Year-End Tax Planning Checklist for Pass-Through Entities (PTEs)

Nov 26, 2025

Year-end tax planning can feel like a scramble. You are closing the books, paying contractors, reviewing cash flow, and trying to keep up with day-to-day operations. In the middle of all that, the tax rules for pass-through entities can change what you owe and how you file. Many business owners wait until tax season to sort things out, but that is when you run out of options.

A smart year-end process helps you reduce your tax bill, fix mistakes early, and set up the next year with fewer surprises. Whether you have an S corporation, partnership, or multi-member LLC, the right steps at the end of the year can help you keep more of your money and stay compliant.

In this guide, you will learn what to review, what to track, and what to decide before the year closes. You will also get a clear checklist you can follow every year and tips that help you understand how your PTE works at tax time.

What Is Year-End Tax Planning for Pass-Through Entities?

Year-end tax planning is the process of reviewing your business finances, updating records, and making strategic decisions before December 31. Pass-through entities have unique rules because the income flows to the owners, which means both business and personal tax returns are affected.

A clear year-end plan helps you:

Reduce taxable income through legal deductions

Confirm that compensation and distributions follow IRS rules

Prepare clean books for tax filing

Make decisions that can lower your tax bill before the year closes

Avoid penalties from missed deadlines or incorrect reporting

This part of the year is a chance to adjust your financial picture before it becomes permanent.

Why Year-End Planning Matters for PTEs

Pass-through entities do not pay federal income tax at the business level. Instead, profit passes through to the owners. That is why year-end decisions matter more for PTEs than for many other business structures.

Here is why it matters:

You can reduce your personal tax liability

Most strategies you apply before December 31 directly affect the income that flows to you. That includes deductions, contributions, timing of income, and year-end purchases.

You can stay compliant with S corporation and partnership rules

The IRS has specific rules for reasonable compensation, guaranteed payments, distributions, and shareholder loans. Mistakes lead to penalties or reclassification of income.

You get a better financial picture for next year

Accurate year-end planning helps you budget, set salaries, schedule tax payments, and prepare the business for growth.

You avoid tax-season surprises

No one enjoys unexpected tax bills. Year-end planning gives you time to prepare for estimated payments and adjust cash reserves.

