What Happens to Your Real Estate If You Die Without a Will in the United States?

Feb 18, 2026

Owning real estate is a big deal. It might be your home, a rental property, or a building your business depends on. But here is a question many busy professionals avoid. What happens to that property if you die without a will?

The answer is not simple, and it is rarely what people expect. Without a will, the government does not guess your wishes. Instead, state law follows a fixed formula to decide who inherits, how property is handled, and when heirs gain control. That process can delay access, create tax issues, and even force a sale of the property.

This guide explains everything in simple terms so you can understand the risks and plan smarter. By the end, you will learn:

Who inherits real estate when there is no will

How probate affects property ownership

Financial and tax risks for heirs

What business owners must know

How to prevent problems with simple planning tools

Let’s walk through it step by step.

What Does “Dying Without a Will” Mean?

Dying without a will is called intestacy. When this happens, state law decides who inherits your property instead of your personal wishes.

In simple terms, if there is no valid will:

You do not choose who receives your property

Informal promises have no legal effect

The court applies a standard inheritance order

Why intestacy exists

States created intestacy laws to provide a default plan when someone does not leave instructions. The law assumes property should stay within a close family.

But the system is rigid. It does not consider:

Business relationships

Long-term partners who are not married

Verbal agreements

Personal intentions

For business owners and executives, this can create serious complications. Property tied to operations may transfer to people with no involvement in the business.

Who Inherits Your Real Estate Without a Will?

State intestacy laws follow a strict inheritance order, usually prioritizing spouse, children, parents, and then extended family.

Each state has its own formula, but the general pattern is similar across the country.

Typical inheritance order

Situation | Likely Heirs |

Married, no children | Spouse inherits most or all |

Married with children | Spouse and children share |

Single with children | Children inherit equally |

No spouse or children | Parents inherit |

No parents | Siblings inherit |

No relatives | Property goes to the state |

If you are married

Spouses usually inherit the largest share. However, outcomes vary depending on whether you have children together or from previous relationships.

In some states:

Spouse receives all property

Spouse shares with children

Spouse receives half of marital property

If you have children

Children typically inherit equal shares. If a child has died, their share may pass to their children.

Important considerations:

Minor children cannot directly manage property

Court supervision may be required

Guardianship issues may arise

If you are single with no children

The inheritance line moves outward:

Parents

Siblings

Nieces and nephews

Extended relatives

If no heirs exist

In rare cases, property transfers to the state. This is called escheat.

What Happens to the Property During Probate?

Without a will, a probate court supervises the estate, appoints an administrator, pays debts, and transfers or sells real estate according to state law.

Probate is a court process that ensures property is distributed legally.

Step-by-step probate process

Court appoints an administrator

This person manages the estate since no executor was named.Property is identified and valued

Real estate must be appraised to determine fair market value.Debts and taxes are paid

Creditors can make claims against the estate.Property is transferred or sold

Heirs receive ownership after obligations are settled.

Why probate matters for real estate

Real estate cannot usually transfer ownership until probate is complete. This can create delays and financial strain.

Business owner impact

If property is used for business purposes:

Operations may pause

Lease arrangements may be affected

Financing agreements may be reviewed

Decision-making authority becomes unclear

This is one of the biggest risks competitors often overlook.

If you want to know exactly what happens during probate, check out our complete guide about "What Happens to Real Estate During Probate in the US?".

Can Heirs Be Forced to Sell the Property?

Yes. If multiple heirs inherit property and cannot agree on its use, a court can order a sale to divide the value.

This situation is common when several family members inherit a single property.

Why forced sales happen

Heirs disagree about keeping or selling

Some heirs cannot afford expenses

Property must be divided fairly

Court orders a partition sale

Example scenario

Three siblings inherit a rental property:

One wants to keep it

One wants cash

One cannot pay maintenance

A court may order the property sold and proceeds divided.

Financial consequences

Sale may occur at an unfavorable time

Legal costs reduce value

Business continuity may suffer

What Happens to Mortgages, Taxes, and Liens?

Debts tied to real estate remain in place after death. The estate must pay them, or heirs inherit the property with the obligation.

Ownership does not erase financial responsibility.

