How Real Estate Depreciation Works and Why It Matters for Taxes

Jan 26, 2026

Real estate depreciation is a tax rule that lets US property owners deduct the cost of a building over time, even though the property may be increasing in market value. It reduces taxable income without reducing cash, which is why it matters so much for taxes and long-term planning.

That simple idea often feels confusing. People hear that real estate is an appreciating asset, yet the IRS allows you to treat it as something that slowly wears out. Both can be true at the same time. Depreciation exists because buildings age, systems break down, and repairs are expected, even in strong markets.

The problem is not depreciation itself. The problem is misunderstanding it. Many owners do not realize depreciation is required, not optional. Others claim it incorrectly, forget about recapture, or assume it only applies to large investors. These mistakes usually show up later, often when taxes are higher and options are limited.

In this guide, you will learn:

What real estate depreciation really is

What property qualifies and what does not

How depreciation is calculated step by step

Why it lowers taxes without hurting cash flow

The risks, limits, and long-term planning impact

What Is Real Estate Depreciation?

Real estate depreciation is a tax deduction that lets property owners recover the cost of a building over time. The IRS assumes buildings wear out, even if their market value increases.

In simple terms, depreciation is how the IRS lets you deduct part of a building’s value each year as an expense. This applies only to property used to produce income, like rental homes or commercial buildings.

Even though real estate often goes up in market value, the IRS treats buildings as assets that slowly wear down. Roofs age. Plumbing breaks. Electrical systems get old. Because of this, the tax code allows owners to spread the cost of the building over many years.

