How to Track Cash Flow for Rental Properties in the US: What Every Landlord Should Know

Jan 28, 2026

To track cash flow for rental properties in the US, subtract all rental-related expenses and mortgage payments from the rental income you actually collect each month. This means tracking rent and other income, recording every expense, accounting for vacancies, and reviewing the results regularly so you know whether your property is truly making money.

On paper, that sounds simple. But in real life, rental properties rarely behave so neatly. One slow month, a small repair, or an unexpected bill can turn what looks like a profitable property into a source of stress. Many landlords assume their rental is doing fine because rent covers the mortgage, only to find out later that cash has been slipping away.

In this guide, you will learn:

What cash flow really means for rental properties in the US

What income and expenses you must track to stay accurate and compliant

How to track cash flow step by step, even if you are not a numbers person

Which tools and methods work best for small to medium rental owners

Common mistakes that make properties look profitable when they are not

By the end, you will be able to answer the question, “Is my rental property truly making money?”. So, let’s get started!

What “Cash Flow” Means for Rental Properties

Cash flow for a rental property is the money left over after you collect rental income and pay all cash expenses, including operating costs and mortgage payments. If the number is positive, the property puts money in your pocket. If it is negative, you are paying out of pocket to keep the property running.

In simple terms, cash flow shows whether your rental is actually making money in real life, not just on paper.

A basic way to calculate it is:

Monthly cash flow = Rental income − Operating expenses − Mortgage payments

Annual cash flow = Net operating income − Total debt service

Cash flow vs profit vs taxable income

These terms are often confused.

Cash flow is about real money moving in and out.

Profit is a business concept that may include non-cash items.

Taxable income is what the IRS uses, after deductions like depreciation.

Note: Cash flow focuses only on real money moving in and out of your bank account, which is why it is one of the most important numbers for rental property owners to track.

What Are the Key Components You Must Track for Rental Property Cash Flow?

The key components you must track are rental income, operating expenses, financing costs, and capital expenditures or reserves. Tracking all four ensures you know exactly how much money your property is generating, what it costs to run, and how much cash you actually keep each month. Missing any of these can make your rental look profitable on paper while draining your bank account in reality.

Rental Income

Rental income is more than just monthly rent.

You should track:

Rent actually collected

Parking fees

Pet rent or pet fees

Laundry income

Storage fees

Late fees and application fees

For multi-unit properties, add income from all occupied units.

A key concept here is effective rental income. This is rental income after vacancy and unpaid rent are removed. Scheduled rent looks good on paper, but effective income shows reality.

Operating Expenses

Operating expenses are the regular costs of running the property.

Common operating expenses include:

Property taxes

Insurance

Repairs and routine maintenances

Property management fees

Utilities paid by the owner

HOA or condo dues

Advertising and leasing costs

Legal and accounting fees

Software or landlord tools

These expenses reduce cash flow every month. They must be tracked as they are paid, not estimated later.

Financing Costs

Financing costs are mainly your mortgage payments.

This includes:

Mortgage principal

Mortgage interest

These costs are not part of net operating income, but they are critical for cash flow. A property with strong income can still have negative cash flow if the loan payment is too high.

Capital Expenditures and Reserves

This is one of the most overlooked areas.

Capital expenditures are big, infrequent costs like:

Roof replacement

HVAC systems

Major plumbing or electrical work

Large renovations

These are not monthly expenses, but they are guaranteed to happen over time.

Smart landlords set aside reserves. A common rule is 5 to 10 percent of rental income or several months of expenses. Ignoring reserves makes a property look more profitable than it really is.

How to Track Rental Cash Flow Step by Step

To track rental cash flow effectively, start by separating your rental finances, choose a method to record income and expenses, track all money coming in and going out consistently, and build a monthly cash flow statement to monitor results. Doing these steps regularly ensures you always know your property’s true profitability and are ready for taxes or unexpected expenses.

Below is a more detailed step-by-step:

Step 1. Separate Your Rental Finances

The first rule is simple. Do not mix personal and rental money.

Open a dedicated bank account for your rental activity. All rent goes in. All expenses come out.

This makes tracking easier, reduces mistakes, and protects you during tax season.

Step 2. Choose a Tracking Method

There are two main options:

Spreadsheets

Spreadsheets work well for small portfolios and hands-on owners. They give full control but require discipline. Also, it still work well if you include:

Income by category

Expense categories aligned with taxes

Monthly and yearly totals

Automatic cash flow calculations

The risk with spreadsheets is falling behind. Accuracy depends on consistency.

Software

Rental accounting software automates income tracking, expense categories, and reports. It is helpful as your portfolio grows or if you want less manual work.

