When a PTE Election Creates Double Taxation for Nonresident Owners

Dec 3, 2025

If you run a business with owners scattered across different states, you’ve probably heard someone say, “Let’s just elect the PTE tax. It saves money.” And sure, in many cases it does. But when nonresident owners are involved, things get tricky fast. What seems like a simple state tax election can quietly create double taxation that no one sees coming until the returns are filed and the damage is done.

Many owners don’t realize that their home state might not give them credit for taxes paid to another state at the entity level. Others discover too late that withholding rules, composite filings, or sourcing differences create gaps the PTE election can’t fix. The end result is the worst possible outcome. You pay twice on the same income.

This guide walks you through why double taxation happens, what states are the most problematic, the warning signs to look for, and what to do before your business makes the election. By the end, you will know exactly when a PTE election helps and when it hurts, so you can plan ahead and avoid expensive surprises.

How Double Taxation Happens for Nonresident Owners

Double taxation is not random. It happens for very specific reasons. Understanding these mechanics helps you spot problems early.

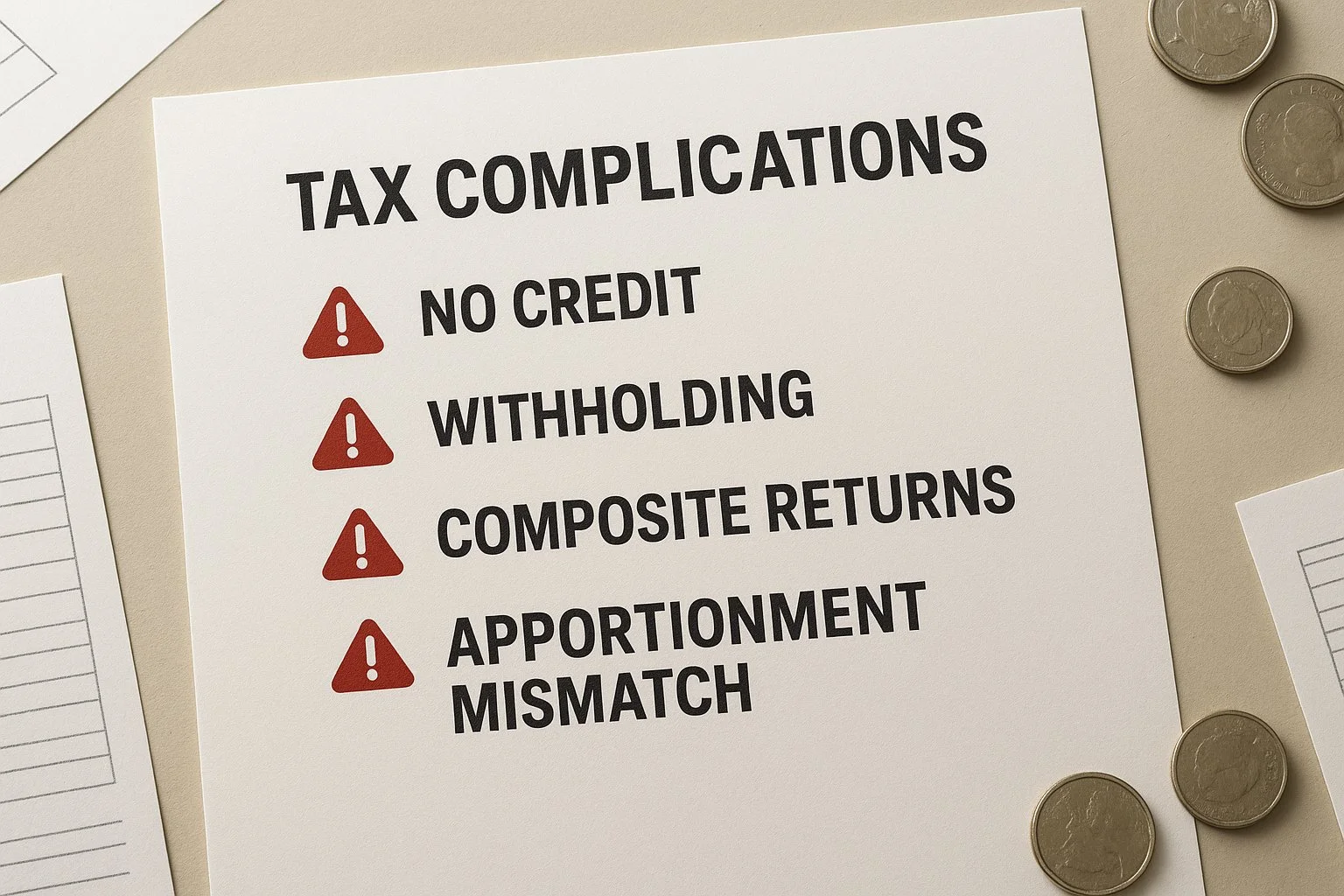

1. No Resident-State Credit for PTE Taxes

This is the biggest reason double taxation occurs.

Many states allow residents a credit for taxes paid to other states. The problem is that some states only allow credits for taxes paid by the individual, not by the entity. Since PTE taxes are paid by the business, the resident owner cannot claim a credit. They pay the entity-level tax in the source state and then pay full tax again in their resident state.

Some states fall into categories such as:

No credit for entity-level taxes

Limited credits that exclude elective PTE taxes

Credit only if the other state’s tax is mandatory

This means the owner gets no offset at home. The same income is taxed twice.

2. Elective vs Mandatory PTE Taxes

Some states offer an elective program, while others have a mandatory PTE tax. Certain resident states only recognize taxes paid to mandatory PTE regimes. If the source state’s PTE tax is elective, the owner may not receive credit. On paper the election looks beneficial. In practice the owner pays twice.