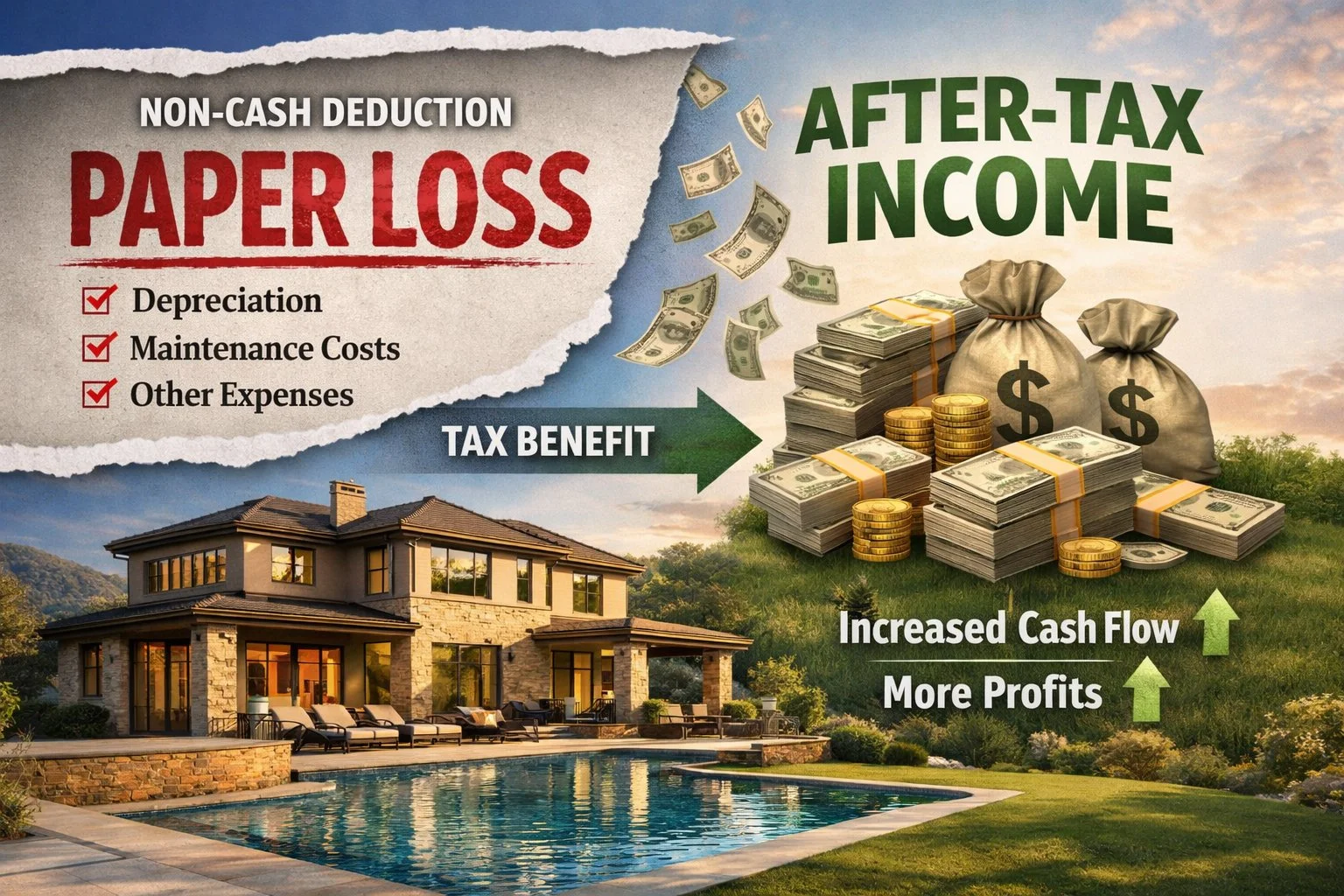

One important thing to understand is this. Depreciation is a non-cash deduction. That means you get a tax write-off without writing a check. You still collect rent. You still keep the cash. The deduction only exists on paper, but the tax savings are very real.

What Property Can and Cannot Be Depreciated?

Only income-producing buildings and structural improvements can be depreciated. Land, personal-use property, and non-income property cannot.

Property That Can Be Depreciated

You can depreciate property if it meets all of these rules:

You own it

You use it to produce income

It has a useful life longer than one year

Common examples include:

Residential rental properties

Commercial buildings

Office spaces

Warehouses

Structural improvements like roofs, walls, plumbing, and HVAC systems

Property That Cannot Be Depreciated

Some property does not qualify, no matter how valuable it is:

Land

Your primary residence

Vacation homes used only for personal use

Property that is not available or intended for rent

Land is the biggest area where mistakes happen. The IRS does not allow land to be depreciated because land does not wear out. Only the building sitting on the land qualifies. Mixing these up can trigger audits and corrections later.

How Long Do You Depreciate Real Estate?

Residential rental property is depreciated over 27.5 years. Commercial property is depreciated over 39 years. Both use the straight-line method.

The IRS sets fixed timelines called recovery periods.

Residential Rental Property

Recovery period: 27.5 years

Method: Straight-line depreciation

Commercial Property

Recovery period: 39 years

Method: Straight-line depreciation

Straight-line means the same amount is deducted every year. No guessing. No front-loading unless special rules apply.

The IRS uses different timelines because residential buildings are assumed to wear out faster than commercial ones. Whether that feels logical or not, those are the rules.

When Does Real Estate Depreciation Start?

Depreciation starts when the property is placed in service, meaning it is ready and available for rent.

This is one of the most misunderstood parts of depreciation.

Placed in service does not mean:

When a tenant moves in

When rent is collected

When renovations are fully finished if the property was already rentable

Placed in service means the property is ready and available to earn income. For example:

The unit is finished

Utilities are connected

You are actively marketing it for rent

Timing matters because depreciation is prorated in the first year. Starting even one month earlier can increase your deduction for that year. Starting late can reduce it.

How Do You Calculate Real Estate Depreciation?

To calculate depreciation, determine the building’s cost basis, subtract land value, divide by the recovery period, and apply IRS proration rules.

Here is the simple step-by-step process.

Step 1: Determine the Cost Basis

Start with:

Purchase price

Certain closing costs

Capital improvements made to the property

This total is your starting basis.

Step 2: Allocate Land vs Building

Next, split the total cost between land and building.

Common methods include:

County tax assessments

Appraisals

Reasonable allocation based on property records

Only the building portion is depreciated.

Step 3: Apply the Recovery Period

Divide the building value by:

27.5 years for residential rental property

39 years for commercial property

This gives your annual depreciation amount.

Step 4. Apply IRS Conventions

The IRS uses the mid-month rule. This means:

You get a partial deduction in the first year

You get a partial deduction in the final year

You do not need advanced math. Most tax software or professionals handle this automatically.

Simple Example

You buy a rental property for $300,000.

Land value: $50,000

Building value: $250,000

$250,000 ÷ 27.5 years = about $9,091 per year in depreciation.

Why Does Real Estate Depreciation Matter for Taxes?

Depreciation lowers taxable income without reducing cash flow.

This is why depreciation is so powerful.

Lower Taxable Income

Depreciation reduces the rental income you report on your tax return. Less reported income means less tax owed.

Improved Cash Flow

Because depreciation is non-cash, you still keep the rent money. You just pay less tax on it.

If you want to learn how to get track your cash flow, check out our guide about "How to Track Cash Flow for Rental Properties in the US".

