Nonresident Owners: Checklist & Best Practices Before Electing PTE

Dec 1, 2025

If you’re a nonresident owner (partner, member, or shareholder) in an LLC, partnership, or S-corporation — and your business is considering a pass-through entity (PTE) tax election — you’re stepping into a loop of benefits, obligations, and potential pitfalls. On one hand, a PTE election can cut your federal tax bill and smooth out state filings. On the other, state-by-state rules, consent requirements, withholding obligations, and credit caveats can complicate everything.

In this guide, you’ll learn exactly what to check before you elect, what to model, how to communicate with other owners, and how to avoid the common mistakes many nonresident owners make. When you finish reading, you’ll have a ready-to-apply checklist and concrete best-practice steps to keep things clean, compliant, and tax-efficient.

The Complete Checklist Before Electing PTE (Nonresident Owner Focus)

Here’s a step-by-step checklist you (and your entity) should run through before making a PTE election. Each item addresses a common trap or necessary condition.

1. Verify State Eligibility for the Election

Confirm your business entity is eligible: typically a partnership, LLC (taxed as partnership or S-Corp), or S-corporation.

Check whether all states where the entity does business allow PTE elections. Some states don’t offer the election at all, or have restrictions that exclude certain owners.

Make sure your home state for the nonresident owner is part of a state system that will accept entity-level payment, or at least provide a credit for taxes paid to another state.

2. Review Operating Agreement and Governing Documents

Ensure the operating agreement or partnership agreement permits a PTE election. It should allow making the election, collecting owner consent, allocating tax burden, and adjusting distributions accordingly.

If the agreement doesn’t cover it, you may need an amendment or written consent from all owners.

3. Confirm Owner Consent Requirements

Some states require unanimous consent, others majority, to make the election. For example, in the case of certain states, all consenting owners must agree or the election could exclude non-consenting members.

Document that consent properly (written consent, meeting minutes, or signed election form).

4. Model the Tax Impact for EVERY Owner (Resident and Nonresident)

Run a full projection: federal, state, and overall cash flow impact. Consider:

How much tax the entity will pay on your share

Whether your home state will grant a full, partial, or no credit for that tax

Impact on your federal taxable income and possible SALT deduction benefit

Compare this to the alternative: personal state income tax (withholding or direct payment) combined with federal SALT cap limitations.

5. Evaluate Home-State Residency Credit Rules

Some states allow a “credit for taxes paid to other states”, but the availability and generosity of that credit vary widely. If your home state disallows or limits such credit — or doesn’t recognize entity-level tax — the benefit of a PTE election may shrink or vanish.

This step is often skipped in generic guides but is critical for nonresident owners.

6. Understand State Withholding and Composite Return Rules

Even after a PTE election, some states may still require withholding on distributions or require filing of nonresident returns or composite returns.

Confirm that the PTE election doesn’t inadvertently trigger dual obligations (entity-level tax + withholding + personal return).

7. Check Estimated Payment Deadlines and Payment Mechanics

Most states demand estimated payments by specific dates once the election is made. Missing the payment deadline can void the election or create penalties.

Confirm payment methods, vouchers, or online filing procedures with the relevant state department of revenue.

8. Confirm Nexus and Multistate Income Sourcing

If the entity earns income in multiple states, check definitions of “nexus,” income sourcing rules, and allocation/apportionment methods.

This affects how much of the income is subject to PTE in each state — and how the tax burden and credits pass to each owner.

