Modeling PTE Election Savings: Real-Life Business Scenarios

Nov 21, 2025

Most business owners hear about the Pass-Through Entity tax election and wonder if it is actually worth the trouble. The promise sounds great. Pay your state income taxes at the entity level and potentially bypass the federal SALT cap. For many owners, that can mean real savings. For others, it barely moves the needle. The challenge is figuring out which camp you belong to.

Instead of drowning you in tax jargon, this guide walks you through real-life examples that show what the PTE election looks like for different types of businesses. You will see how it can help a single-member LLC, an S-Corp, a partnership, a multi-state operation, and a high-income professional firm. You will also see a case where the election offers almost no benefit.

By the end of this guide, you will know:

How PTE savings actually work through simple numbers

Whether your business structure and state tax rate make the election worthwhile

Common patterns in businesses that benefit from PTE

How to estimate your own potential savings

Let’s get into it.

Scenario 1. Single-Member LLC With Steady Income

Maria owns a small design studio. She works with a mix of local businesses and online clients. Her income is consistent year after year, which makes planning simple. She operates in a state with a high income tax rate. Every year, she feels boxed in by the federal SALT cap because she pays more state tax than she can deduct.

She starts looking into the PTE election to see if it can help.

How Her Numbers Look

Annual business profit: $180,000

State tax rate: 9 percent

Estimated state tax: $16,200

SALT deduction limit on personal return: $10,000

Before PTE, Maria can only deduct $10,000 of all combined state and local taxes. The rest is stuck. With PTE, her business pays the $16,200 at the entity level and deducts the full amount against federal taxable income.

Estimated Savings

After accounting for how the credit flows back to her state return, Maria sees roughly $2,000 to $4,000 in annual tax savings depending on other personal factors.

Takeaway

Solo owners with steady profits and high state taxes often get clear and predictable benefits from electing PTE.

Scenario 2. S-Corp Owner With High State Taxes

James runs a marketing agency. As an S-Corp owner, he pays himself a reasonable salary, then takes the rest out as distributions. Since he is in a high-tax state, almost every dollar above his W-2 salary comes with a steep state tax bill.

He wonders if PTE applies to both salary and distributions. It does not. The PTE election applies only to pass-through business income, not wages. That still helps because most of his income is in distributions.

How His Numbers Look

W-2 salary: $120,000

Distributions: $220,000

State tax rate: 10 percent

Only the $220,000 in distributions is eligible for the PTE election.

Estimated Savings

If the business pays the tax at the entity level, James effectively deducts the $22,000 state tax on the business return. That lowers his federal taxable income noticeably. His net benefit after credits ranges from $3,000 to $6,000.

Takeaway

S-Corp owners who earn most of their income from distributions can see attractive savings through PTE.