3. Sourcing and Apportionment Mismatches

This happens when states disagree about where the income should be taxed.

For example:

One state uses market-based sourcing

The other uses cost-of-performance

One state includes certain deductions or adjustments the other does not

A portion of income ends up being taxable in both states with no matching credit.

This is common for service businesses, consulting firms, agencies, and remote teams.

4. Nonresident Withholding Still Applies

Many people assume a PTE election removes withholding requirements. In several states it does not. That means the entity pays the PTE tax and still must withhold nonresident tax or file a composite return on behalf of the owner.

The owner ends up paying:

PTE tax at the entity level

Withholding or composite tax at the individual level

Later, the owner may claim a refund or partial credit, but the home state may not recognize any of these payments. This creates a double hit, plus more filing work.

5. Composite Return Rules That Block Credits

Some composite filings prevent the owner from claiming a credit in their resident state. If the owner is included in a composite filing in the source state, their home state may deny the credit because the tax was not paid individually.

When paired with a PTE election, this creates overlapping taxes with no relief.

6. Entity-Type Mismatch Issues

Some states treat partnerships and S corporations differently for PTE credit purposes. A state may allow full credit for partnership PTE taxes but only a partial credit for S corporation PTE taxes. Or a state may allow an income subtraction for partnership owners but only a credit for S corporation owners.

When the source and resident states do not match these rules, the nonresident owner loses relief.

7. Timing and Calculation Differences

Even when credits exist, mismatches can still cause residual double taxation. Issues include:

Credit caps

Credits limited to tax on that specific income

Nonrefundable credits with limited carryforward

Tax year differences

Even a small mismatch can push owners into paying amounts that would never appear if the states aligned.