Rental software can:

Sync bank accounts

Categorize expenses automatically

Generate cash flow and tax reports

Popular tools include Rentastic, Baselane, DoorLoop, and REI Hub. These are useful for landlords who want automation and clean reporting.

There is no single right answer. The best method is the one you will actually keep updated.

Step 3. Choose an Accounting Method

Most US landlords use the cash method.

With the cash method:

You record income when you receive it

You record expenses when you pay them

This matches how the IRS expects most individual landlords to report rental activity. It also aligns naturally with cash flow tracking.

Step 4. Record Income Consistently

Each time money comes in, record:

Date received

Amount

Type of income

Unit or property

Do not record security deposits as income. These belong to the tenant and should be held separately unless legally applied to rent or damages.

Step 5. Track and Categorize Expenses in Real Time

Waiting until the end of the year is risky.

Track expenses as they happen:

Save receipts and invoices

Digitize paperwork

Assign each expense to the correct category

Good categories make tax filing easier and keep your cash flow numbers honest.

Step 6. Build a Monthly Cash Flow Statement

Once a month, summarize everything.

A simple monthly cash flow statement includes:

Total rental income collected

Total operating expenses paid

Net operating income

Mortgage payments

Net cash flow

Review this every month. Patterns become obvious when you look regularly.

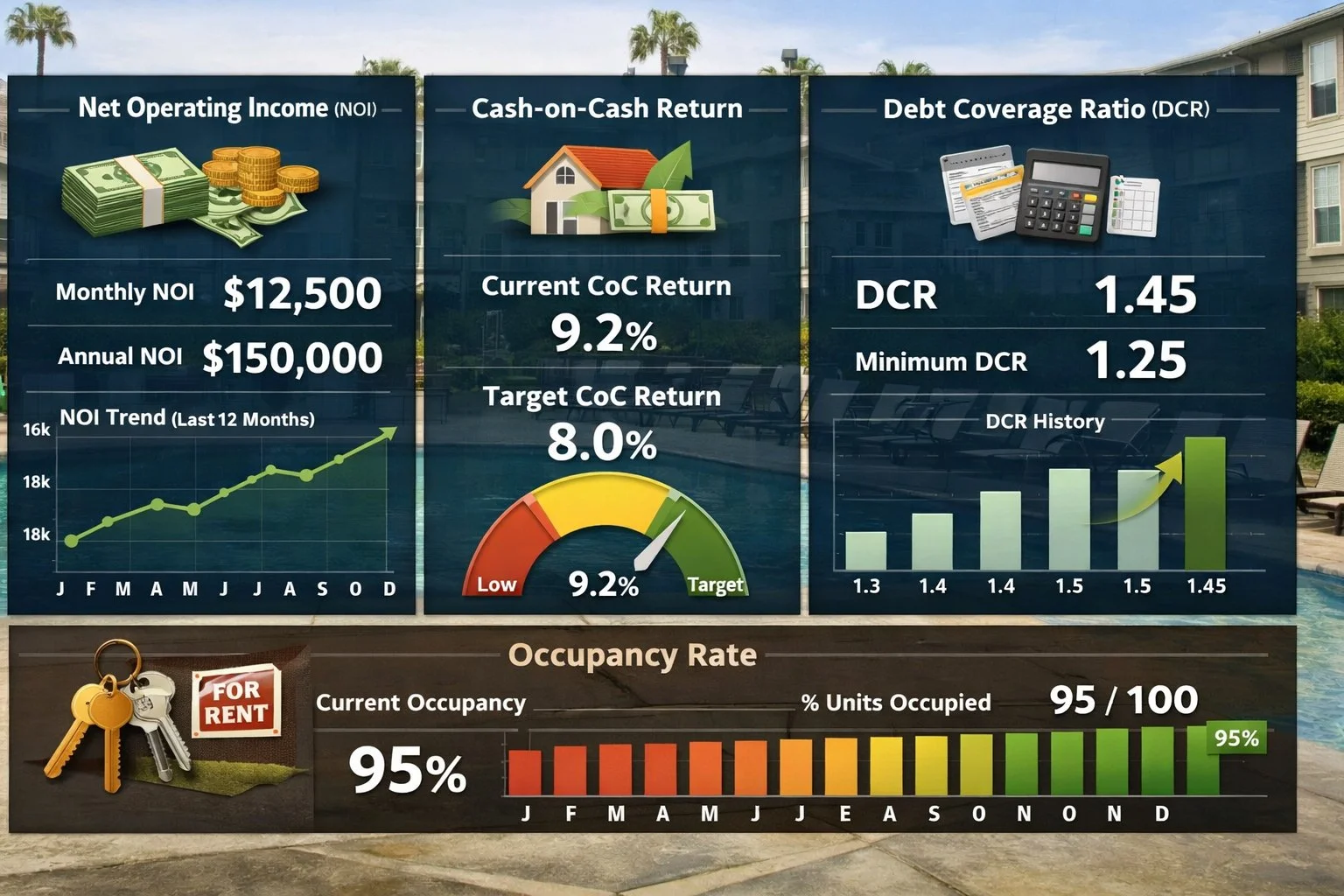

What are the Key Metrics Needed to Monitor Beyond Cash Flow?