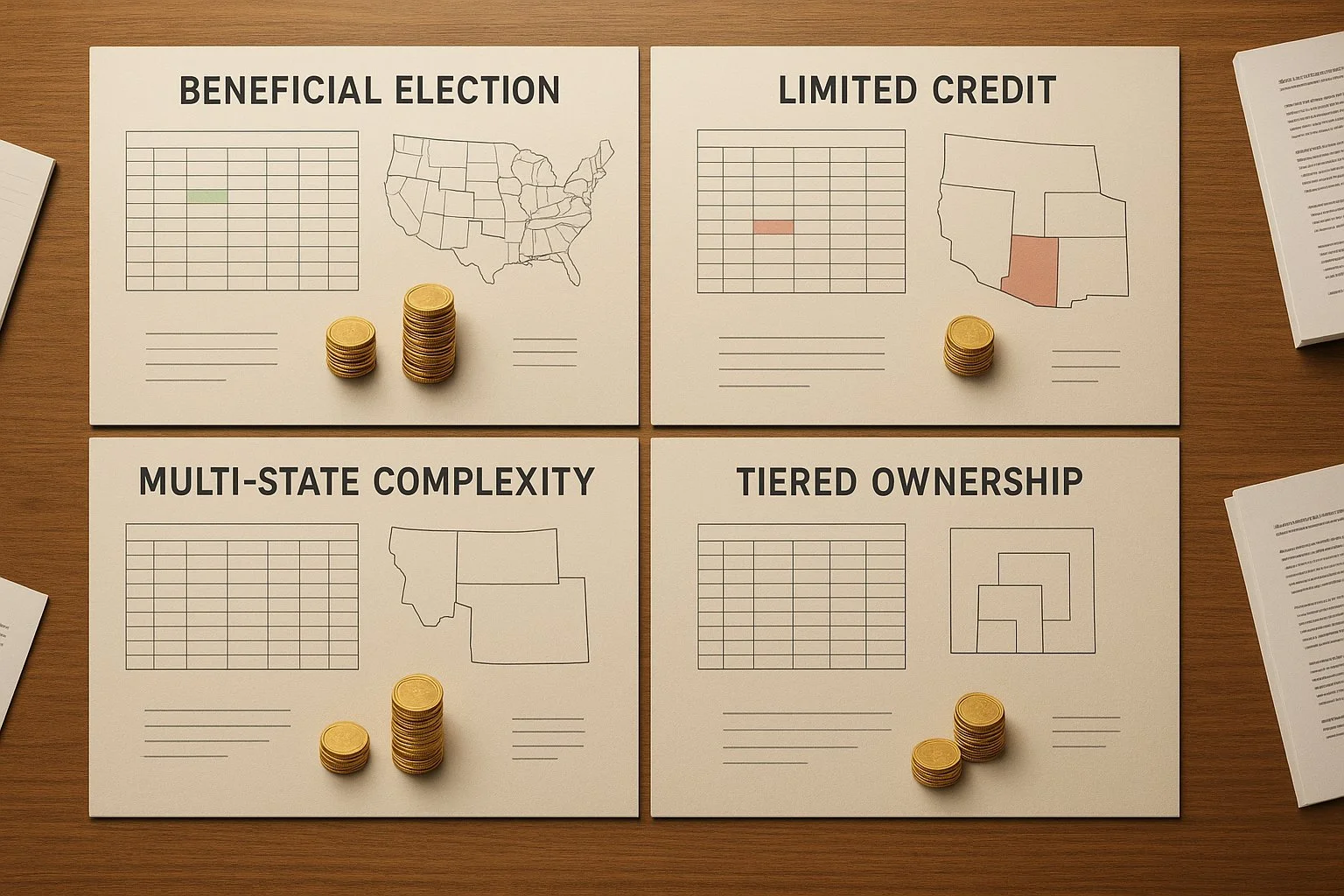

9. Evaluate Tiered Ownership Structures

If an owner is itself an entity (e.g., trust, another partnership, or corporate entity), many states restrict or exclude such owners from PTE credits.

In tiered structures, income flowing through lower-tier entities can lead to complexity in tracking, credit pass-through, and compliance obligations.

10. Plan Owner Reporting and Documentation

The entity must prepare modified K-1s (or equivalent) including each owner’s share of PTE tax paid, state credits, or income allocations.

For nonresident owners, also provide necessary statements (credit vouchers, withholding certificates, nexus disclosures) so they can accurately file their personal returns.

11. Align Cash Distribution Policies With Tax Payments

Because the entity pays the tax up front, it impacts available cash flow. Make sure the entity’s distribution policy is adjusted so that nonresident owners receive enough cash to cover their share of the PTE tax.

Clarify whether tax payments reduce distributable profits or come as additional owner contributions

Best Practices for Nonresident Owners Before Electing PTE

Going through the checklist is important. But there are a few “meta-rules” and habits that will make things much smoother long-term.

