PTE Election and Nonresident Owners: What You Need To Know

Nov 24, 2025

Some tax rules feel like they were written to test your patience. The Pass-Through Entity (PTE) tax is one of them. At first glance, it looks simple. Your business elects to pay tax at the entity level instead of passing everything down to individual owners. In practice, things get spicy when nonresident owners are in the mix.

If you run a partnership or S corporation and you have owners who don’t live in the state where your business operates, you’ve probably wondered whether they are eligible for the PTE election, whether they must consent, and how credits flow back to them. The rules vary by state and the fine print is easy to miss.

In this guide, you will learn how the PTE election works for nonresident owners, what states typically require, how credits work, what problems to avoid, and how to decide whether your company should include nonresident owners in the election.

What Is a Nonresident Owner and Why It Matters for PTE Elections?

A nonresident owner is someone who owns part of a partnership or S corporation but does not live in the state where the business is taxed. This matters because state tax rules focus heavily on residency. States usually want to tax residents on all their income and nonresidents only on income sourced inside the state.

For PTE elections, the big question is simple.

Can the business include nonresident owners in the election, and if so, what does the state require from them?

Nonresident owners also face different credit rules. Some get full credit. Some get partial credit. A few get no credit at all. The variation is one reason businesses need to look closely at state-specific rules before making the election.

If you want to learn more about the PTE election, how it works, and who qualifies, take a look at our main guide to the PTE tax election.

How the PTE Election Works When a Company Has Nonresident Owners

When a business makes a PTE election, it pays tax at the entity level on income sourced to that state. Nonresident owners are usually included automatically unless the state requires them to opt out. The state then gives the nonresident a PTE credit on their personal return so they avoid double taxation.

