What Is a 1031 Exchange? Explained for US Property Owners

Jan 30, 2026

A 1031 exchange allows U.S. property owners to sell an investment or business property and reinvest the proceeds into another property without immediately paying capital gains taxes. This tax-deferral strategy preserves your equity and helps you grow your portfolio faster.

Because you don’t have to pay taxes upfront, a 1031 exchange gives you more flexibility to upgrade, diversify, or consolidate your real estate holdings. It’s like keeping your money fully working for you instead of giving a big chunk to the IRS while still complying with federal rules. Named after Section 1031 of the Internal Revenue Code, this tool is a powerful way for investors and business owners to expand their portfolios strategically.

In this guide, we’ll break down everything you need to know about 1031 exchange in a way that’s easy to understand. By the end, you’ll know:

Who qualifies and who doesn’t

The core rules you must follow to avoid IRS penalties

How timelines, reinvestment, and reporting work

State-level considerations that can affect your outcome

The benefits, drawbacks, and step-by-step process

How to avoid common mistakes and when to seek professional help

Let’s dive in.

Who Qualifies for a 1031 Exchange and What Properties Are Excluded?

Only properties held for business or investment purposes qualify for a 1031 exchange, and certain property types are excluded.

To be eligible:

You must own the property for investment or business use—rental homes, commercial buildings, and land typically qualify.

Properties that do not qualify include personal residences, vacation homes, fix-and-flip inventory, stocks, bonds, and REITs.

Other Eligibility Notes:

Both the property you sell and the replacement property must meet these rules.

Intent matters: The IRS looks at whether your purpose is investment, not personal use.

What Are the Core Rules for a Successful 1031 Exchange?

A 1031 exchange only works if you follow federal rules on property type, reinvestment, timelines, and reporting. Missing any of these can make the exchange invalid and trigger taxes.

Like-Kind Property Requirement

Properties must be like-kind, meaning they are both U.S. real estate held for business or investment.

It doesn’t have to be the same type: a rental home can be swapped for a retail center.

Personal-use properties and stocks do not qualify.

After 2017, exchanges are limited to real property only.

Qualified Intermediary Requirement

You cannot receive the cash from the sale directly.

A Qualified Intermediary (QI) holds the funds and ensures compliance.

If you touch the proceeds, the IRS considers it constructive receipt, and taxes become due.

Reinvestment and Boot Rules

To fully defer taxes, the replacement property must be equal or greater in value.

Boot refers to cash or net debt relief received—this is taxable.

Partial reinvestment creates partial taxation on the leftover gain.

Mandatory Exchange Timelines

45 days: Identify potential replacement properties in writing.

Options: three-property rule, 200 percent rule, 95 percent rule.

180 days: Complete the purchase of the replacement property.

Missing either deadline disqualifies the exchange.

Tax Reporting and Documentation Requirements

File IRS Form 8824 with your tax return.

Include details: properties, dates, values, and how proceeds were used.

Keep detailed records for potential audits.

What Types of 1031 Exchanges Can Property Owners Use?

There are several types of 1031 exchanges including delayed exchange, simultaneous exchange, reverse exchange, and improvement exchange. Each one is designed to meet different timing and investment needs.

Delayed Exchange: Most common. Sell first, buy later within timelines.

Simultaneous Exchange: Sell and buy on the same day. Rare and tricky.

Reverse Exchange: Buy replacement property first, then sell the old one. Complex and expensive.

Improvement Exchange: Use exchange funds to improve the new property before closing.