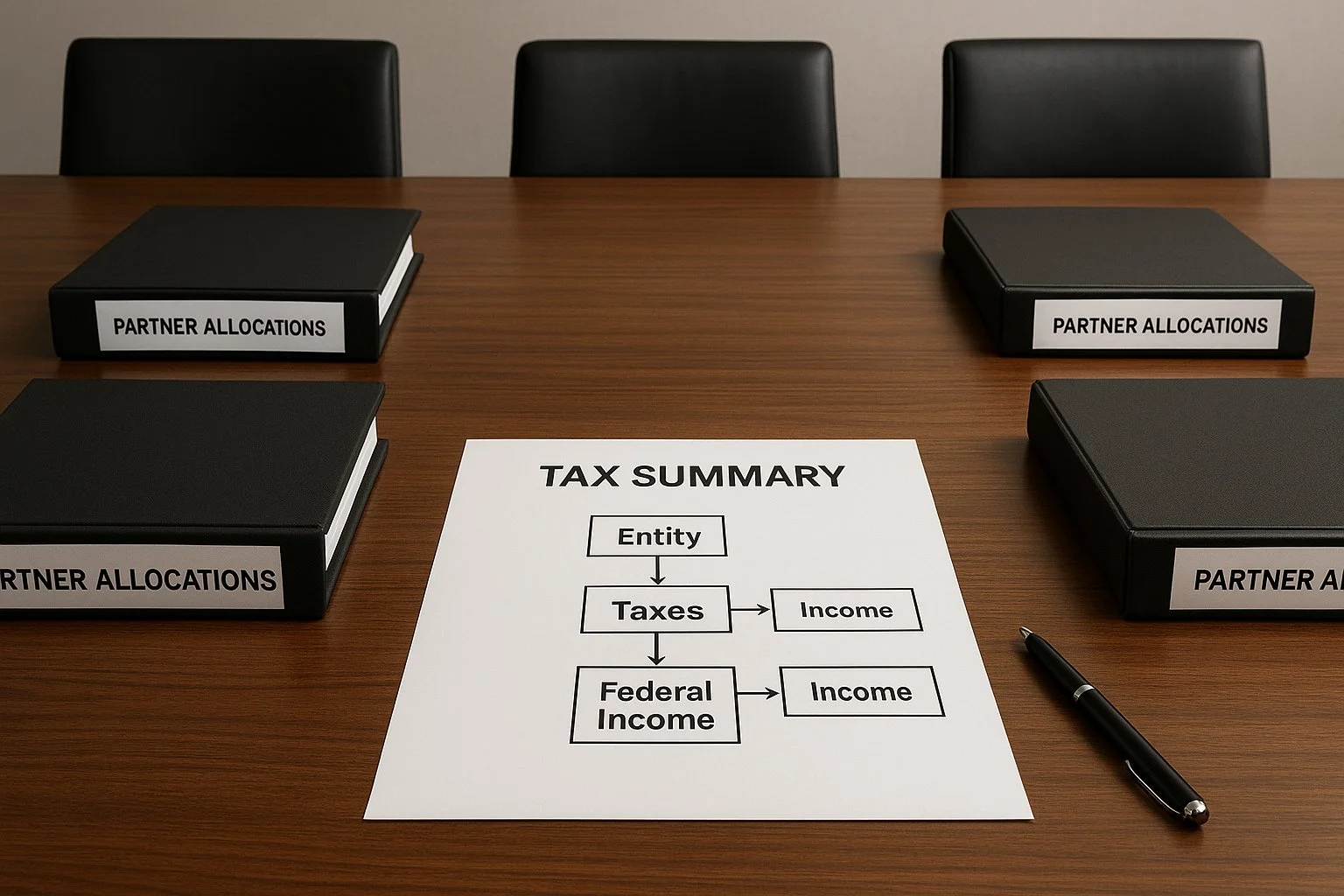

Scenario 3. Partnership With Uneven Profit Splits

Aisha and Ben own a construction firm together. Aisha owns 70 percent and Ben owns 30 percent. Their income changes from year to year because contracts fluctuate. They also deal with uneven profit splits, which complicates tax planning at the partner level.

The PTE election can bring more consistency because the business handles the state tax payment before profits ever hit the partners.

How Their Numbers Look

Total firm profit: $600,000

Ownership splits: Aisha 70 percent, Ben 30 percent

State tax rate: 7 percent

State tax at entity level: $42,000

Under PTE, the business pays the state tax. Each partner gets a credit based on their share:

Aisha: 70 percent of $42,000 = $29,400

Ben: 30 percent of $42,000 = $12,600

Estimated Savings

Both partners benefit because the entity-level deduction lowers their federal taxable income. Depending on their personal brackets, total combined savings may reach $4,000 to $8,000.

Takeaway

Partnerships with uneven allocations often find PTE useful because the entity tax payment replaces a messy partner-level deduction.

