Cost Segregation in Real Estate: When It Makes Sense and When It Doesn’t

Feb 2, 2026

Cost segregation in real estate makes sense when you own a high-value property, pay significant taxes, and plan to hold the building for several years. It usually does not make sense for low-cost properties, short-term flips, or situations where tax losses cannot be fully used.

If you own commercial or rental real estate, depreciation is one of the biggest tax breaks available to you. Cost segregation is a strategy that lets you take more of that deduction sooner, instead of spreading it slowly over decades. Done at the right time and for the right property, it can unlock major cash flow and improve after-tax returns. Done at the wrong time, it can add cost, complexity, and even create tax headaches later.

In this guide, you will learn everything about cost segregation in real estate. By the end, you will clearly understand:

What cost segregation is and how it works

When it makes sense and when it does not

The risks and trade-offs involved

How to decide if it fits your situation

The goal is to help you make a clear, confident decision without getting lost in tax jargon. So, let’s get started!

What Cost Segregation Is and Why It Matters

Cost segregation is a tax strategy that lets real estate owners take bigger tax deductions earlier instead of spreading them over decades.

How It Works

Normally, buildings are depreciated over 27.5 years (residential) or 39 years (commercial).

Cost segregation breaks the property into parts like carpeting, lighting, fixtures, electrical systems, and landscaping.

These parts can be depreciated in 5, 7, or 15 years, letting you write off a larger portion of your costs sooner.

Why It Helps

Immediate tax savings: More deductions early means lower taxable income.

Improved cash flow: The extra cash can be reinvested in your business, used to pay down debt, or fund new property purchases.

Time value of money: A deduction today is worth more than the same deduction years from now.

If you want to know how you can track

A Quick Example

Purchase price of an office building: $1,000,000

Portion reclassified for faster depreciation: $250,000

Marginal tax rate: 35%

First-year tax savings: $250,000 × 0.35 = $87,500

Note: Because cost segregation can increase cash flow in the early years of ownership, it’s important to understand where that money is actually going. Many landlords overlook this step, but properly tracking cash flow for rental properties helps confirm whether tax strategies like cost segregation are improving real-world financial performance, not just reducing taxes on paper.