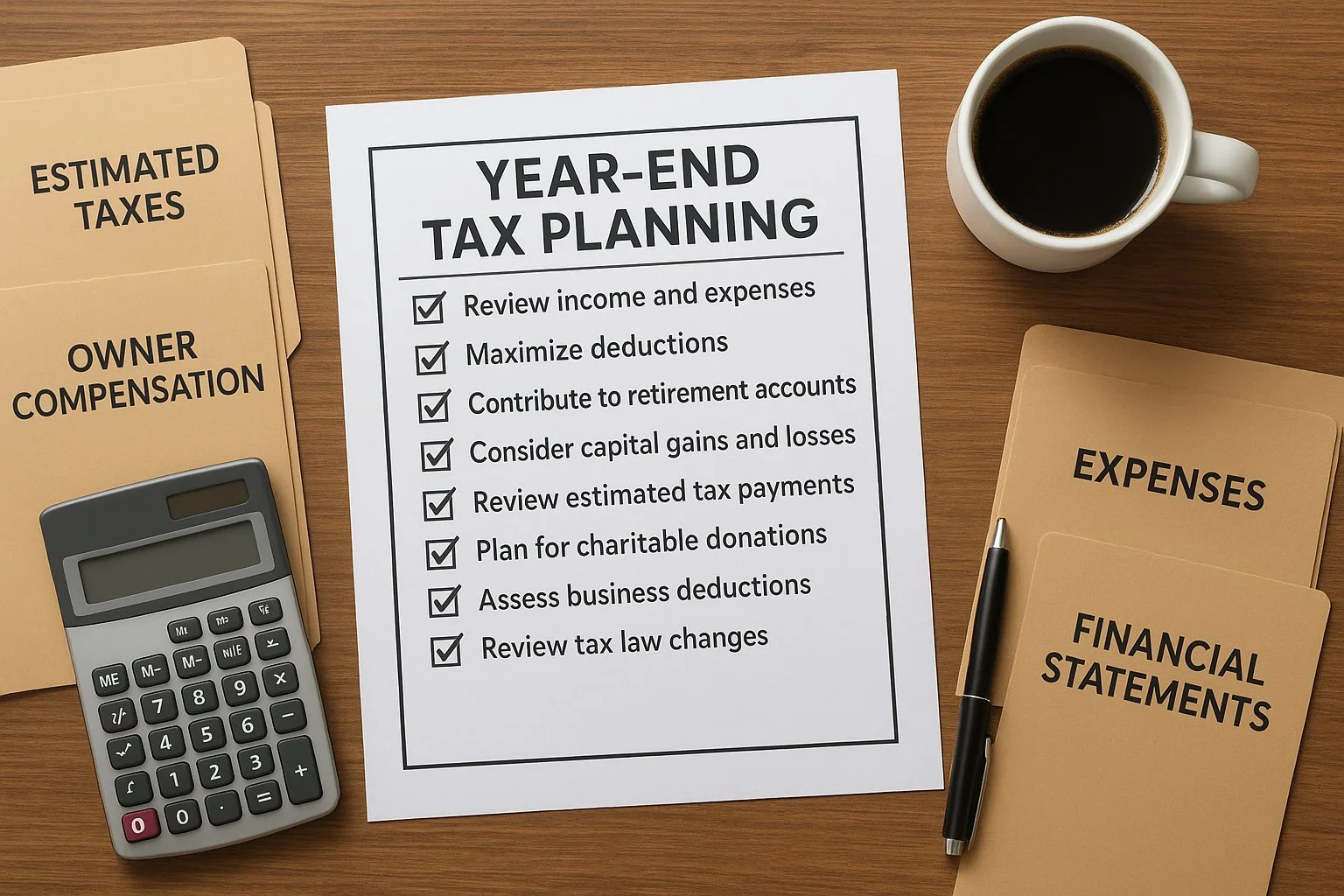

Your Year-End Tax Planning Checklist for PTEs

This is your full checklist. Each item is written so you can follow it step-by-step.

Review Your Estimated Taxes

Pass-through owners often pay quarterly estimated taxes. If income changed during the year, your estimated payments might not match what you owe.

Check the following:

Your year-to-date business profit

Any changes in owner compensation

Major expenses or deductions

Whether you are underpaid or overpaid

If you are short, your accountant may suggest a final estimated payment in January to avoid penalties.

Confirm Owner Compensation Rules

The IRS has strict rules for how owners of pass-through entities pay themselves.