Obligations that continue

Mortgage balance

Property taxes

Home equity loans

Contractor liens

Judgment liens

How debts are handled

Estate funds are used first

Property may be sold to pay debts

Heirs may assume or refinance loans

Why this matters for professionals

Real estate often supports income generation. When debts remain:

Cash flow may be disrupted

Business property may need refinancing

Personal guarantees may affect heirs

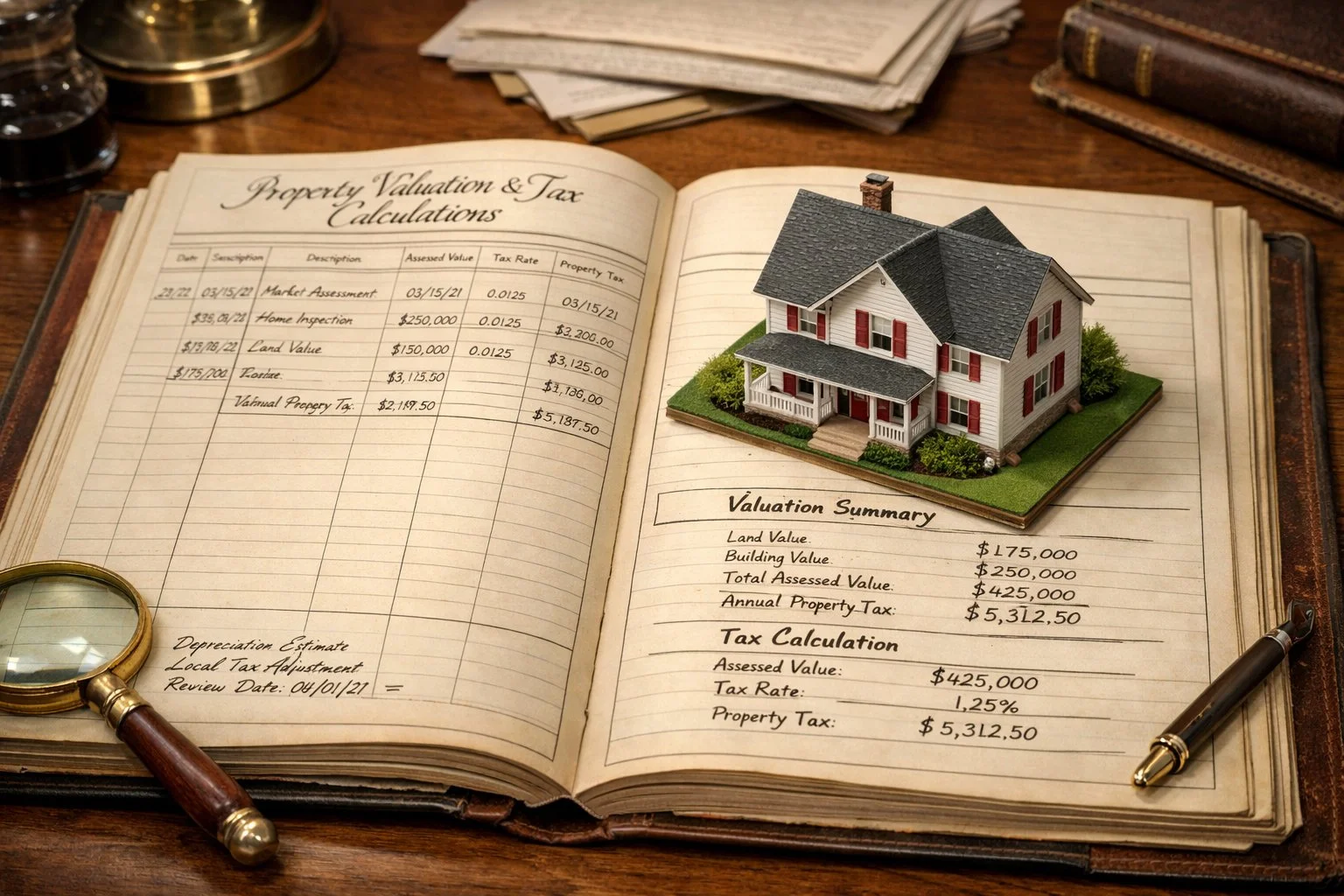

Tax Consequences Most People Overlook

Real estate inherited without a will may trigger estate tax exposure, valuation challenges, and capital gains considerations for heirs.