Paper Losses

In some cases, depreciation can create a loss on paper even when the property is profitable. These losses can help offset other passive income.

Depreciation does not make you poorer. It improves after-tax cash flow.

What Are Passive Loss Rules and How Do They Affect Depreciation?

Depreciation losses are passive losses and may be limited based on income and participation level.

The IRS separates income into categories. Rental real estate is usually considered passive.

This means:

Losses from depreciation may not offset wages or business income

Income limits may apply

Special rules exist for active participants and real estate professionals

The key takeaway is this. Depreciation always exists, but you may not be able to use all of it immediately. Unused losses can often be carried forward to future years.

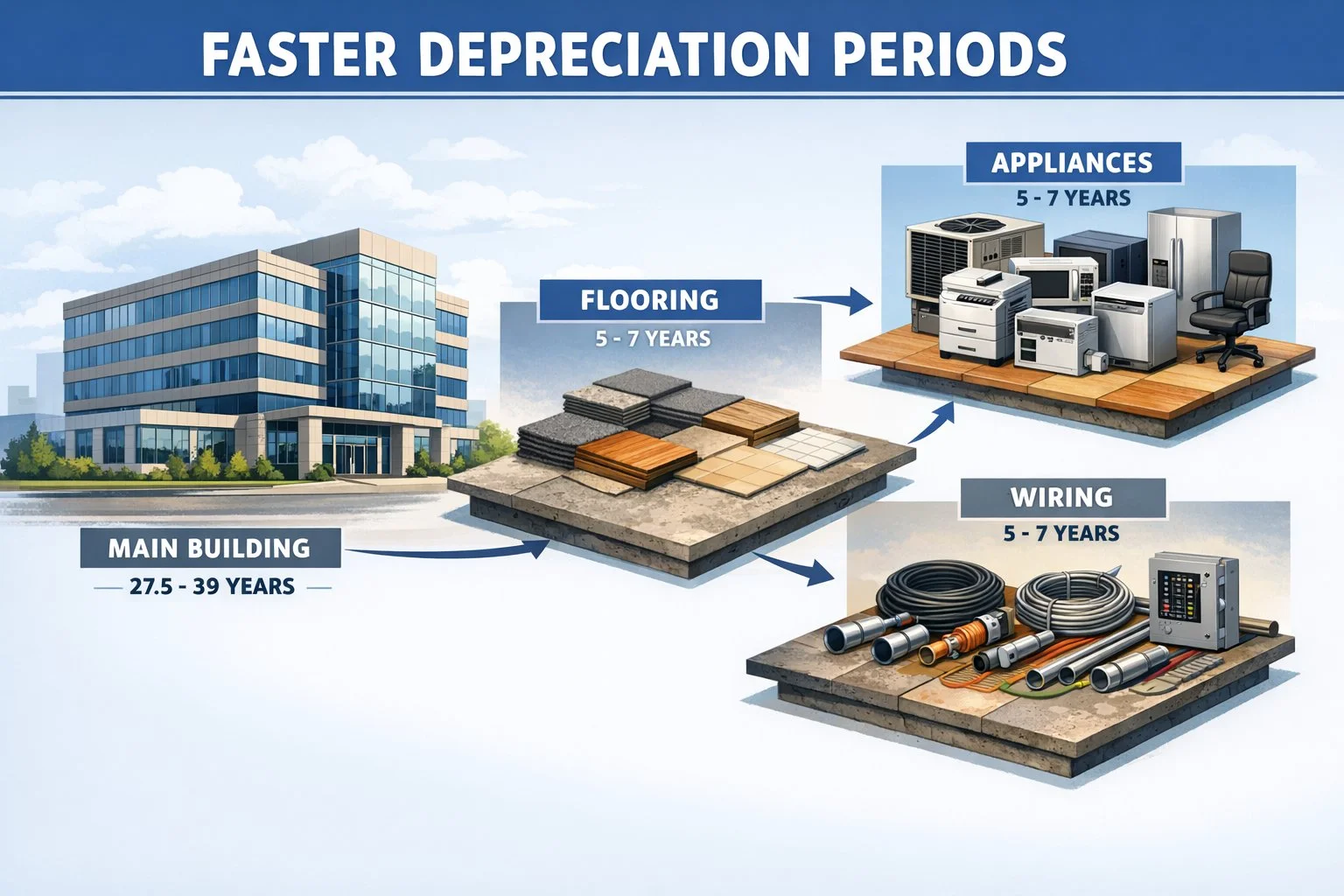

What Is Cost Segregation and Accelerated Depreciation?