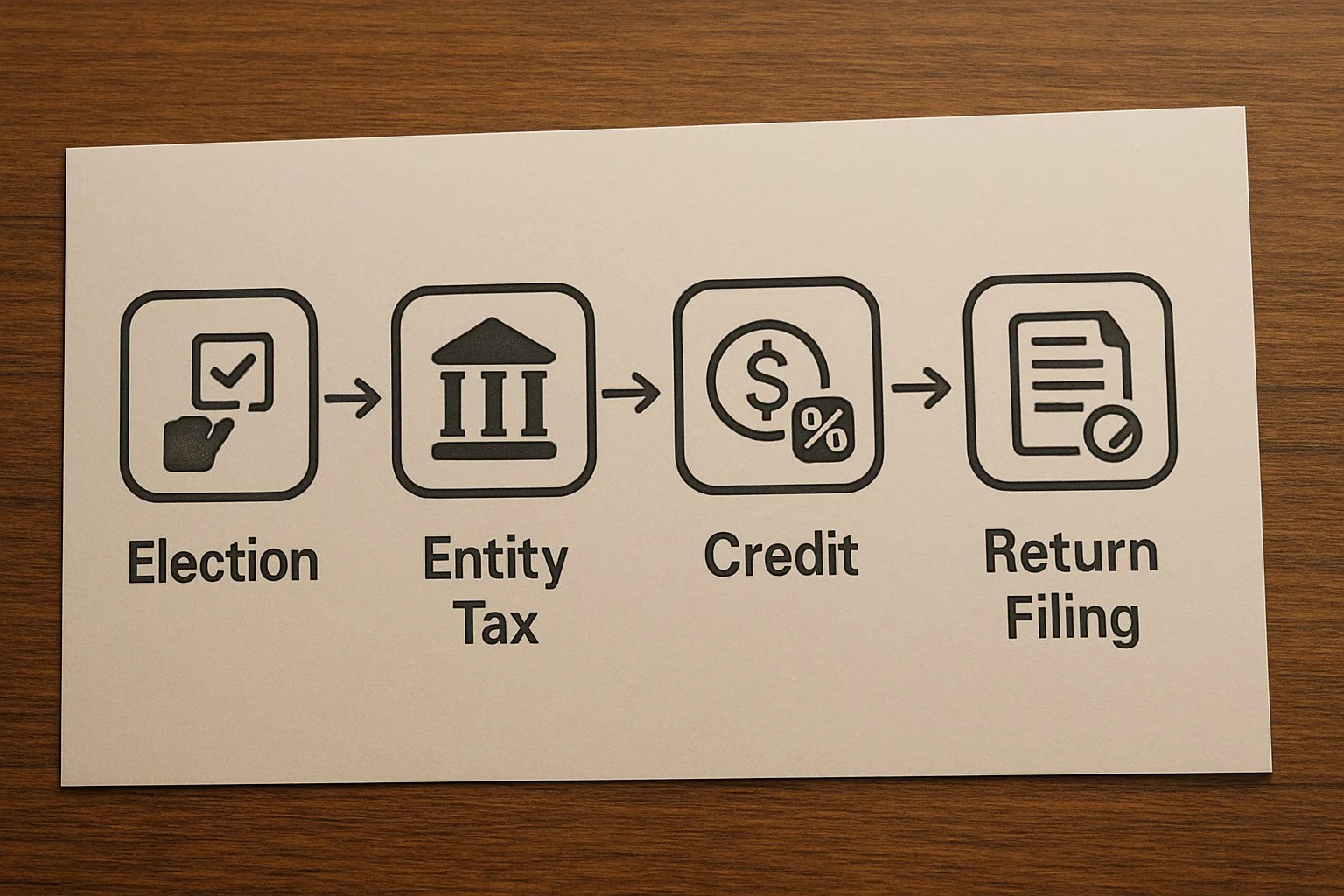

Here is the typical process in plain terms:

The entity makes the election

Most states let partnerships and S corporations elect to pay tax at the entity level. Some require annual elections. Others require the election to be binding for multiple years.Nonresident owners are included unless the state has a special rule

Some states require unanimous consent. Others let businesses elect without owner approval. A few states exclude nonresidents unless they sign a consent form.The entity pays tax on all income sourced inside that state

Income is taxed based on state rules, allocation formulas, and sourcing.Nonresident owners receive a pass-through credit

This credit is meant to offset the owner’s tax liability on that state’s return so they do not pay twice.Owners file nonresident returns or composite returns

Some states waive the filing requirement if the entity elects PTE tax. Others still require nonresident returns.

This structure helps reduce federal tax for many business owners, but the rules for nonresidents can be very different from the rules for residents.

State Rules Overview: How States Treat Nonresident Owners in PTE Elections

Every state designs its own PTE rules. Some states make the process smooth. Others create hurdles. Below is a practical overview of what businesses face when nonresident owners are involved.