Scenario 4. Multi-State Business With Several Tax Jurisdictions

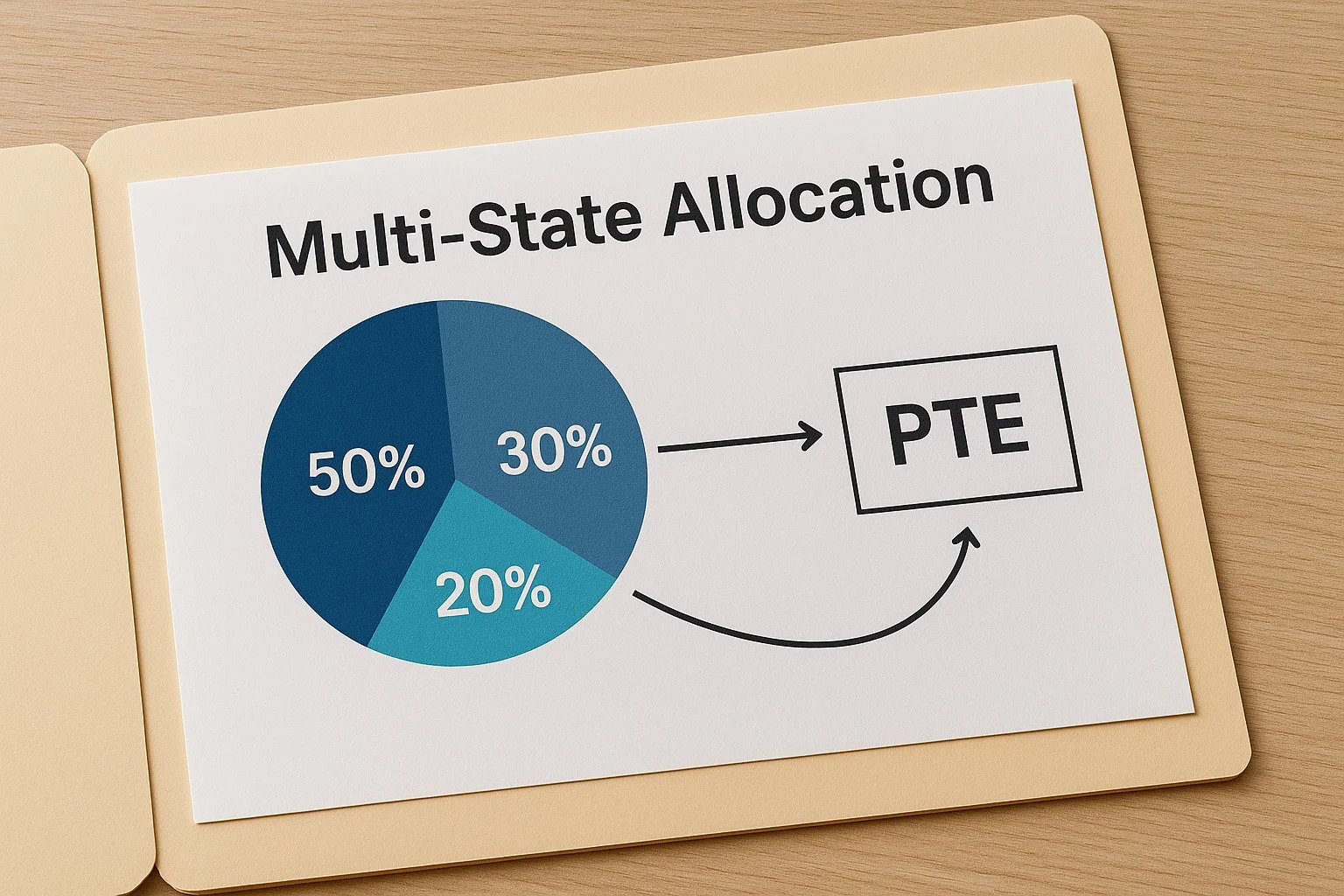

Olivia runs an e-commerce brand that sells nationwide. She has nexus in three states. Each state handles the PTE election differently. State A allows it. State B has an optional credit. State C offers no PTE election at all.

Her accountant explains that even partial adoption can deliver savings.

How Her Numbers Look

Total profit: $750,000

Allocation:

State A: 50 percent of income

State B: 30 percent

State C: 20 percent

State A PTE: Yes

State B PTE: Optional

State C PTE: None

If she elects PTE in State A and State B, the business pays tax at the entity level for those portions. Only State C’s share flows through to her personal return normally.

Estimated Savings

Even with partial participation, Olivia reduces her federal taxable income on roughly 80 percent of her profits. Her combined savings might fall between $6,000 and $12,000 depending on her personal tax bracket and each state’s PTE rules.

Takeaway

Multi-state businesses can still benefit from PTE even when not every state participates.

Scenario 5. High-Income Professional Services Firm

A group of attorneys owns a profitable firm. Their profits are high. Their state tax rate is even higher. The SALT cap hits them especially hard. They constantly lose valuable deductions on their federal returns.

The PTE election lets them push the state tax payment down to the entity level, where it becomes a full deduction.