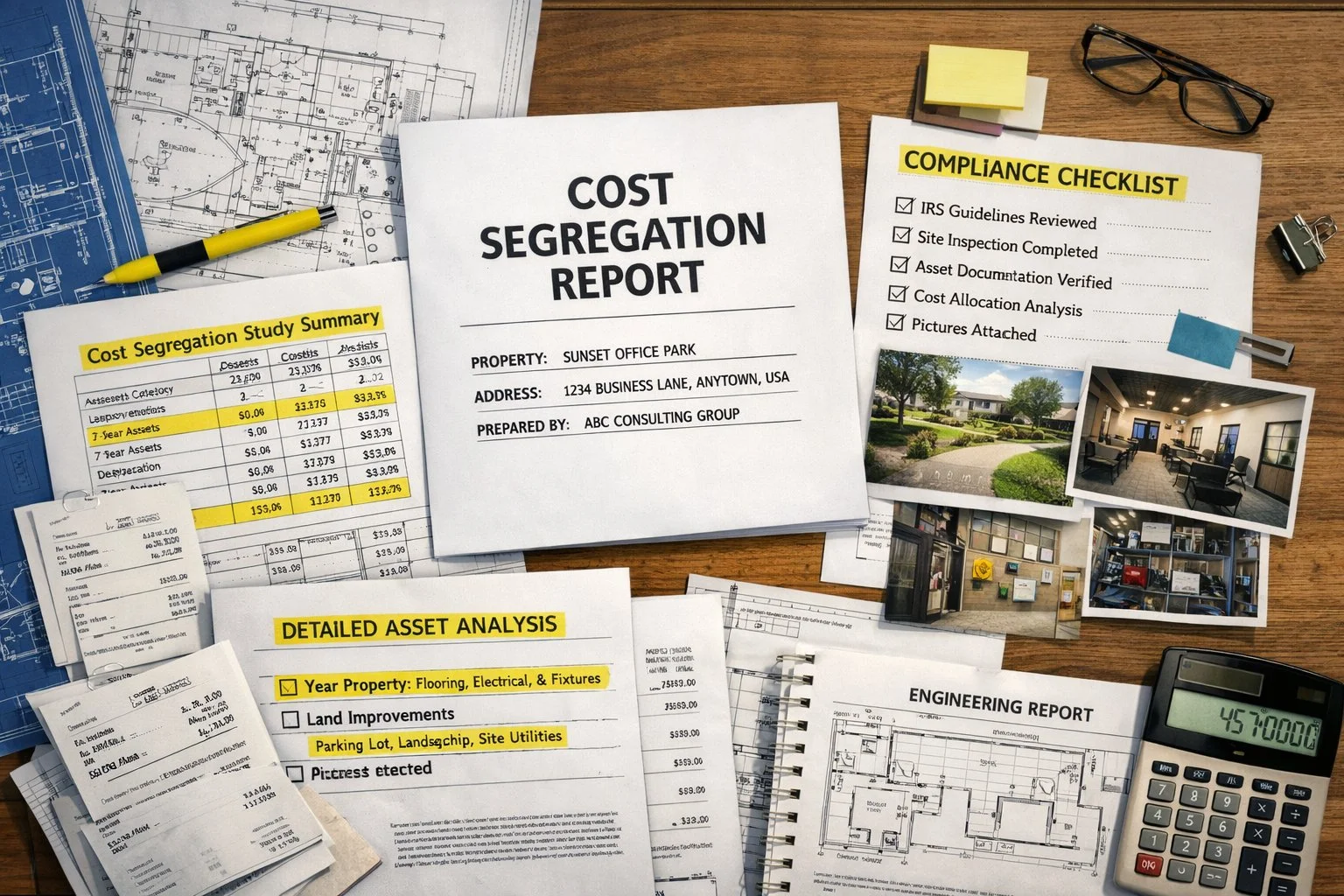

How a Cost Segregation Study Works in Practice

A cost segregation study is done by professionals who combine tax knowledge with engineering expertise. The first thing to know is that you can’t do this yourself—it requires accurate allocation of building costs to satisfy the IRS if they ever audit you.

Here’s how it works:

Data collection: The firm reviews blueprints, invoices, and construction costs.

Site inspection: Engineers check the property to identify assets that can be reclassified.

Analysis and allocation: Each component is assigned a proper depreciation category.

Report delivery: You get a full report that your CPA uses to apply accelerated depreciation on your tax return.

Optional catch-up: If the study is done after the year of acquisition, your CPA can file Form 3115 to claim missed deductions retroactively.

The goal of the study is to maximize upfront tax savings while staying fully compliant, making sure you can defend your deductions if the IRS ever examines your return.

When Cost Segregation Makes Sense

Cost segregation makes sense for high-value, complex properties owned by profitable investors who plan to hold the property long enough to maximize the benefits.

Property and Deal Factors

High-value properties: Typically, properties with a basis of $750,000 to $1 million or more justify the cost of a study.\

New acquisitions or construction: Performing the study shortly after placing the property in service maximizes deductions from day one.

Substantial renovations: Major upgrades or remodels allow you to write off both old and new assets efficiently.

Complex buildings: Offices, hotels, medical facilities, and multi-family properties often have more components that can be reclassified for faster depreciation.

Tax and Income Profile of the Owner

High-income taxpayers: Owners in higher tax brackets benefit most from accelerating deductions now.

Active participants: Investors who actively manage their properties or qualify as real estate professionals can often bypass passive loss limitations.

Profitable businesses: Those who can fully use deductions in the current year see the largest immediate impact.

Ownership and Planning Horizon

Long-term hold: Properties held for five years or longer give you time to enjoy cash flow benefits while managing eventual tax recapture.

Strategic reinvestment: The accelerated cash flow can fund other investments or operational needs.

Exit planning: Understanding how recapture affects your eventual sale ensures you don’t get surprised later.

When Cost Segregation Usually Does Not Make Sense

Cost segregation is often not worth it for low-value properties, short-term holds, or owners who can’t use the deductions now.

Property-Level Limitations

Low-basis properties: If your building costs less than $400k–$500k, the study cost may exceed your savings.