Cost segregation accelerates depreciation by breaking parts of a building into shorter recovery periods.

Instead of depreciating the entire building over 27.5 or 39 years, cost segregation identifies components that qualify for faster depreciation, such as:

Appliances

Flooring

Certain wiring

Fixtures

These parts may be depreciated over 5, 7, or 15 years.

When Cost Segregation Makes Sense

Large properties

High-income years

Long-term ownership plans

When It May Not Be Ideal

Small properties

Short holding periods

Low income where deductions are not usable

This strategy can be powerful, but it increases complexity and audit risk if done incorrectly.

What Is Bonus Depreciation and How Does It Apply to Real Estate?

Bonus depreciation allows certain qualifying improvements to be deducted faster, but the rules change often.

Bonus depreciation can apply to:

Certain improvements

Certain property components identified through cost segregation

The percentage allowed changes based on tax law and year. Because of frequent changes, timing matters and professional guidance is important.

What Is Depreciation Recapture?

Depreciation recapture is the tax paid on previously claimed depreciation when the property is sold.

Here is the part many people miss.

The IRS taxes depreciation you claimed, or were allowed to claim, when you sell the property. This is called depreciation recapture.

Key points:

Applies even if you never claimed depreciation

Taxed at up to 25 percent

Separate from capital gains tax

Simple Example

Depreciation saved you taxes for years. When you sell, part of that savings is paid back through recapture. This does not mean depreciation was bad. It means it must be planned for.