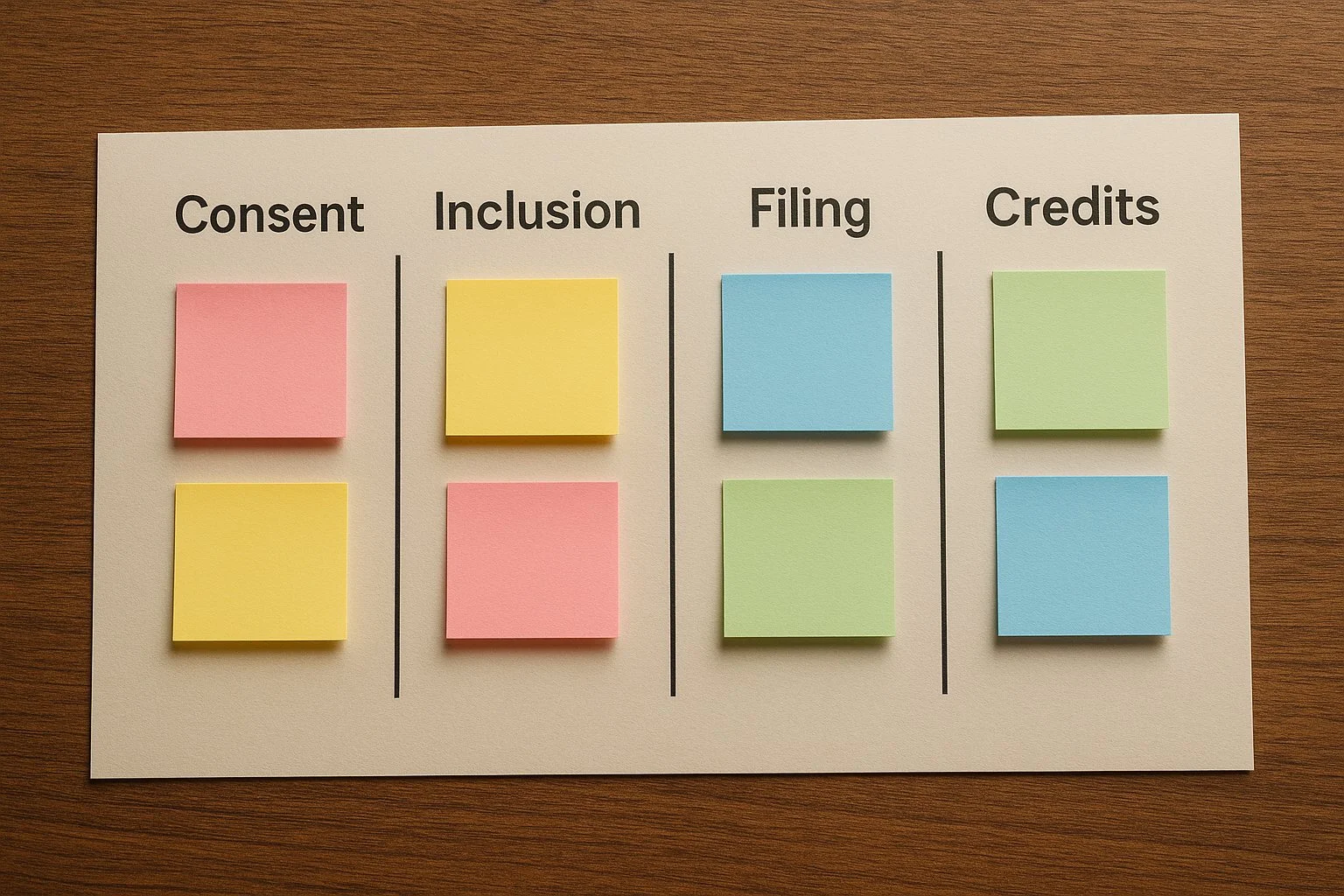

1. Consent Requirements

Some states require all owners to approve the election.

Some require consent only from nonresident owners.

Others do not require owner consent at all.

States with strict consent rules often want to make sure nonresidents understand how their credit works and whether they must still file a state return.

2. Mandatory Inclusion vs Optional Inclusion

Many states automatically include all owners, resident and nonresident, in the election.

Some states allow owners to opt out.

A few states allow entities to elect PTE only for resident owners.

When nonresidents can opt out, businesses must decide whether including them improves or reduces the overall tax benefit.

3. Filing Rules

States fall into three basic groups.

No nonresident filing required

The entity pays the tax and the state treats the nonresident as covered.Nonresident filing required

The owner must still file a nonresident return to claim credits or reconcile income.Composite return option

Some states combine nonresident owners into one return, which simplifies reporting.

4. PTE Credits Vary

Some states give dollar-for-dollar credits.

Others limit credit to the owner’s share of the entity tax.

A few do not allow credit at all for nonresidents.

Understanding this piece is essential because it affects whether the election actually saves tax for each owner.