Communicate early and clearly with all owners: Before any election, send a summary of potential impacts to every owner. Show mock numbers, possible cash needs, and filing consequences. Transparency avoids surprises.

Work with advisors familiar with multi-state rules and nonresident issues: PTE laws vary widely by state, and a misstep can cost more than the benefit. A good CPA or tax lawyer can help model multiple scenarios (resident vs nonresident, single state vs multi-state, tiered ownership, withholding vs credit, etc.).

When possible, apply for withholding waivers: If your entity distributes to nonresidents, getting a waiver or reduction of nonresident withholding (when allowed) may prevent double taxation or excessive withholding.

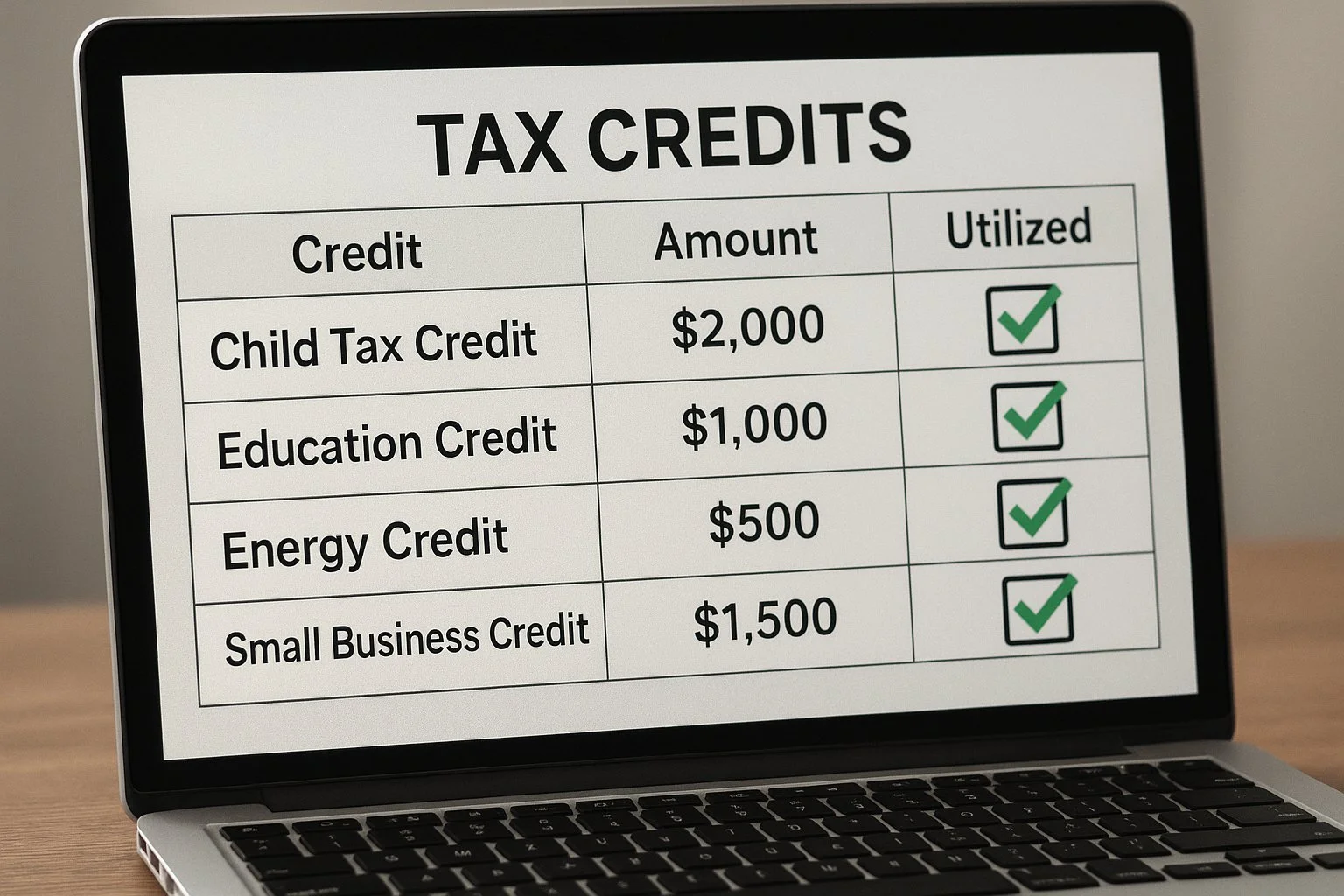

Track credit eligibility and utilization: For nonresident owners, credits for state taxes paid by the entity may sit unused if their home state doesn’t allow them or limits them. Having a tracking system helps you avoid stranded credits.