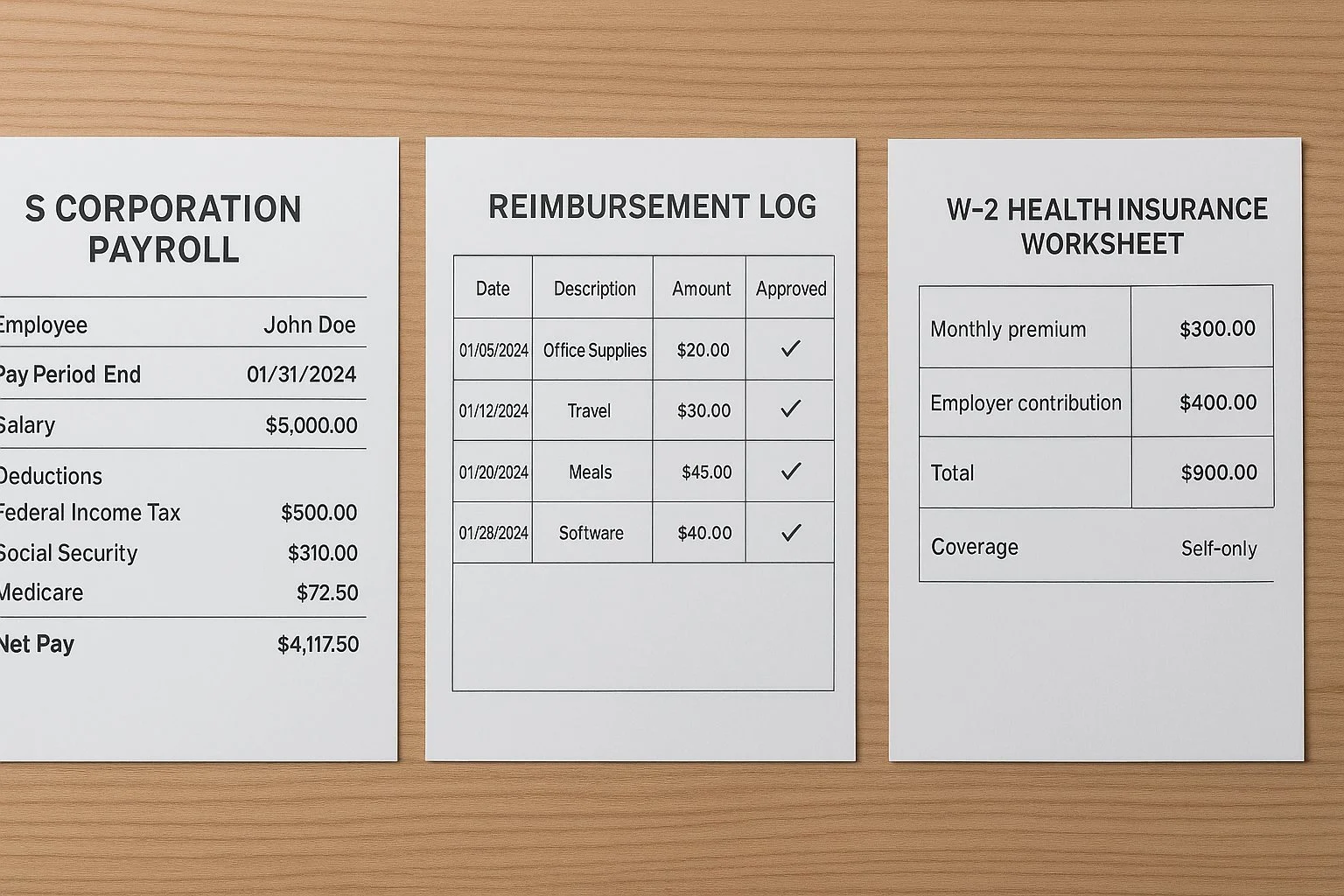

For S corporation owners

You must pay yourself a reasonable salary through payroll. If you paid yourself too little or only took distributions, the IRS can reclassify income and add penalties.

Review:

Salary amount

Payroll reports

Health benefits

Retirement contributions

If adjustments are needed, do them before the final payroll run of the year.

For partnership and multi-member LLC owners

You do not get a salary. Earnings flow through as:

Guaranteed payments

Distributive share

Year-end distributions

Check that all guaranteed payments are recorded correctly. Also confirm that distributions match your ownership percentages.

Track and Categorize Business Expenses

Missing receipts and uncategorized expenses can cost you real money. Before year-end, review and clean up your books.

Check:

Subscription and software charges

Mileage logs or travel records

Office supplies

Equipment and hardware purchases

Marketing and advertising expenses

Contract labor

Home office expenses

Any reimbursable personal expenses

A clean record helps you claim every legal deduction and reduces time spent during tax season.

Review Your Books and Financial Statements

A clean set of books is essential for tax filing.

Make sure the following are accurate:

Profit and loss statement

Balance sheet

Owner equity accounts

Partner capital accounts

Loan balances

Bank and credit card reconciliations

If anything looks off, fix it now. January is too late.

Consider the PTE Tax Election for SALT Deduction Relief

The PTE tax election has become a major year-end strategy for many states. This election allows certain pass-through entities to pay state income tax at the entity level, which can help owners bypass the federal $10,000 SALT deduction cap.

Ask yourself:

Does your state offer the PTE election?

Do you qualify?

Is the deadline approaching?

Will it reduce your federal taxes?

This decision is time-sensitive because most states require the election during the tax year or by year-end. Filing too late means missing out for the entire year.

If you want a deeper explanation of how the PTE election works, see your earlier article and consider interlinking both pieces for readers who want to learn more.

Maximize Retirement Contributions

Year-end is the perfect time to review retirement contributions. Contributions reduce taxable income and build long-term savings.

Consider:

Solo 401(k)

SIMPLE IRA

Traditional IRA

Some plans allow contributions until the tax filing deadline, but decisions about salary deferrals often need to be completed by year-end.

Review Your QBI Deduction Eligibility

The Qualified Business Income (QBI) deduction allows many pass-through owners to deduct up to 20 percent of their qualified business income.

Review:

Whether your income falls within QBI limits

Whether you meet wage and asset tests

Whether owner compensation affects the deduction

Whether the business falls into the “specified service business” category

Small adjustments at the end of the year can help maximize this deduction.

Evaluate Depreciation and Equipment Purchases

If you plan to buy equipment, software, or machinery, December may be a good time. Section 179 and bonus depreciation rules let you write off part or all of the purchase in the same year.

Review:

Large equipment needs

Computer upgrades

Office furniture

Machinery

Vehicles that meet business-use requirements

Do not make purchases you do not need, but if an upgrade is already planned, year-end may give you a tax benefit.

Check Payroll, Benefits, and Contractor Payments

Before the year closes, confirm your payroll records are correct.