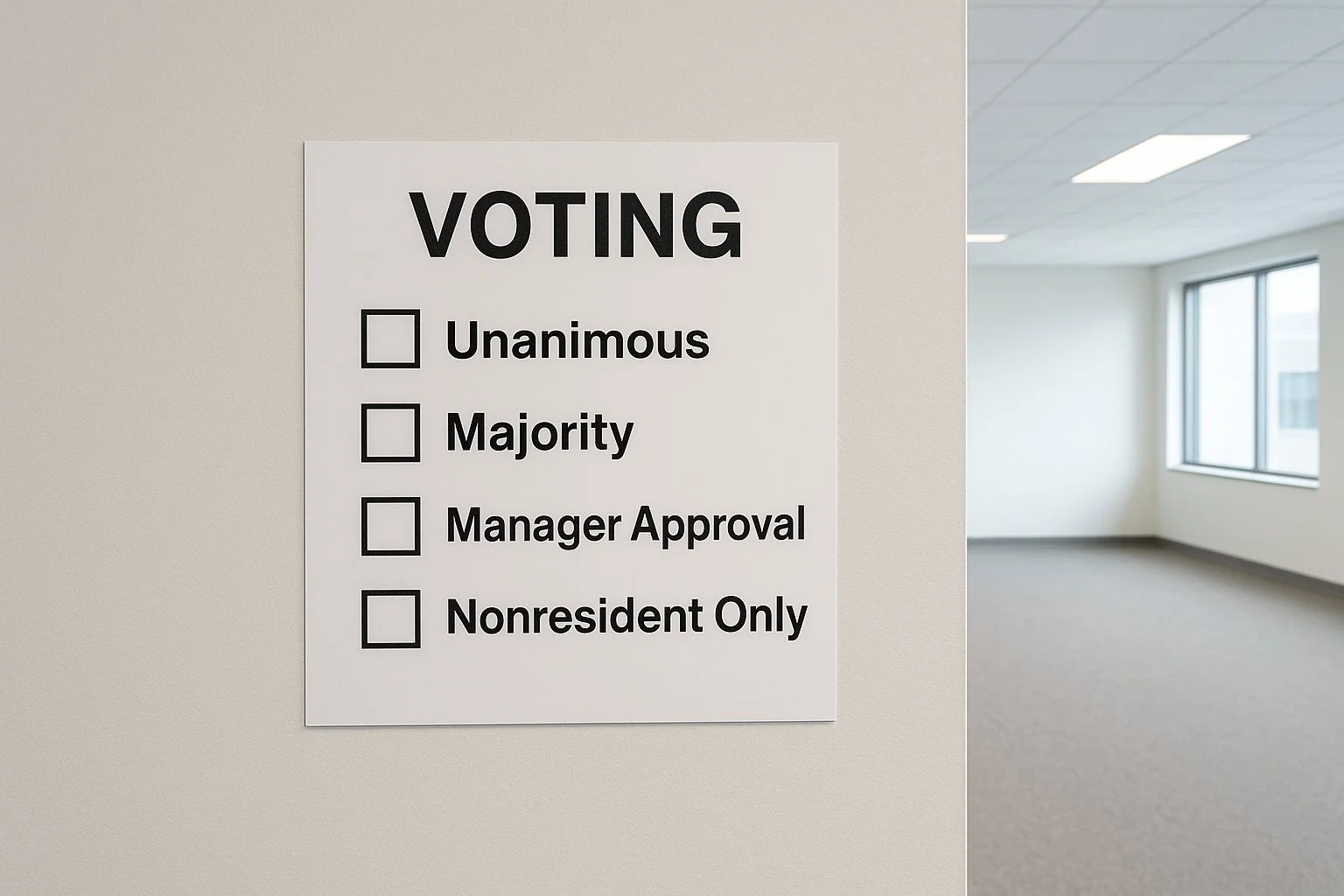

Consent Requirements for Nonresident Owners

Consent rules are one of the biggest sticking points. Below is a breakdown of the main models you will see.

1. Unanimous Consent Required

Some states say every owner must approve the election. If even one nonresident owner says no, the entity cannot elect at all.

2. Majority Vote or Manager Approval

Other states allow:

a majority owner vote

board or manager approval

specific officer approval

In these cases, nonresident owners do not have veto power.

3. Nonresident Consent Only

A few states require consent only from nonresident owners because they are more likely to be affected by filing requirements.