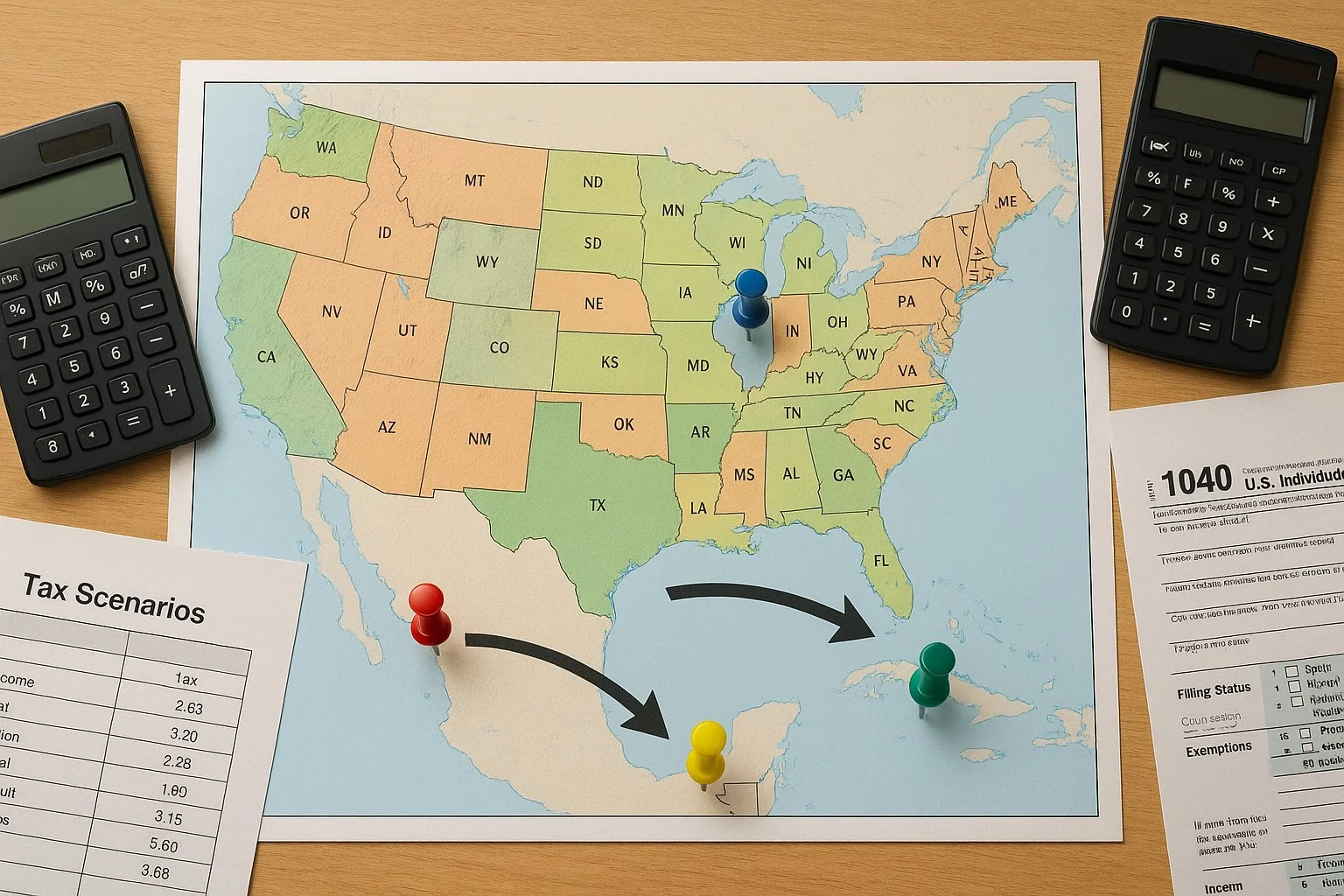

State-by-State Highlights: Where Double Taxation Is Most Likely

This is where many competitors stop short. The truth is that some states cause more nonresident headaches than others.

New York PTE Tax Issues for Nonresidents

New York’s PTET program is widely used, but:

Nonresident owners must file a New York return to claim the credit

The credit is only usable in New York

Many resident states do not allow a matching credit for New York’s PTET

If the owner lives in a nonconforming state, New York PTET often increases their total tax.

California PTE Election Issues

California’s PTE credit is:

Nonrefundable

Limited to the amount of California tax on PTE income

Carryforward only for a limited number of years

A nonresident who does not owe California tax after credits may not benefit from the election and may still pay full tax in their home state without a credit.

New Jersey BAIT Double Taxation Problems

New Jersey’s BAIT is generous for residents but complicated for nonresidents.

Issues include:

Nonresident withholding may still apply

Some states do not accept BAIT credits

Composite filings can block the owner from taking a resident credit

This makes BAIT risky for groups with many out-of-state owners.

Massachusetts PTE Credit Rules

Massachusetts offers relief, but:

Credits vary between partnerships and S corporations

Some nonresidents cannot claim full credits

Apportionment rules differ from other states

A small sourcing difference can cause overlapping taxes.

Connecticut PTE Tax and Nonresident Concerns

Connecticut has a mandatory PTE tax, but that does not remove issues such as:

Resident states refusing to recognize Connecticut’s credits

Sourcing differences

Composite filing complications

Nonresident owners often still need separate filings and may not get full home-state relief.