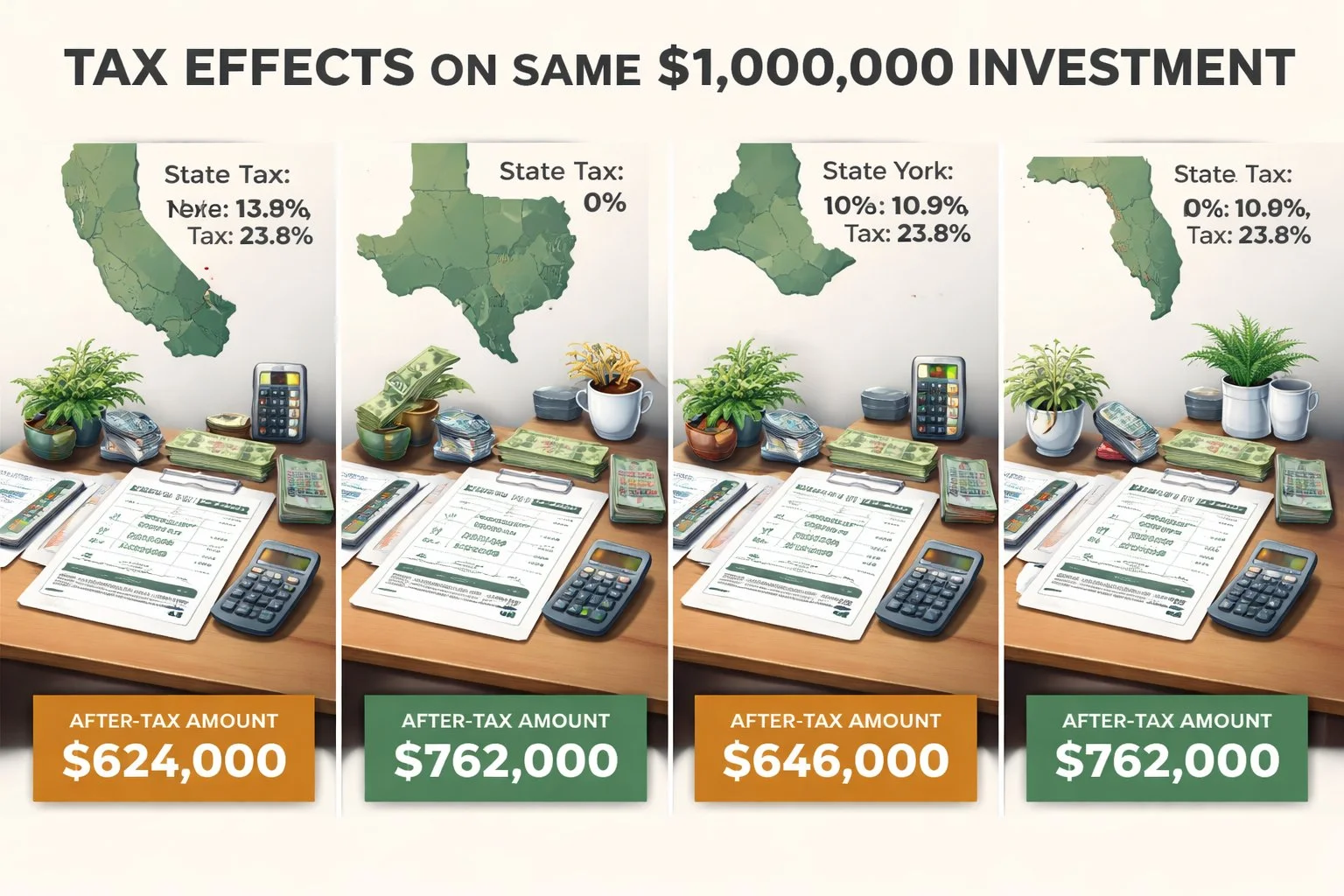

How Can State Taxes Affect a 1031 Exchange for US Property Owners?

Even if your 1031 exchange qualifies federally, state taxes may still impact your gains. Some states track deferred gains or have “clawback” rules.

States do not always conform to federal 1031 rules.

Some require reporting deferred gains even after the exchange.

Moving property between states can trigger state taxes later.

Multistate owners must plan carefully to preserve the benefit.

Tip: Always check state-specific rules before completing an exchange.

What Are the Benefits of a 1031 Exchange for Business Owners?

1031 exchanges let business owners defer taxes, preserve capital, and optimize investment strategy.

Tax Deferral: Keep full equity for reinvestment.

Portfolio Optimization: Consolidate multiple properties or move to better-performing assets.

Cash Flow Growth: Switch to lower-maintenance, higher-income properties.

Estate Planning: Deferred gains may vanish for heirs if stepped-up basis rules apply.