How Their Numbers Look

Total firm profit: $1.2 million

Number of partners: 5

Profit per partner: $240,000

State tax rate: 9.5 percent

Entity-level state tax: $114,000

Estimated Savings

When the firm pays the $114,000 directly, the entire amount reduces federal taxable income. Depending on each partner’s federal bracket, this can translate into $3,000 to $7,000 of savings per partner.

Takeaway

High-income partnerships or professional firms often see some of the biggest benefits from electing PTE.

Scenario 6. When the PTE Election Does Not Create Savings

Sam runs a small retail shop. He has a thin profit margin and operates in a low-tax state. Friends keep telling him that everyone is adopting the PTE election, so he should too. Before jumping in, he checks the numbers.

How His Numbers Look

Annual profit: $85,000

State tax rate: 3 percent

State tax: $2,550

In a low-tax state, the state payment is already small. Even if he shifts it to the entity level, his federal deduction barely changes. His accountant finds that the administrative cost to elect PTE would outweigh any savings.

Estimated Savings

Almost zero.

Takeaway

Low-income, low-tax situations often see little to no financial benefit from electing PTE.

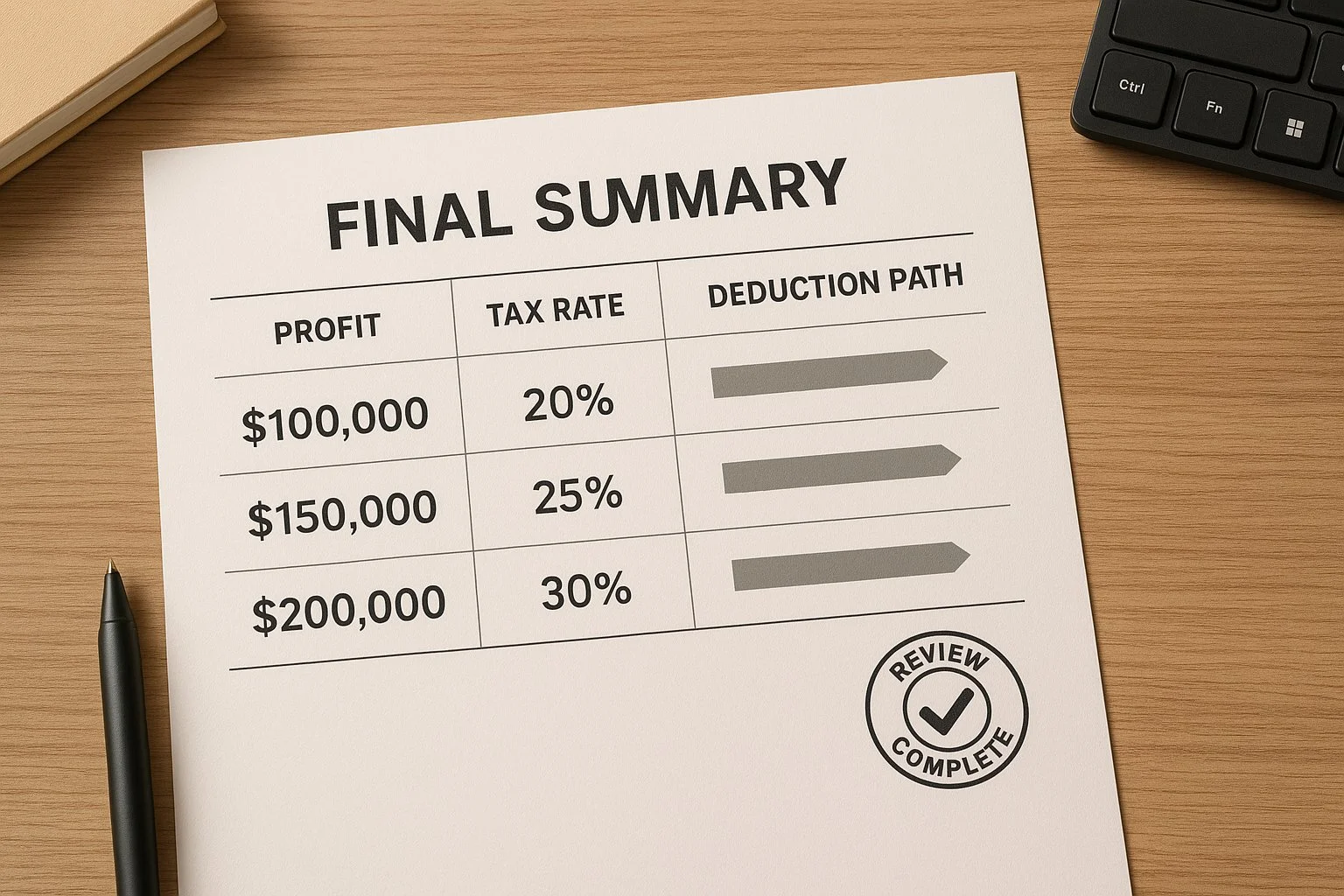

Quick Comparison Table

Below is a simple high-level overview of the scenarios above.

Scenario | Entity Type | Profit | State Rate | PTE Allowed | Estimated Savings |

Single-Member LLC | LLC | $180,000 | 9 percent | Yes | $2,000 to $4,000 |

S-Corp Owner | S-Corp | $220,000 distributions | 10 percent | Yes | $3,000 to $6,000 |

Partnership | Partnership | $600,000 | 7 percent | Yes | $4,000 to $8,000 |

Multi-State | LLC/S-Corp | $750,000 | Mixed | Partial | $6,000 to $12,000 |

Professional Firm | Partnership | $1.2 million | 9.5 percent | Yes | $3,000 to $7,000 each |

Low-Tax Retailer | LLC | $85,000 | 3 percent | Yes | Minimal |

This table makes it clear that profitability and state tax rates play the biggest role in determining whether PTE is worth it.

How to Estimate Your Own PTE Election Savings

If you want a quick way to see whether the PTE election might be worthwhile for your business, here is a simple approach.

1. Identify your business profit

Use your projected net income for the year, not gross revenue.

2. Check your state’s PTE tax rate

Each state uses its own rate. Some follow the individual rate. Others set a special PTE rate.

3. Estimate the state tax the business would pay

Multiply profit by the state rate. This gives you the deduction amount if paid at the entity level.

4. Compare that deduction to your current SALT limit situation

If you already hit the $10,000 SALT cap, PTE could help. If you do not hit the cap, your savings may be limited.