High-Risk Resident States

These states often deny or limit credits for entity-level tax:

States that do not have their own PTE programs

States that only offer credits for individual-level payments

States that deny credits for elective PTE taxes

Owners living in these states are at the highest risk for double taxation.

Real Examples: When Nonresident Owners Actually Get Double Taxed

Examples make this easier to see.

Example A: Home State Does Not Recognize the PTE Credit

A partnership elects PTE tax in New York. A partner lives in a state that only recognizes individual-level tax, not entity-level tax. The partner pays their share of PTET in New York and then pays full tax on the same income in their home state with no credit.

Double taxation occurs.

Example B: Withholding + PTE Tax + Composite Filing

A business pays a PTE tax in the source state. That state requires nonresident withholding even after the PTE election. The owner is also included in a composite return. The owner now has three separate state-level interactions that may not be recognized by their resident state.

This is very common in New Jersey.

Example C: Apportionment Differences Create Overlapping Tax

A multistate service firm has income sourced to two states. One uses market-based sourcing. The other uses cost-of-performance. A portion of income is taxed in both places. The resident state denies credit for the overlap.

The owner pays tax on 120 percent of the income.

When Nonresident Owners Should Opt Out of a PTE Election

Opting out can protect nonresident owners from an unnecessary tax bill. Consider opting out when:

The home state does not allow a credit for entity-level taxes

The election creates more tax than it saves

The nonresident has limited income sourced to that state

Composite filing rules block credits

Withholding requirements create duplicate payments

Sometimes keeping nonresidents out preserves the benefit for resident owners without harming others.

How Businesses Can Avoid Double Taxation Before Electing

A PTE election should never be a last-minute decision. Use these steps to protect owners:

1. Map Each Owner’s Resident-State Rules

This is the most important step. List each resident state and determine:

Do they allow credit for entity-level tax

Do they require individual filings

Do they recognize elective PTE programs

Do they have their own PTE regime

If the answer is no on any of these, red flags are in play.

2. Run Tax Modeling Before Electing

Compare three scenarios:

No election

Election with all owners included

Election with nonresidents excluded

Look at each owner’s total combined tax.

3. Consider Mixed Owner Residency

Mixed groups benefit unevenly. A PTE election that helps owners in high-tax states like New York or California might hurt those in low-tax or nonconforming states. Electing blindly can create friction among partners.

4. Review Withholding, Composite, and Filing Rules

Know the answers to questions like:

Does the election remove the need for withholding

Are composite returns still required

Does composite filing block owners from claiming credits

Will refunds be delayed

This prevents cash-flow surprises.

5. Get Consent Rules Right

Some states require all owners to consent to the election. Others only need majority approval. Before voting, explain the impact clearly and document the results so everyone understands the financial outcomes.