The main metrics to monitor beyond cash flow are Net Operating Income (NOI), cash-on-cash return, debt coverage, and occupancy rates. These numbers help landlords see the financial health of their properties, make smarter investment decisions, and catch problems before they hurt profits.

Net Operating Income (NOI)

NOI is the total rental income minus operating expenses, before paying mortgage or financing costs.

Why it matters: NOI shows how well the property performs independently of loans. It helps compare different properties fairly and understand operational efficiency. Tracking NOI over time highlights trends in rent growth, expenses, or property performance.

Cash-on-Cash Return

Cash-on-cash return measures the annual pre-tax cash flow relative to the cash you invested in the property.

Why it matters: This metric tells you how effectively your invested capital is working. It helps determine whether a property is generating enough return compared to other investments or your target yield.

Debt Coverage Ratio (DSCR)

DSCR is the ratio of NOI to total debt service (mortgage payments).

Why it matters: DSCR indicates whether a property earns enough to cover its loan payments. A DSCR above 1 means income exceeds debt obligations, while a low DSCR signals potential cash flow risk or the need to refinance.

Occupancy and Vacancy Rates

Occupancy rate measures how much of the property is rented versus vacant. Vacancy rate is the opposite.

Why it matters: High vacancy reduces cash flow and ROI. Monitoring these rates helps landlords adjust rent, improve marketing, or address tenant turnover to maintain steady income.

Examples for Monthly and Annual Cash Flow

Monthly Cash Flow

Let’s walk through a basic example.

Gross monthly rent: 2,000 dollars

Vacancy allowance at 5 percent: 100 dollars

Effective rent: 1,900 dollars

Monthly expenses:

Property taxes and insurance: 350 dollars

Repairs and maintenance: 150 dollars

Property management: 160 dollars

Utilities: 90 dollars

Total operating expenses: 750 dollars

Net operating income:

1,900 - 750 = 1,150 dollars

Mortgage payment:

900 dollars

Monthly cash flow:

1,150 - 900 = 250 dollars

This property produces 250 dollars per month in positive cash flow. Without tracking vacancy and maintenance, it might look much better than it really is.

Annual Cash Flow Example

Let’s see how cash flow adds up over a full year.

Assumptions for a single-family rental:

Monthly rent: $2,000

Vacancy allowance: 5% ($100/month)

Other income (parking/laundry): $50/month

Operating expenses:

Property taxes and insurance: $350/month

Repairs and maintenance: $150/month

Property management: 8% of rent ($160/month)

Utilities paid by landlord: $90/month

Mortgage payment: $900/month

Step 1: Calculate annual effective income

Effective monthly rent = $2,000 − $100 + $50 = $1,950

Annual effective rent = $1,950 × 12 = $23,400

Step 2: Calculate annual operating expenses

Taxes & insurance: $350 × 12 = $4,200

Repairs & maintenance: $150 × 12 = $1,800

Property management: $160 × 12 = $1,920

Utilities: $90 × 12 = $1,080

Total annual operating expenses = $4,200 + $1,800 + $1,920 + $1,080 = $9,000

Step 3: Calculate annual net operating income (NOI)

NOI = $23,400 − $9,000 = $14,400

Step 4: Subtract annual mortgage payments

Annual mortgage = $900 × 12 = $10,800

Annual cash flow = $14,400 − $10,800 = $3,600

So, this property generates $3,600 of cash flow per year, even after accounting for vacancies, expenses, and mortgage payments.