Tax outcomes depend on estate size, property value, and state law.

Key Tax Concepts

Step-Up in Basis

Heirs receive property valued at market price at time of death. This can reduce capital gains taxes if sold later.

Estate Tax Thresholds

Large estates may owe federal or state estate tax.

Valuation Requirements

Professional appraisal often required

Impacts tax reporting

Why This Matters for Business Owners

Commercial property valuation affects tax liability

Poor records increase risk

Planning reduces exposure

This is one of the most overlooked risks in intestate real estate transfer.

Special Rules That Affect Real Estate Inheritance

Ownership structure determines whether real estate goes through probate or transfers automatically.

How property is titled can change everything.

Joint ownership with survivorship

When two owners hold property with survivorship rights:

Ownership automatically transfers to the surviving owner

Probate is usually avoided

Tenancy by the entirety

Available for married couples in many states:

Surviving spouse receives full ownership

Offers creditor protection in some cases

Transfer-on-death (TOD) deeds

Some states allow TOD or beneficiary deeds:

Owner names a beneficiary in advance

Property transfers directly upon death

Probate is bypassed

Property owned by a business entity

This is critical for your target audience.

If property is owned by an LLC or corporation:

Ownership follows the entity’s governing documents

Membership interest transfers, not the property itself

Operating agreements control succession

This structure often prevents forced sales and probate delays.

Community Property States and Spousal Rights

In community property states, spouses generally own half of marital property and may inherit additional portions under intestacy rules.

Community property rules apply in certain states, including:

Arizona

California

Texas

What community property means

Property acquired during marriage is considered jointly owned.

When one spouse dies without a will:

Surviving spouse keeps their half

Additional share may be inherited

Distribution depends on whether children exist

Understanding marital property rules is essential for estate planning accuracy.

How Long Does the Process Take and What Does It Cost?

Probate without a will can take months to years and reduces estate value through court costs, legal fees, and property expenses.

Timeline depends on:

Estate complexity

Disputes among heirs

State procedures

Common Costs

Cost Type | Description |

Court filing fees | Required to open probate |

Attorney fees | Legal administration |

Property maintenance | Insurance, repairs |

Appraisal fees | Property valuation |

Tax preparation | Estate reporting |

Hidden Financial Impact

Delayed access to property

Reduced estate value

Administrative burden on heirs

For professionals with high-value assets, delays can be costly.

How to Avoid These Outcomes

Planning tools allow you to control property distribution, reduce probate delays, and protect business continuity.

You do not need a complex plan to improve outcomes.

Effective planning strategies

1. Create a legally valid will

Specifies who inherits property.

2. Establish a living trust

Allows property transfer without probate.

3. Use survivorship ownership

Transfers ownership automatically.

4. Record a transfer-on-death deed

Available in many states.

5. Hold property in an LLC

Provides continuity and control.

Why planning matters for professionals

Planning helps:

Maintain business stability

Reduce legal costs

Protect heirs from disputes

Improve tax outcomes

Final Thoughts

If you die without a will, state law controls who inherits your real estate, probate can delay access, and financial obligations and tax exposure may affect both your heirs and your business operations.

What this means for you

Control is limited. The court, not your preferences, decides distribution.

Operations can be disrupted. Business-used property may be tied up in probate.

Financial risk continues. Mortgages, taxes, and liens still apply.

Planning reduces uncertainty. Simple tools can protect both family and business continuity.

If real estate plays a role in your income or operations, consider reviewing how your property is titled and documented. A conversation with a qualified legal or tax professional can help you confirm your setup and avoid avoidable surprises.

Frequently Asked Questions

Does a spouse automatically inherit the house?

Not always. In many states, spouses inherit most property, but children may share ownership depending on family structure.

Can property transfer without probate?

Yes. Joint ownership, trusts, and beneficiary deeds can bypass probate.

What happens to rental property without a will?

It becomes part of the estate and is distributed to heirs according to state law.

Can heirs sell a house during probate?

Usually yes, but court approval may be required.

What happens if the property has a mortgage?

The loan remains. The estate or heirs must continue payments or refinance.

What happens to business real estate?

Ownership depends on how the property is titled and whether it is owned personally or by an entity.