Check:

W-2 employee wages

S corporation owner salaries

Contractor payments for 1099s

Health reimbursement arrangements

Health insurance premiums

Fringe benefits

Reimbursements

1099-NEC forms must be sent out in January. Clean records make the process smoother.

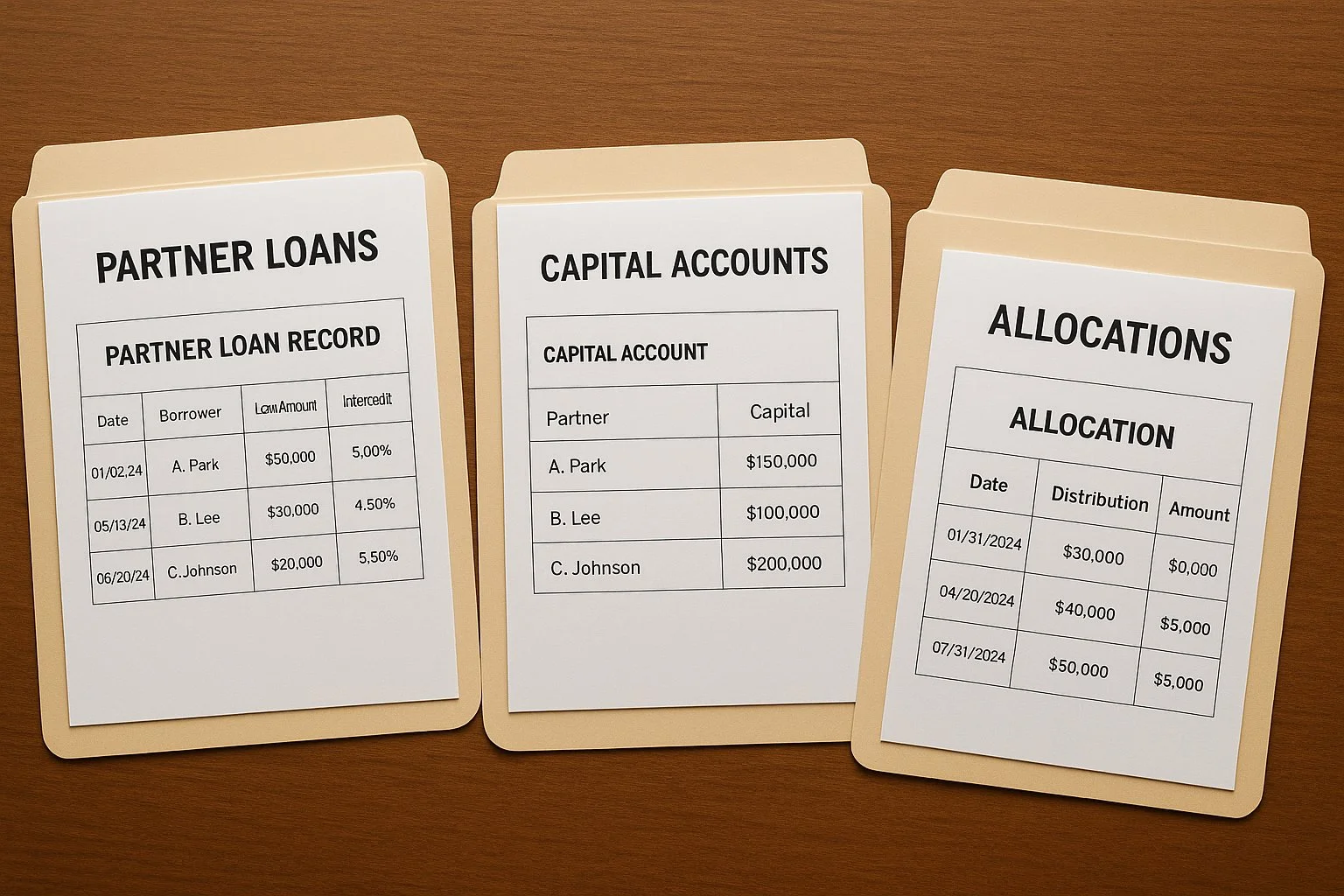

Update and Review Your Partnership or Operating Agreement

With partnerships and multi-member LLCs, year-end is the ideal time to review your agreement.

Confirm:

Ownership percentages

Profit and loss allocations

New partners or departing partners

Capital accounts

Distribution rules

This prevents disputes and avoids surprises at tax time.

Review Loans, Distributions, and Capital Accounts

Pass-through entities must track owner equity carefully.

Check:

Member or shareholder loans

Repayments

Owner draws or distributions

Capital contributions

Ending capital account balances

Incorrect records can trigger errors on your return and create issues during an IRS review.