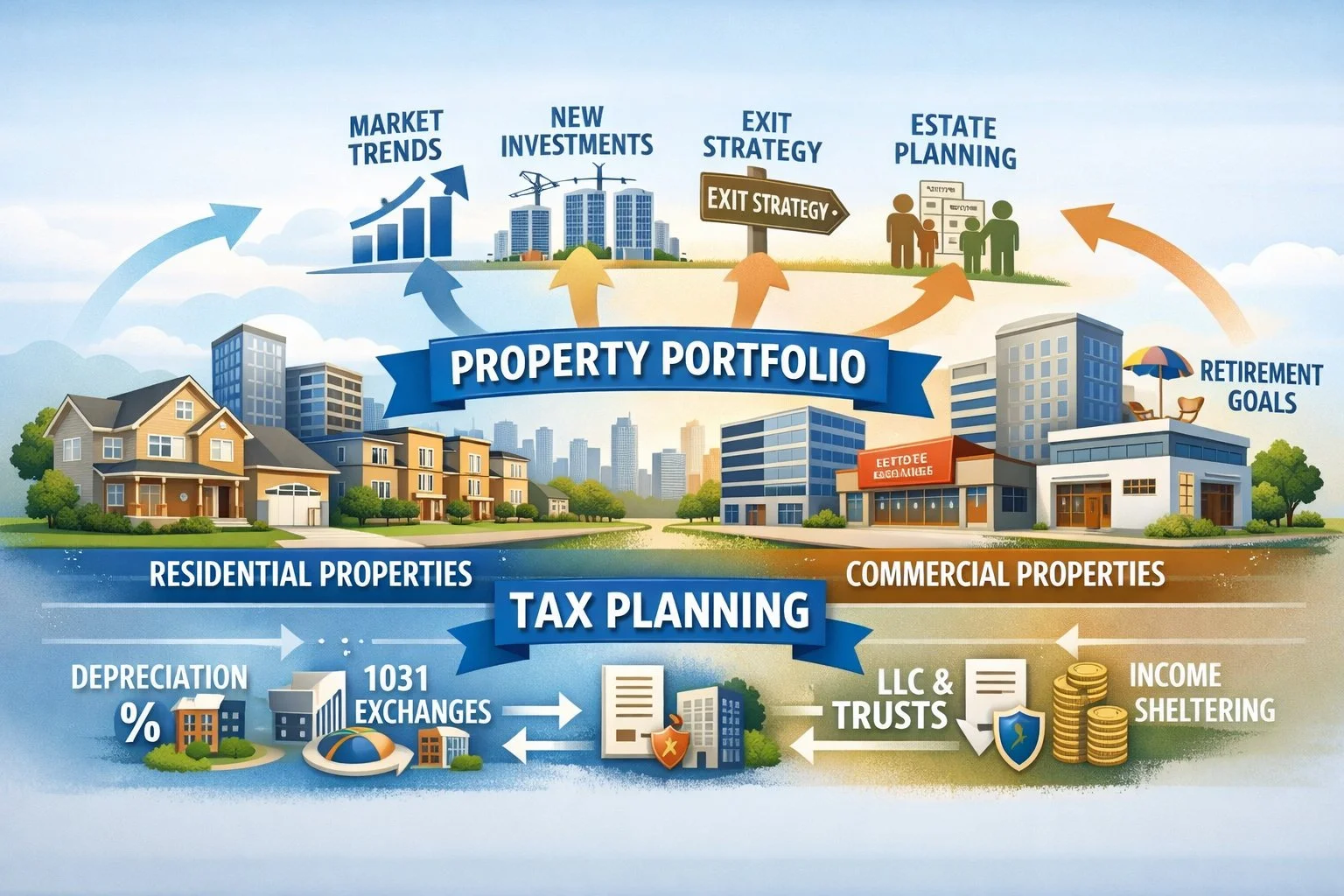

How Does Depreciation Fit Into Long-Term Real Estate Planning?

Depreciation affects long-term planning by influencing selling decisions, estate planning, and lifetime tax outcomes. Understanding it helps property owners reduce taxes today while avoiding surprises when selling or transferring property.

Impact on Selling Decisions

Depreciation reduces taxable income each year, but it also creates depreciation recapture when you sell. Planning ahead can help minimize taxes and maximize cash from a sale. Knowing your depreciation history is essential before listing a property.

Estate Planning Considerations

If you pass property to heirs, depreciation affects how much tax they might owe. Inherited property often gets a “step-up in basis,” which can reset depreciation for heirs and reduce taxes. Proper planning ensures your estate transfers efficiently.

Integration With Overall Financial Strategy

Depreciation should not be treated in isolation. It interacts with cash flow, investment strategy, and risk management. Considering it as part of your long-term real estate plan helps align annual tax benefits with broader financial goals.

What Are the Common Real Estate Depreciation Mistakes?

Common real estate depreciation mistakes include not claiming depreciation, depreciating land, using the wrong placed-in-service date, and ignoring depreciation recapture. These errors can lead to missed deductions, IRS corrections, or unexpected tax bills later.

Not Claiming Depreciation at All

Some property owners skip depreciation because they think it is optional or not worth the effort. This is a costly mistake. The IRS treats depreciation as “allowed or allowable,” meaning it applies even if you never claim it. You lose the yearly tax benefit, but you still face depreciation recapture when you sell.

Depreciating Land

Land cannot be depreciated. Only the building and certain improvements qualify. Including land in depreciation calculations inflates deductions and increases audit risk. This mistake is common when owners do not properly allocate the purchase price between land and building.

Using the Wrong Placed-in-Service Date

Depreciation starts when the property is ready and available for rent, not when a tenant moves in or when rent is collected. Using the wrong date can reduce first-year deductions or create inconsistencies in your tax records.

Ignoring Depreciation Recapture

Many owners focus only on the yearly tax savings and forget that depreciation affects taxes when the property is sold. Ignoring recapture can lead to surprise tax bills and poor selling decisions. Depreciation should always be planned with the exit in mind.

Doing DIY Calculations Without Understanding the Rules

Online calculators and rough estimates often miss IRS conventions, allocation rules, and reporting requirements. Small errors repeated over many years can turn into large compliance problems later.

Final Thoughts and When to Work With a CPA or Real Estate Tax Specialist

Real estate depreciation is mandatory, powerful, and often misunderstood. It lowers taxes today but affects taxes tomorrow. That is why it should be treated as part of a long-term financial plan, not just a yearly deduction.

DIY approaches may work for simple situations with one small property. But professional help is often worth it when you have multiple properties, high income, ownership structures, or advanced strategies like cost segregation.

Handled correctly, depreciation improves cash flow, supports growth, and fits into a bigger real estate tax strategy. Handled poorly, it creates surprise tax bills later.

Remember, real estate depreciation should never be viewed on its own. It affects cash flow, tax liability, selling decisions, and how property fits into your long-term goals. For a broader view of how depreciation connects with budgeting, debt strategy, and estate planning, see our full guide on real estate financial planning for US property owners.

Frequently Asked Questions

How long do you depreciate rental property?

Residential rental property is depreciated over 27.5 years using the straight-line method.

Can you choose not to depreciate?\

No. The IRS applies depreciation whether you claim it or not.

Does depreciation reduce cash flow?

No. Depreciation is a non-cash deduction and does not reduce rental income received.

Is depreciation required by the IRS?

Yes. Depreciation is considered “allowed or allowable” under IRS rules.