Stay on top of state-law changes: PTE laws are still evolving in many states. What works this year may change next year. Review state revenue department announcements annually (or engage your advisor to do so).

Common Mistakes Nonresident Owners Make (And How to Avoid Them)

Because many guides assume “resident owner” or “single-state,” nonresident-specific pitfalls often get overlooked. Here are some of the most common — and how to avoid them:

Assuming PTE election removes all personal filing obligations: Many states still require nonresident owners to file returns — or mandate withholding/composite returns. Always verify.

Overlooking governing document restrictions: If your operating or partnership agreement doesn’t allow entity-level tax elections, you could be stuck in limbo or noncompliant.

Ignoring nonrefundable or limited credits: Some states offer nonrefundable credits or carryforward-only credits rather than refundable credits. That may reduce the immediate benefit, or render the credit mostly useless for nonresident owners in low-tax home states.

Failing to plan for cash flow: Entity-level tax often must be paid up front. If the business doesn’t have distributions or cash, nonresident owners may get hit with unexpected tax obligations and no cash.

Missing deadlines or estimated payment requirements: A late payment or missed voucher could invalidate the election, derail the intended benefit, and lead to penalties.

Underestimating complexity with tiered ownership: When partners are entities, or ownership structures are nested, the rules become more intricate — and mistakes (especially around credit pass-through) are common.

Quick-Reference Table: What Nonresident Owners Must Verify Before Election

✅ What to Verify / Confirm | Why It Matters / Risk if Missed |

State allows PTE election for entity type and nonresident owners | Otherwise, election invalid or benefit lost |

Governing agreement permits PTE election and distributions aligned with tax payments | Avoid internal disputes and noncompliance |

All owners consent (or required majority) | Election may be void or excluded if consent missing |

Tax impact modeled for resident & nonresident owners | Prevents unpleasant surprises, stranded credits, or excess tax burden |

Home-state credit/withholding rules checked | Ensures state-level credit works, or flags double-tax risk |

Withholding/composite return obligations reviewed | Avoids unexpected requirements or penalties |

Estimated-payment schedule & payment mechanics verified | Protects the election and avoids late-payment penalties |

Nexus and multistate income sourcing rules confirmed | Ensures correct allocation and tax burden across states |

Tiered ownership structure evaluated for eligibility | Prevents exclusion or incorrect credits for nested owners |

Reporting and documentation procedures in place (K-1s, credit vouchers, notices) | Ensures owners have what they need for personal returns |

Cash distribution policy reviewed and aligned with tax payments | Avoids cash-flow shortfalls for owners covering tax burden |

Example Scenarios (When PTE Election Helps — or Doesn’t)

Let’s walk through a few real-world examples. These will help you and other owners visualize whether a PTE election is likely to benefit you — or backfire.

Scenario A: High-income nonresident owner in credit-friendly home state

Business is an LLC taxed as partnership, 60% of income is from State X (which allows PTET).

The owner lives in State Y, which gives full credit for taxes paid to other states.

After modeling: entity-level tax payment lowers federal taxable income; owner gets full credit on their State Y return; cash distribution policy covers the entity tax.

Result: PTE election likely beneficial — lower federal tax, state credit preserves value, no extra withholding or filing needed.

Scenario B: Nonresident owner whose home state does not grant full credit — or strongly limits it

Business is based in State A (makes PTET election) but owner lives in State B, which caps credit or disallows entity-level taxes.

Modeled outcome: owner’s state tax liability remains high; they may lose federal benefit after state-level adjustments; credit may not offset tax liability fully.