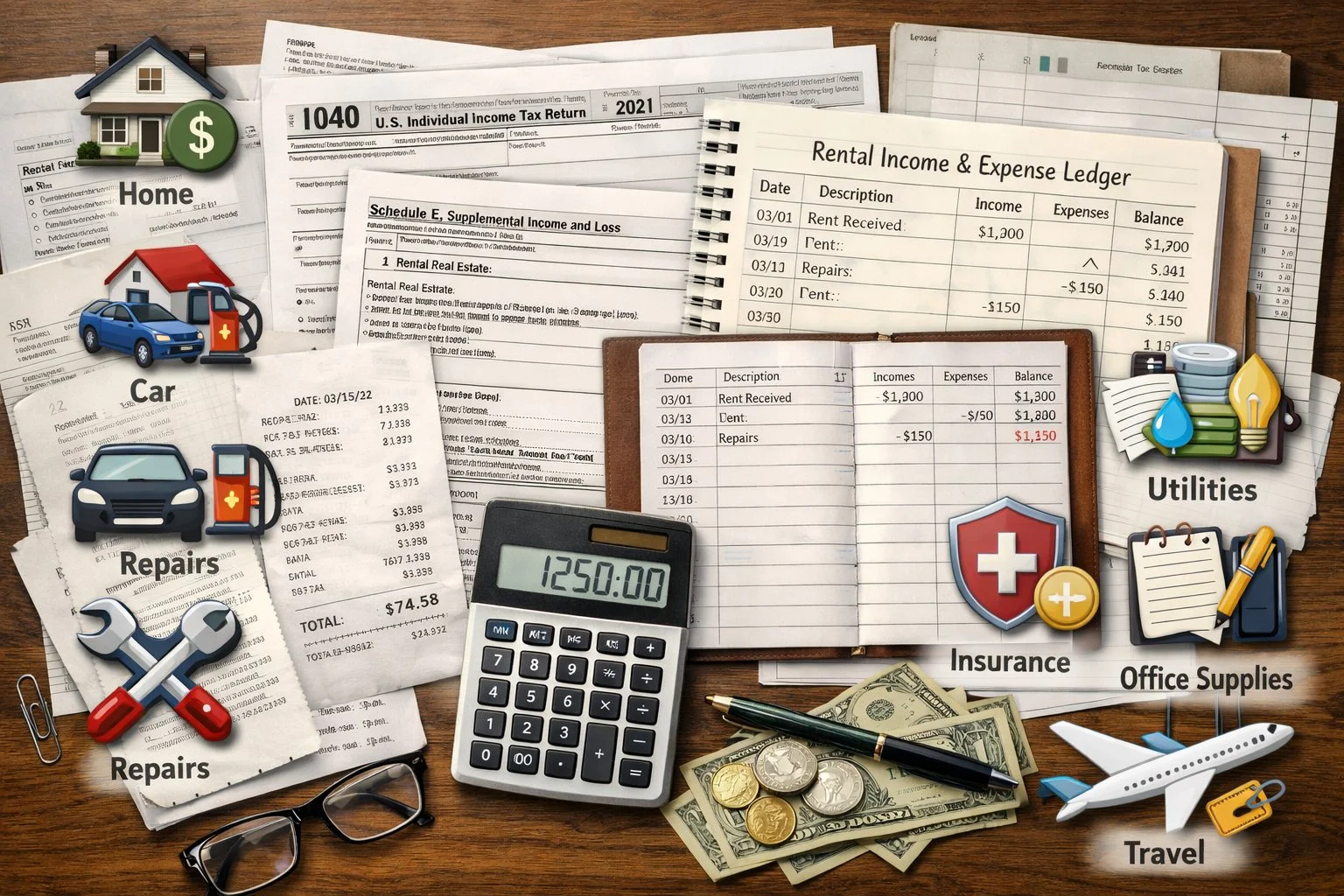

What US Tax Considerations Affect Rental Cash Flow Tracking?

US tax rules affect rental cash flow tracking through how income is reported, which expenses are deductible, how depreciation works, and when costs must be capitalized instead of deducted. Understanding these rules helps landlords track cash flow accurately and avoid surprises at tax time.

Below are the key tax factors that influence how cash flow should be tracked.

Cash Method vs. Accrual Method

Most US rental property owners use the cash method for taxes.

This means:

Income is reported when you receive it

Expenses are deducted when you pay them

This matches how cash flow works in real life.

This option works best for small and mid-sized landlords because it is simpler and easier to track.

Deductible Expenses That Impact Cash Flow

Many rental expenses reduce taxable income, even though they also reduce cash.

Common deductible expenses include:

Mortgage interest

Property taxes

Insurance

Repairs and maintenance

Property management fees

Utilities paid by the owner

Legal and accounting fees

Tracking these expenses properly helps lower taxes and improve after-tax cash flow.

This may not be ideal if expenses are missed or misclassified.

Depreciation: A Non-Cash Expense That Still Matters

Depreciation reduces taxable income without using cash. For residential rentals, buildings are depreciated over 27.5 years.

