how to respond, review our complete guide on NYS tax notices to understand your options, deadlines, and documentation requirements.

Final Thoughts: Why This Timeline Matters

Ignoring a New York State tax notice is rarely about one missed letter. It is usually part of a bigger picture. Busy schedules, cash flow pressure, or simple confusion can push tax issues to the bottom of the list. This timeline shows why that delay matters.

Each step in the process removes options. Early on, you can ask questions, dispute errors, or set up payment plans. As time passes, penalties grow, appeal rights disappear, and the state gains more power to collect. What starts as a manageable issue can turn into a long-term financial and legal burden.

This article works hand in hand with the broader guide on New York State tax notices. Together, they explain not just what the notices mean, but what happens when they are ignored and how problems escalate. If you are dealing with a notice now or worried about one you missed, the most important step is action.

Responding early, even if you cannot pay right away, keeps you in control. Waiting almost always hands that control to the state.

Frequently Asked Questions

How long does New York State wait before filing a tax warrant?

There is no fixed timeline, but it often follows ignored notices and missed deadlines. It can happen within months.

Can New York freeze my business bank account without warning?

Yes. Once enforcement begins, accounts can be frozen quickly.

Is it ever too late to respond?

It is rarely too late to act, but waiting limits options and increases costs.

Does ignoring a notice mean an audit?

Not always. Many ignored notices involve simple balances or missing information.

Can penalties or interest be reduced later?

Sometimes, but only in specific cases and usually with proper requests.