While tax deferral is a major advantage, it’s important to consider other exit options, such as selling or refinancing. See our Real Estate Exit Strategies for a full breakdown.

What Are the Risks and Limitations of a 1031 Exchange?

1031 exchanges come with strict rules, deadlines, and potential costs that can limit flexibility.

Expanded Explanation:

Tight Deadlines: 45- and 180-day rules create pressure.

Fees: Qualified Intermediaries charge 1–3% of proceeds.

Complexity: Reverse and improvement exchanges require legal and accounting expertise.

Partial Benefit: Mistakes or boot can trigger partial taxation.

How Does the 1031 Exchange Process Work Step-by-Step?

A 1031 exchange involves a carefully timed sequence: sell, identify, buy, and report.

Step 1: Pre-sale planning with your CPA or tax advisor.

Step 2: Sell the relinquished property; proceeds go to a QI.

Step 3: Identify replacement property within 45 days.

Step 4: Purchase replacement property within 180 days.

Step 5: File IRS Form 8824 and keep all documentation.

Tip: Following these steps exactly is crucial for tax deferral.

What Are the Most Common Mistakes That Can Disqualify a 1031 Exchange?

The exchange can fail if you mishandle funds, miss deadlines, or misclassify properties.

Receiving cash instead of using a QI.

Missing the 45- or 180-day deadlines.

Using the property for personal use rather than investment.

Poor documentation or incomplete tax reporting.

Avoiding these errors ensures you get full tax deferral benefits.

When Should Property Owners Consult a Tax Professional About a 1031 Exchange?

You should consult a tax professional before attempting a 1031 exchange to ensure compliance and maximize benefits.

Professionals help with federal and state rules.

They guide QI selection, property identification, and documentation.

Early consultation prevents costly mistakes and missed deadlines.

Final Thoughts: Is a 1031 Exchange the Right Choice for Your Investment Strategy?

A 1031 exchange is ideal for investors who want to defer taxes, preserve capital, and strategically grow their portfolio—but it requires careful planning and strict compliance.

If you own investment or business property, a 1031 exchange can help you:

Defer federal capital gains and depreciation recapture taxes, keeping more money to reinvest.

Upgrade or diversify your portfolio, moving into higher-value or more passive-income properties.

Plan for the future, potentially passing on deferred gains to heirs with a stepped-up basis.

However, it’s not suitable for everyone:

You need to meet all federal rules, including timelines, like-kind property, and reinvestment requirements.

State tax rules may still apply, affecting the actual benefit.

Mistakes, like missing deadlines or mishandling proceeds, can trigger taxes.

Bottom Line:

A 1031 exchange can be a powerful tool, but only if executed correctly. Work with a qualified tax professional or CPA, follow the rules, and plan carefully to maximize the benefit. By doing so, you can defer taxes, grow your investment portfolio, and make smarter property decisions without paying capital gains taxes upfront.

Beyond the exchange itself, it’s important to understand how a 1031 exchange fits into your overall real estate financial planning strategy, including cash flow needs, risk tolerance, and long-term tax goals. Looking at the bigger picture helps ensure the exchange supports your broader investment plan, not just the current transaction.

Frequently Asked Questions

Can I use a 1031 exchange on my primary residence?

No. A 1031 exchange only applies to properties held for business or investment purposes. Primary residences and personal-use properties do not qualify.

Do I eventually have to pay taxes on a 1031 exchange?

Yes. A 1031 exchange defers taxes, it does not eliminate them. Taxes are due when you sell the property without completing another qualifying exchange, unless estate planning rules apply.

How many replacement properties can I identify in a 1031 exchange?

You can identify up to three replacement properties regardless of value, or more than three if their total value does not exceed 200 percent of the sold property’s value.

What happens if I miss the 45-day or 180-day deadline?

If you miss either deadline, the exchange fails and the IRS treats the sale as taxable. There are very limited exceptions, so deadlines must be followed strictly.

Is a Qualified Intermediary required for every 1031 exchange?

Yes. A Qualified Intermediary is required to hold the sale proceeds and manage the exchange. Receiving the funds directly will disqualify the exchange and trigger taxes.