Even though depreciation does not affect monthly cash flow, it affects:

Tax bills

Overall profitability

Long-term planning

This option works best when depreciation is tracked separately from cash expenses.

If you want to understand more about depreciation in real estate, check out our comprehensive guide about "How Real Estate Depreciation Works and Why It Matters for Taxes".

Capital Expenses vs. Repairs

The IRS treats repairs and improvements differently.

Repairs are usually deducted in the year paid

Improvements are capitalized and depreciated over time

This affects both taxes and how cash flow is measured.

This may not be ideal if large improvements are treated like regular expenses.

Passive Activity Loss Rules

Rental losses are often considered passive. This can limit how much loss you can use to offset other income.

Therefore, tracking cash flow can help you identify when losses exist and how they affect your tax situation.

This option works best when rental activity is reviewed alongside your total income.

Why Good Cash Flow Tracking Helps at Tax Time

Accurate cash flow tracking makes it easier to:

Prepare Schedule E

Support deductions

Answer IRS questions

Plan for estimated taxes

Cash flow tracking is not just about performance. It supports tax compliance and smarter planning.

What Are the Common Cash Flow Tracking Mistakes US Property Owners Make?

Common cash flow tracking mistakes include mixing personal and rental finances, ignoring small expenses, forgetting vacancy and reserves, and relying on estimates instead of real numbers. These mistakes can make a rental property look profitable when it is not.

Below are the most common issues and why they matter.

Mixing Personal and Rental Finances

One of the biggest mistakes is using the same bank account for everything.

When rental and personal expenses are mixed:

Transactions are hard to track

Expenses get missed

Tax reporting becomes messy

This may not be ideal if you own more than one property.

Tracking Expected Rent Instead of Collected Rent

Cash flow is based on money received, not money owed. Therefore, counting unpaid rent makes cash flow look better than reality.

This option works best when only collected rent is recorded.

Forgetting Vacancy and Credit Loss

Many owners assume full occupancy every month.

In reality:

Tenants move out

Payments arrive late

Units sit empty

Ignoring vacancy leads to overly optimistic cash flow.

Ignoring Small Expenses

Small costs add up.

Items often missed include:

Supplies

Mileage

Software subscriptions

Bank fees

This may not be ideal if expenses are tracked only at year-end.

Not Setting Aside Reserves

Some landlords track cash flow but spend every dollar.

Without reserves:

Repairs become emergencies

Cash flow swings wildly

This option works best when reserves are treated as required, not optional.

Misclassifying Repairs and Improvements

Treating improvements as regular expenses can distort cash flow and tax reporting. That is why large upgrades should be tracked separately.

This may not be ideal if you rely only on bank statements.

Reviewing Cash Flow Too Infrequently

Looking at numbers once a year is too late. You should do monthly reviews to help spot issues early.

This option works best when cash flow is reviewed regularly.

Final Thoughts

Tracking cash flow is more than just numbers, it’s the foundation for making smart decisions with your rental properties. By knowing exactly what comes in, what goes out, and planning for unexpected expenses, you can keep properties profitable, reduce financial stress, and make informed tax and investment choices.

When cash flow tracking is paired with a broader real estate financial plan, it helps you see the full picture: how properties contribute to your income, your long-term wealth, and your estate goals. For example, knowing your property’s cash flow makes it easier to plan transfers to heirs, optimize deductions, or decide whether to hold or sell a property.

For US property owners, combining monthly cash flow tracking with a comprehensive real estate financial strategy, like the one discussed in our guide about [Real Estate Financial Planning Explained for US Property Owners], ensures that your rentals work for you today and for your long-term goals. Start tracking consistently, review regularly, and use the insights to guide every financial decision about your real estate portfolio.

Frequently Asked Questions

What is cash flow for rental properties?

Cash flow is the money left over after subtracting all rental expenses, mortgage payments, and reserves from rental income. It shows the actual cash you earn or owe each month.

How often should landlords track cash flow?

Landlords should track cash flow monthly to monitor trends and annually for tax reporting. Regular tracking helps spot issues before they become serious.

Does depreciation affect cash flow?

No. Depreciation is a non-cash tax deduction. It reduces taxable income but does not impact the actual cash moving in or out of your accounts.

Is positive cash flow always required?

Not always. Some investors accept negative cash flow temporarily for long-term appreciation or tax benefits, but positive cash flow ensures a property can pay its bills and fund repairs.

What is the best way to track cash flow for multiple properties?

Use dedicated software or spreadsheets that let you track income and expenses by property. Linking bank accounts and categorizing transactions per property makes monitoring, reporting, and tax filing much easier.