4. No Consent Required

Several states let the entity elect without any owner consent. This is the easiest structure for businesses with many small owners.

If you want a full checklist of what nonresident owners need before electing PTE, check out our guide about Nonresident Owners: Checklist & Best Practices Before Electing PTE.

How PTE Tax Credits Work for Nonresident Owners

Credits are the biggest reason tax planning gets tricky for nonresident owners. The PTE election is helpful only if the credit they receive offsets the tax the entity paid.

Here are the main credit types.

1. Dollar-for-Dollar Credit

This is the cleanest version. The owner gets a credit equal to their share of the PTE tax. They use this credit on their nonresident return for that state.

2. Limited Credit

Some states cap the credit.

Example: the credit cannot exceed the owner’s calculated tax for the year. If the owner’s share of PTE tax is higher than their personal liability, the excess may be lost.

3. No Credit

A few states do not offer a personal credit for nonresident owners.

In these states, the election may cause double taxation unless the state waives the filing requirement.

4. Refundable vs Nonrefundable

Refundable credits return any excess back to the taxpayer.

Nonrefundable credits do not.

Refundable credits tend to produce the cleanest outcomes for nonresident owners.

Not all states provide a credit for entity-level PTE taxes. See our full guide on [PTE election double taxation] for state-specific examples and scenarios.

Filing Requirements for Nonresident Owners

Filing rules determine how much administrative work the entity and its owners must take on after making the election.

1. Nonresident Return Required

Many states still require nonresident returns even if the entity pays tax at the entity level. These returns document income and claim the PTE credit.

2. No Return Required

Some states waive the nonresident filing requirement if the entity elects PTE. This makes life easier for owners.

3. Composite Return Option

A composite return groups nonresident owners into a single filing.

This can simplify compliance for states that require a return even with a PTE election.

Businesses with many nonresident owners often choose composite filing to reduce paperwork.

Pros and Cons for Nonresident Owners

Here is the tradeoff in simple terms.

Pros

They may receive a credit that lowers or eliminates state tax owed.

Some states waive the nonresident filing requirement.

Their share of entity-level tax may reduce their federal taxable income.

In some states, the credit is refundable, which can create cash flow benefits.

Cons

Some states do not give full credits, which can increase their tax bill.

They may still have to file a nonresident return.

Income sourcing rules may create inconsistencies across states.

Some states require consent, which complicates the election.

A few states do not offer any PTE credit for nonresidents.

The net benefit depends on the state and how much income is sourced there.

Examples: How Different States Handle PTE Elections for Nonresidents

This section shows how rules can vary. These examples are simplified to show the differences.

State Example 1: Automatic Inclusion and Refundable Credits

All owners are included.

Nonresident owners get a refundable credit.

No nonresident return required.

This is the most favorable setup for nonresident owners.

State Example 2: Consent Required and Nonrefundable Credits

All owners must agree.

Nonresident owners get a credit, but it is capped at their liability.

Filing still required.

This creates extra work and may reduce the value of the credit.

State Example 3: Excludes Nonresidents Unless They Opt In

Nonresidents must sign a consent form.

Credits depend on income sourcing.

Some deductions may not apply.

This structure requires communication and planning between owners.

State Example 4: No Credit for Nonresidents

Entity-level tax applies.

No credit flows to nonresident owners.

Double taxation risk is high.

In this setup, nonresident owners often opt out if allowed.

When the PTE Election Makes Sense for Nonresident Owners

This decision is not the same as deciding for resident owners. Here are the situations where the election usually makes sense for nonresidents.

1. The State Offers a Strong Credit

When the credit is dollar-for-dollar or refundable, nonresidents are more likely to benefit.

2. The State Waives Filing Requirements

This saves nonresidents time and money.

3. Most Income Is Sourced in One State

This reduces complexity across multiple tax jurisdictions.

4. The Owner’s Home State Allows Resident Credits

Some states give residents a credit for taxes paid to another state. If so, the PTE election can be even more valuable.