Meet with Your Accountant Before Year-End

This is usually the most important step. Waiting until tax season limits your options. Meeting before December 31 gives you time to adjust payroll, update records, or make strategic decisions.

Bring:

Updated financial statements

Payroll reports

Partnership agreements

Retirement plan details

Year-to-date tax estimates

Planned purchases

Your accountant can help you model different scenarios, identify savings, and avoid compliance issues.

Extra Year-End Tips for S Corporations

S corporations have unique rules that need attention before year-end. Use these tips to stay compliant.

Reasonable salary rules

Your salary must match market rates. If you paid yourself too little, adjust before the final payroll run.

Accountable plan reimbursements

If you reimburse yourself for expenses, they must be processed through an accountable plan. Review these reimbursements before year-end.

Health insurance reporting

Owner health insurance must be reported correctly on your W-2. Many owners forget this.

Built-in gains tax considerations

If you recently converted from a C corporation, check whether any assets trigger the built-in gains tax.

Extra Year-End Tips for Partnerships and Multi-Member LLCs

Partnership rules can be complex. Year-end is a good time to review these items.

Guaranteed payments

These must be recorded correctly and included on your K-1.

Partner distributions

Distributions must match your ownership percentages unless your agreement says otherwise.

Partner loans

If you loaned money to the partnership, confirm balances are recorded.

Capital account reporting

Partnership tax returns now require capital accounts on the tax basis. Make sure your books match the return.

State-Specific Considerations

Each state has different tax deadlines and rules, especially for:

PTE tax elections

Estimated tax payments

Payroll filings

Partnership taxes

Franchise taxes

Entity-level taxes

Check:

Your state’s PTE tax election deadline

Whether your state requires minimum taxes

Whether you owe sales tax on digital or service-based income

Franchise tax thresholds

A small state-level oversight can affect your return.

Conclusion

Year-end tax planning is not something you check off in an hour. It is a chance to clean up your books, confirm compliance, reduce taxes, and set your business up for a strong next year. Whether you run an S corporation, partnership, or multi-member LLC, the steps in this checklist help you understand what needs attention and why each part matters.

If you follow this guide every year, you stay ahead of deadlines, reduce risk, and keep more of your hard-earned money. And if a topic raises more questions, your accountant can help you analyze your numbers and make the best decisions for your situation.

For you to have a better understanding about PTE, check out our guide about PTE Tax Election.

Frequently Asked Questions

What counts as a pass-through entity for tax purposes?

A pass-through entity includes S corporations, partnerships, and most multi-member LLCs. These businesses do not pay federal income tax at the entity level. Instead, the income flows through to the owners, who report it on their personal returns.

Why is year-end tax planning so important for PTEs?

Year-end planning helps you reduce your tax bill, update your books, and make decisions that affect your personal return. Since income flows through to you, the actions you take before December 31 can change what you owe in April.

What are the most common year-end tasks for S corporations?

The key tasks include checking reasonable salary, finalizing payroll, reviewing distributions, confirming health insurance reporting on W-2s, updating retirement contributions, and cleaning up your books before filing.

What should partnerships or multi-member LLCs focus on at year-end?

Partnerships should review capital accounts, guaranteed payments, partner distributions, and loan balances. They should also confirm that profit and loss allocations match the partnership agreement.

Do all states offer a PTE tax election?

No. Most states offer it, but not all. The rules, deadlines, and eligibility requirements vary by state. You need to check your state's tax department website or talk to your accountant to confirm if your state participates.

How do year-end purchases affect my taxes?

If you buy equipment or software before year-end, you may qualify for Section 179 or bonus depreciation. These rules can let you deduct part or all of the cost in the same year, which lowers taxable income.

Can the PTE election lower my federal taxes?

Yes. Paying state taxes at the entity level may help you avoid the $10,000 SALT deduction cap on personal returns. This can reduce your federal taxable income and lower your overall tax liability.

What happens if I underpay estimated taxes during the year?

If your estimated payments are too low, you may face penalties. Your accountant may suggest a final estimated payment in January to reduce or eliminate those penalties.

Do retirement contributions help reduce taxes for PTEs?

Yes. Contributions to accounts like SEP IRAs, Solo 401(k)s, and SIMPLE IRAs can reduce taxable income for both the owner and the business. Some contributions must be made by year-end, so timing matters.

When should I meet with my accountant for year-end planning?

The best time is late November or early December. Waiting until tax season limits your options. Meeting before year-end lets you adjust payroll, check records, and make decisions that lower taxes before the year closes.