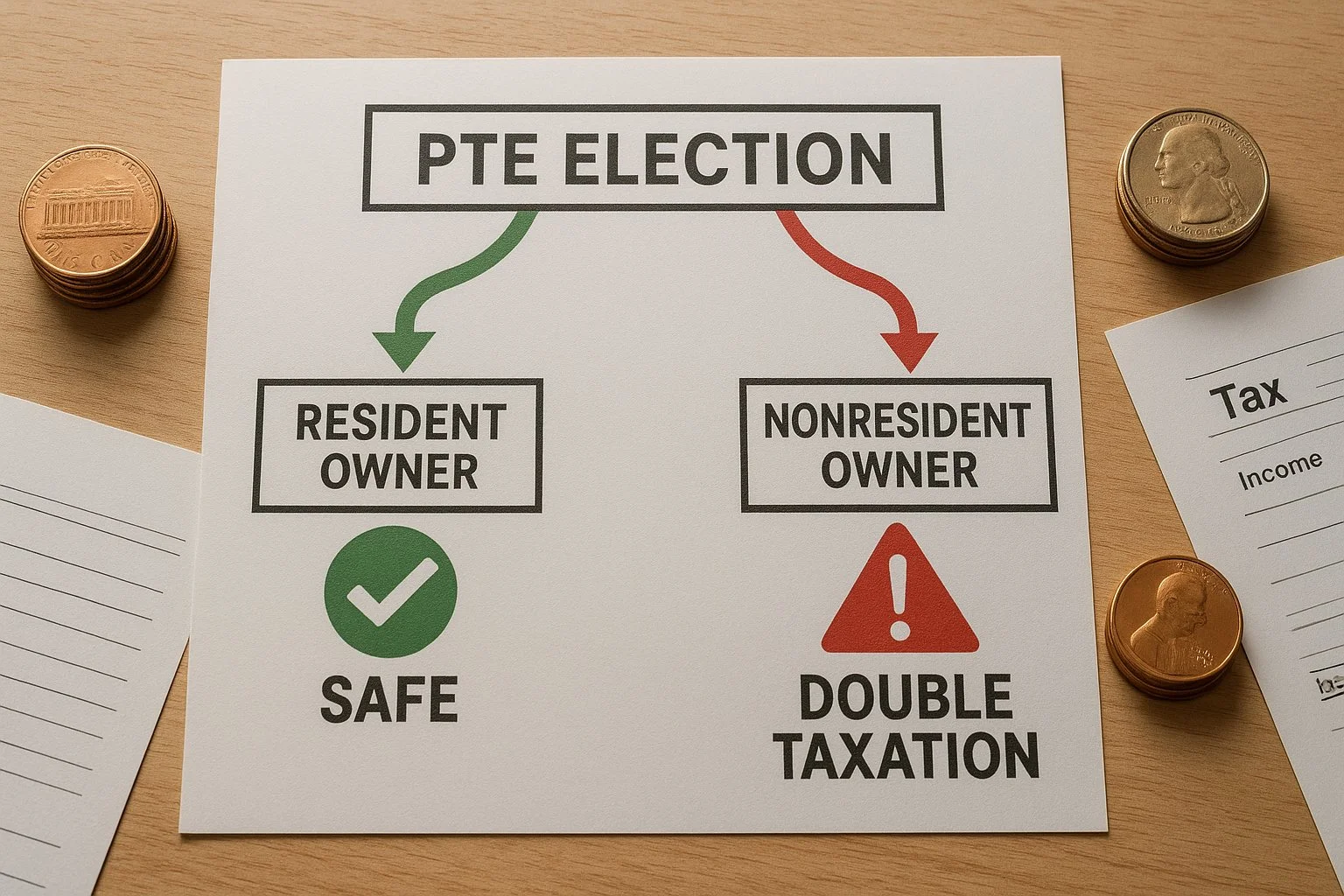

Final Thoughts: Who Should Use a PTE Election and Who Should Avoid It

A PTE election can be a powerful tax planning tool, but it is not universal. It helps when owners live in states that recognize entity-level taxes. It causes problems when owners live in states that deny credits or treat the election differently.

If you have nonresident owners, mixed residency, or multistate income, you should model the election before committing. Even small mismatches can lead to double taxation that wipes out the benefit of the SALT workaround.

The best way to protect yourself is to review every owner’s state rules, run the numbers, and understand the filing requirements before electing. With the right planning, you can take advantage of PTE benefits without creating tax problems for your team.

For a complete understanding of PTE elections, state rules, and compliance requirements, read our comprehensive guide on PTE elections for nonresident owners.

Frequently Asked Questions

Can a PTE election cause double taxation?

Yes. Double taxation happens when the owner’s home state does not allow a credit or adjustment for entity-level tax paid to the source state.

Do nonresident owners benefit from a PTE election?

Sometimes, but not always. It depends on whether their home state recognizes the PTE tax and allows relief.

What happens if my home state does not allow a PTE credit?

You pay the entity-level tax in the source state and full tax again in your home state.

Should nonresidents opt out of a PTE election?

Only if their home state denies credit or if modeling shows the election increases their total tax.

Can nonresident withholding still apply after a PTE election?

Yes. Some states do not remove withholding requirements even after the election.

How do composite returns affect PTE credits?

Composite filings can prevent owners from claiming resident credits because the tax was not paid individually.

Which states are most likely to cause double taxation?

States that deny credits for entity-level tax, states with no PTE program, and states that treat elective PTE regimes differently.

Does a PTE election eliminate withholding?

Not always. Some states still require it.

Are S corporations affected differently?

Yes. Uneven PTE benefits can create one class of stock concerns.

Should small businesses use PTE elections at all?

Only after modeling each owner’s state impact.