5. Federal Benefits Outweigh the State-Level Complications

If the entity-level deduction creates significant federal tax savings, the election may still be worthwhile even if the state credit is imperfect.

When the Election Might Not Make Sense

Some situations make the PTE election less appealing for nonresident owners.

1. The State Offers Limited Credits

If credits are capped or nonrefundable, nonresidents may lose benefits.

2. The State Requires Nonresident Consent

This can block the election if owners disagree.

3. The Owner’s Home State Does Not Allow a Resident Credit

This can create double taxation at the state level.

4. The Business Has Many Nonresident Owners in Multiple States

The administrative work can outweigh the federal benefit.

5. The State Excludes Nonresidents by Default

If nonresident owners must opt in, and they decline, the entity may not meet the requirements for the election.

Practical Scenarios Where the Decision Changes

Let’s look at a few real-life style examples to show how the factors play out.

Scenario 1: Single-State Operation With Favorable Credits

A business in a state with full, refundable credits elects PTE. Nonresident owners benefit without extra work. This is the simplest scenario.

Scenario 2: Multi-State Business With Split Income

Income allocation creates different credit outcomes for each nonresident owner. The entity must compare results before electing.

Scenario 3: Home State Does Not Allow Resident Credit

Even if the PTE election creates federal savings, nonresident owners may prefer to opt out or block the election if consent is required.

Conclusion

PTE elections work well for many businesses, but nonresident owners add a layer of complexity that should not be ignored. States treat nonresidents differently, credits vary widely, and filing rules can change the value of the election for each owner.

When handled correctly, the PTE election can reduce federal taxable income and make state compliance easier. When handled poorly, it can create double taxation or unnecessary filing work. The key is understanding the rules in each state and determining how they apply to every owner.

This guide gives you a clear picture of what to expect so your business can make a smart, informed decision about whether a PTE election makes sense when nonresident owners are involved.

Choosing the right tax path for your owners can be complex. For a detailed comparison of PTE elections, composite returns, and traditional withholding, see our guide about PTE Election vs Composite Return vs Traditional Withholding.

Frequently Answer Questions

Do nonresident owners qualify for the PTE tax election?

Yes. Most states include nonresident owners in the PTE election, but some require the owner to sign a consent form or opt in. A few states restrict or exclude nonresident owners based on their filing status.

Do nonresident owners need to file a state tax return if the entity elects PTE?

It depends on the state. Some states waive the nonresident return requirement. Others still require a nonresident return so the owner can claim the PTE credit.

How do PTE credits work for nonresident owners?

Nonresident owners typically receive a credit based on their share of the entity-level tax paid. Some states offer a full credit, while others limit or cap the credit.

Can a PTE election create double taxation for nonresident owners?

Yes, in certain states. Double taxation can happen when a state gives no credit or only a partial credit to nonresident owners. This is why state-by-state review is important.

Do all owners need to approve a PTE election?

Not always. Some states require unanimous consent. Others allow approval by a majority vote or by the entity’s manager or officer.

Can nonresident owners opt out of the PTE election?

Some states allow opt-out elections for nonresident owners. When allowed, opting out means the owner pays tax through the normal nonresident withholding or composite return rules.

Does the PTE election reduce federal taxable income for nonresident owners?

Yes. When the entity pays state tax at the entity level, it becomes a federal deduction. This reduces the amount of income reported on the owner’s federal return.

How does a nonresident owner claim a PTE credit?

The owner usually claims the credit on their nonresident state return. If the state allows composite filing or waives returns for PTE electors, the entity may apply the credit on the owner’s behalf.

Are PTE credits refundable for nonresident owners?

Some states offer refundable credits. Many do not. Refundable credits give the cleanest outcome because the owner receives money back if the credit exceeds their liability.

Should a business with nonresident owners elect PTE?

It depends on the state rules, the type of credit offered, owner residency, and how income is sourced. The election usually works best when the state offers strong credits and simple filing rules.