Result: PTE election might not pay off — may even increase total tax burden or cash obligations.

Scenario C: Multi-state LLC with aggressive nexus and several nonresident owners, some in states with poor credit treatment

The business operates in several states, some with PTET, some without.

Owners scattered across multiple home states, some credit-friendly, some not.

Complicated distribution and withholding requirements.

Result: Very high compliance burden. Unless modeled carefully and distributions managed well, benefit may be minimal — or worse, cumbersome.

Scenario D: Tiered ownership structure (owner is a trust or another pass-through entity)

The top-level ownership is an entity rather than an individual — e.g. a trust, estate, or upper-tier partnership.

Some states exclude such owners from PTET credit eligibility.

Result: That owner (or those at bottom of the chain) may get no benefit or incomplete credits. Consider electing only after restructuring or avoid PTET entirely.

Final Thoughts: When a PTE Election Makes Sense — And When It Doesn’t

A PTE election can be a powerful tax-planning tool — but it’s not a one-size-fits-all solution. For nonresident owners, the benefits vary wildly depending on your home state, the entity’s structure, nexus, distribution policy, and compliance readiness.

As a rule of thumb, a PTE election tends to make sense for nonresident owners when:

Their home state offers full or generous credit for taxes paid to other states,

The entity has predictable, stable net income,

Cash distributions are sufficient to cover tax payments,

Ownership is direct (not tiered), and

All owners consent and are on the same page.

On the flip side, if credit limitations, withholding rules, multi-state complexity, or tiered structures are in play — the election may introduce more headache than benefit.

If you’re unsure, run a full model comparing “with PTE election” vs “without,” factoring in state credits, withholding, filing obligations, and cash flow. And if possible, work with a CPA or tax advisor who has multi-state and nonresident experience.

By running this checklist, modeling carefully, and using the best practices above — you give yourself the best shot at making a smart, compliant, beneficial PTE decision.

If you want to understand how this checklist fits into the larger PTE election process, our main guide about PTE Election which walks through all the core rules, owner requirements, and multi-state considerations.

Frequently Asked Questions

Do nonresident owners still need to file personal state returns after the PTE election?

Yes, in many cases. Some states still require nonresident returns or composite returns, even if the entity paid the tax at its level. Always verify state-specific rules.

Does a PTE election replace nonresident withholding requirements on distributions?

Not necessarily. In states with nonresident withholding rules, election may not eliminate withholding requirements. You may still owe withholding or opt for composite filing.

Can a single nonresident owner opt out while the rest consent?

It depends on the state and the governing agreement. Some states allow excluding non-consenting owners; others require unanimous consent. Always check state statutes and operating agreements.

Will the PTE election always save me money?

No. The benefit depends heavily on your home state’s treatment of credits, nexus, withholding rules, and cash distributions. A proper projection for all scenarios is essential.

What documents will I get as a nonresident owner if the entity elects PTE?

Typically, a modified K-1 (or equivalent), state-specific credit statements or vouchers, withholding certificates (if any), and a summary of what was paid at the entity level. Use these for your personal return.

Does a PTE election change how much cash the business needs to set aside for taxes?

Yes. Since the entity pays the tax instead of individual owners, the business needs more cash on hand. Many owners update their distribution policy so everyone has enough cash to cover their share of the PTE tax.

Can nonresident owners opt out of the PTE election for their portion of income?

In some states, yes, but not all. A few states let non-consenting owners get excluded from the election, while others treat the election as binding for everyone once it’s made.

Is a PTE election reversible if the owners decide it wasn’t beneficial?

Usually not for the year in which it was elected. Most states treat it as an annual election that becomes irrevocable once the deadline passes. You can choose to skip the election in future years.

How does a PTE election affect multi-state apportionment for nonresident owners?

It depends on where the income is earned. Each state uses its own formula to decide what portion of the entity’s income is taxable there. Nonresident owners may receive multiple state credit statements based on how income is apportioned.

Do nonresident owners still receive K-1s after a PTE election?

Yes. Owners still receive a K-1, but it will include additional information such as their share of PTE tax, state-level credits, and reporting instructions they’ll need for personal filings.