5. Look at your federal tax bracket

The higher your bracket, the more valuable the deduction becomes.

6. Consider the structure of your entity

LLCs taxed as partnerships and S-Corps often benefit most

Sole proprietors cannot use the PTE election

7. Evaluate consistency

The election often works best when income is steady. If your income drops suddenly, you may not gain as much.

Final Thoughts

The PTE election can be a powerful way to reduce your tax burden, but it is not a one-size-fits-all solution. As you saw in the examples above, businesses with higher profits and higher state tax rates tend to see the most value. Situations with lower income or lower state taxes might get little to no benefit.

The best thing you can do is run your numbers through the same simple steps used in each scenario. If the savings look meaningful, talk to a tax professional so you can file the election correctly and take advantage of the available credits.

To understand the mechanics behind the scenarios above, visit the complete breakdown of how the PTE election works.

Frequently Asked Questions

How does the PTE election help business owners save on taxes?

It shifts state income taxes from your personal return to your business return. This lets the business deduct the full amount and helps you avoid the $10,000 SALT cap limit.

Who benefits the most from the PTE election?

Owners in high-tax states, partnerships, S-Corps with large distributions, and firms with steady profits usually see the biggest savings.

Can sole proprietors use the PTE election?

No. Sole proprietorships do not qualify because the election is for pass-through entities only.

Does the PTE election reduce my federal taxes every year?

It can. Your savings depend on your state tax rate, your business profit, and whether you already hit the SALT cap.

Are wages paid to S-Corp owners included in PTE savings?

No. Wages are not eligible. Only pass-through income such as distributions can qualify.

Can multi-state businesses use the PTE election?

Yes. They can elect PTE in states that offer it. Savings depend on income allocation in each state.

What happens if my profit drops after making the PTE election?

Your deduction decreases. In some states, the election cannot be reversed for that tax year.

Does every state offer a PTE election?

No. Many do, but rules vary. Some states offer optional elections, while others do not allow it at all.

How do partners or shareholders receive credits after a PTE election?

The business pays the state tax, then owners receive a credit on their personal return based on their share of income.

Is the PTE election always worth it for small businesses?

Not always. If your state tax rate is low or you do not hit the SALT cap, the savings may be minimal.