Simple structures: Warehouses or basic office buildings have fewer reclassifiable assets, limiting benefits.

Older buildings: Fewer remaining depreciable components reduce the effectiveness of cost segregation.

Tax Situation Constraints

Existing net operating losses (NOLs): If you already have losses, additional depreciation may not provide immediate value.

Passive loss limitations: Investors who can’t use deductions due to IRS passive loss rules may see minimal benefit.

Low current tax bracket: If your income is low now, it may be better to defer depreciation until you are in a higher bracket.

Short-Term Ownership Plans

Planned quick sale: Fix-and-flip scenarios or short-term holdings may trigger higher taxes due to depreciation recapture, erasing upfront savings.

Recapture risk: Accelerated depreciation increases your taxable gain on sale, so timing is critical.

Costs, Risks, and Compliance Considerations

Cost segregation can save money, but study quality, IRS compliance, and proper planning are essential.

Typical study costs: Between $5,000 and $25,000, depending on property size and complexity.

Quality matters: Cheap or low-detail studies risk IRS adjustment or audit issues.

Documentation: Proper blueprints, invoices, and inspection notes are essential.

Audit readiness: A professionally done study with CPA coordination reduces risk.

Remember, a study is not just a one-time report. It’s an investment in accuracy and compliance that protects your deductions and peace of mind.

How to Decide If Cost Segregation Is Right for You

Use a clear checklist to weigh the benefits, costs, and risks before committing.

Property value and complexity: Is the building worth $750k+ and has enough components to reclassify?

Ability to use deductions: Can your taxable income absorb the accelerated depreciation?

Holding period: Will you keep the property long enough to make recapture manageable?

Overall tax strategy: Does this fit with your other real estate or business plans?

Professional support: Do you have a CPA and a qualified engineering firm to run the study?

If most answers are “yes,” cost segregation is likely worth considering. If not, you may save money by skipping it.

Remember: Cost segregation should never be evaluated in isolation. It works best when it fits into a broader strategy that considers cash flow, taxes, debt, and long-term goals. For a step-by-step breakdown of how these pieces work together, see our guide on real estate financial planning for U.S. property owners.

Final Thoughts: Making the Right Decision and Getting Professional Help

Cost segregation can save a lot of money, but only if it’s done correctly. The right professional guidance is essential to make it work for your property and stay fully compliant with the IRS.

How to Choose the Right Support

Qualified firms: Look for providers with both engineering and tax expertise

CPA coordination: Your CPA should review the study and apply deductions properly on your tax return.

Audit defensibility: Ensure the study is thorough, well-documented, and IRS-ready.

Avoid shortcuts: Cheap or vague reports may cost more in the long run if adjustments or audits happen.

The Big Picture Takeaway

Cost segregation is a strategic tool, not a magic shortcut. It works best for high-value, complex properties held long-term by owners who can use deductions immediately.

It’s not for every property or every investor. Low-value properties, short-term holdings, or owners who can’t absorb deductions often won’t benefit enough to justify the cost.

Plan, model, and get professional advice. With careful guidance, cost segregation can improve cash flow, reduce taxes, and make your property work harder for you—safely and legally.

Frequently Asked Questions

How does a cost segregation study affect property resale?

Accelerated depreciation can increase taxes when you sell because of depreciation recapture, but proper planning ensures the upfront cash flow benefit still outweighs future taxes.

Can renovations done years after purchase qualify for cost segregation?

Yes. Major renovations or upgrades can be analyzed separately through a partial asset disposition, letting you accelerate depreciation on new components without redoing the original study.

Do all states allow the same benefits as federal tax law?

No. Some states don’t conform to federal bonus depreciation rules. You may need to add back certain deductions on your state return, so always check state-specific rules.

How long should I hold a property to make cost segregation worthwhile?

Typically, at least five years. This allows enough time to benefit from accelerated deductions and mitigate the impact of any depreciation recapture when selling.

What makes a cost segregation study “IRS-defensible”?

A study is defensible if it uses professional engineering methods, proper documentation (invoices, blueprints, inspections), and coordination with your CPA to report deductions accurately.